Kenya’s unemployment rate will worsen in 2024 compared to last year, an assessment by the World Bank has shown, reflecting a tough economic environment that has been characterised by a slowdown in business activity and hiring freezes.

In a new report, the World Bank has put the unemployment rate at 5.7 percent in 2024, slightly higher than the 5.6 percent registered last year.

This is because gross domestic product (GDP)—or the sum of all the goods and services produced in the country—is also expected to slow down to five percent from 5.6 percent last year.

Data from the Kenya National Bureau of Statistics shows that real GDP underperformed in the first and second quarters of this year due to a contraction in sectors such as building and construction and a flat growth in manufacturing.

The Stanbic Kenya Purchasing Managers’ Index (PMI), which measures the performance of key private sector indicators such as output, new orders, and employment—dipped slightly to 49.7 from 50.6 in August.

“Firms signalled that recent declines in output were to blame for the cut in staffing. Although employment decreased, it did so at only a marginal pace and mostly in the agriculture sector,” analysts at Stanbic Bank and American analytics firm, S&P Global, said in the August PMI report.

This year, the economy was rocked by a month-long youth-led anti-tax protest that created economic uncertainty and delayed consumer spending decisions.

The resulting political uncertainty, which roiled President William Ruto’s administration, exacerbated the cash flow challenge as interest rates rose amid elevated cost of living pressures.

The World Bank’s unemployment rate of 5.7 percent is the same as in 2022, a period when the economy was characterised by drought, high inflation, and interest rates.

