Scalability on the Ethereum (ETH) network has been a point of contention within the cryptocurrency ecosystem for years, primarily due to high fees and network congestion during periods of peak demand.

The latest solution to emerge as the final fix to Ethereum’s scalability woes are Zero-knowledge rollups (ZK rollups), a form of scaling that runs computations off-chain and submits them on-chain via a validity proof.

Zk rollup season

— cryptowarlord.eth ( ͡° ͜ʖ ͡°) (@CryptoWarlordd) December 7, 2021

Earlier in the year, protocols that opted to use optimistic rollups such as Optimism and Arbitrum dominated the headlines and were touted as the best solution to scaling on Ethereum, but aside from Arbitrum, the hype for those protocols has quieted down and traders have pointed out that even optimistic rollups have higher than desirable fees when the network is under peak demand.

Early successes in 2021

At the same time that optimistic rollup solutions were in the spotlight, protocols that adopted the ZK rollups model quietly demonstrated their capabilities.

dYdX, a decentralized perpetual and futures exchange, was one of the earliest adopters of ZK-rollup technology through its partnership with StarkWare, whose StarkNet network is a permissionless decentralized ZK-Rollup.

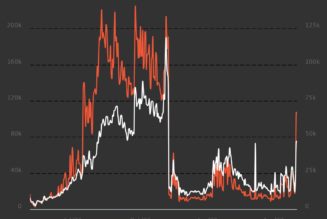

To date, the platform has seen a decent amount of success and at times managed to process a higher 24-hour trading volume than Coinbase.

Loopring (LRC) is another protocol that has utilized ZK-rollups to decrease transaction costs and speed up its throughput capabilities, which has helped drive the price of LRC to a new all-time high of $3.83 in early November.

Related: Ethereum layer-two TVL reaches all-time high

ZK-rollups could be the next “rotation” for traders

Following last week’s sharp market-wide sell-off, ZK-rollups have reemerged as a buzzword in crypto sector.

Polygon, a layer-two platform for the Ethereum network, made headlines with the announced acquisition of Mir, a project developing two subcategories of zero-knowledge proofs known as PLONK and Halo.

The 250 million MATIC token investment by Polygon, which already offers some of the lowest fees of any protocol on the Ethereum network, was done in an effort “to explore and encourage all meaningful scaling approaches and technologies at this stage,” according to Polygon co-founder Sandeep Nailwal.

Another much-anticipated protocol that has been gaining traction recently is zkSync, a scaling solution created by Matter Labs that secured $50 million in a Series B round led by Andreessen Horowitz in early November.

According to Digital Delphi, the two main projects that are live on zkSync is ZigZag, a decentralized exchange, and a funding platform called Gitcoin.

Analysts at Delphi Digital said,

“According to L2 fees, token swaps through ZigZag on zkSync have the lowest fees.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Tagged: crypto blog, Crypto news, cryptocurrencies, layer2, Market Analysis, Markets, Scalability