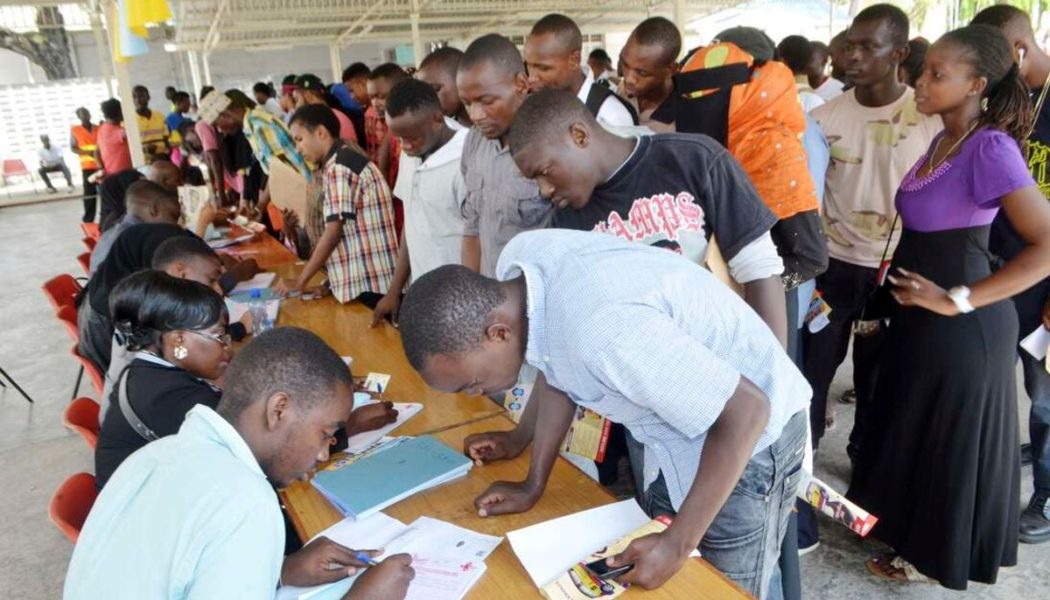

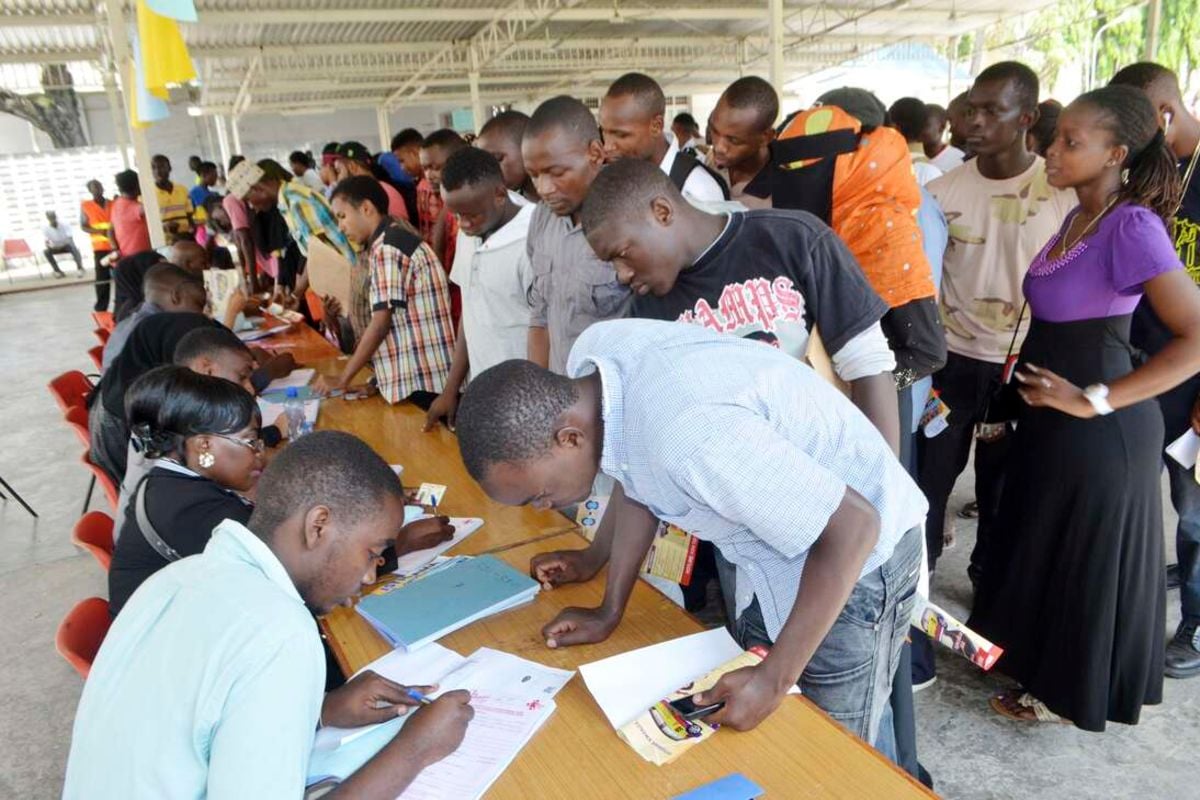

Youth joblessness

Kenya’s unemployment rate is highest among the youth in the informal sector, the largest employer, where earnings are little and erratic.

The Kenyan government has also been a victim of the sluggish private sector growth, with layoffs and a freeze on bonus payments for workers in corporate Kenya resulting in lower-than-expected collections in payroll taxes.

The Kenya Revenue Authority missed its payroll tax targets by Sh25.8 billion in the year to June, reflecting the impact of Kenya’s soft economy on jobs and wages.

Income tax collection fell by Sh49.9 billion in the financial year ending June as the private sector grappled with a turbulent environment characterised by shrinking sales and high operating costs, the National Treasury said.

The companies analysed included Safaricom, Equity Group, EABL, KCB, Co-operative Bank and Absa Kenya. Other are Standard Chartered Bank Kenya, NCBA Group, I&M Bank and BAT Kenya.

Companies reward their executives with performance-related bonuses primarily for protecting shareholder returns through improved profitability, thanks to their role as strategy leaders in the C-suite.

Bonuses are based on business performance parameters such as the growth of the profits and cash generated by the business, the performance of the company’s share in the stock market, shareholder returns such as dividends and the development of new revenue streams.

Bonuses, overtime allowance and retirement benefits paid are tax-exempt if paid to an employee whose salary before the bonus and overtime allowance does not exceed Sh11,180 per month (Sh134,164 per year). This means that bonuses earned by the top executives are taxed.

The tightening of the global financial market led to the closure of several start-ups, most of which found it difficult to access credit to continue operations. The closures left thousands of employees without quality formal jobs, even as the economy continued to churn out hard-to-tax informal jobs.