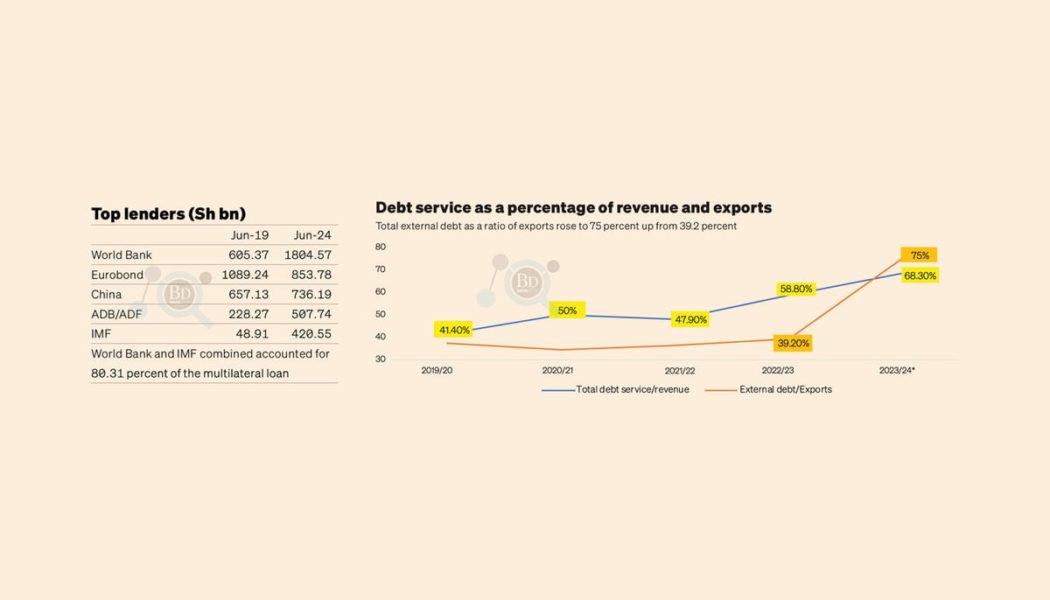

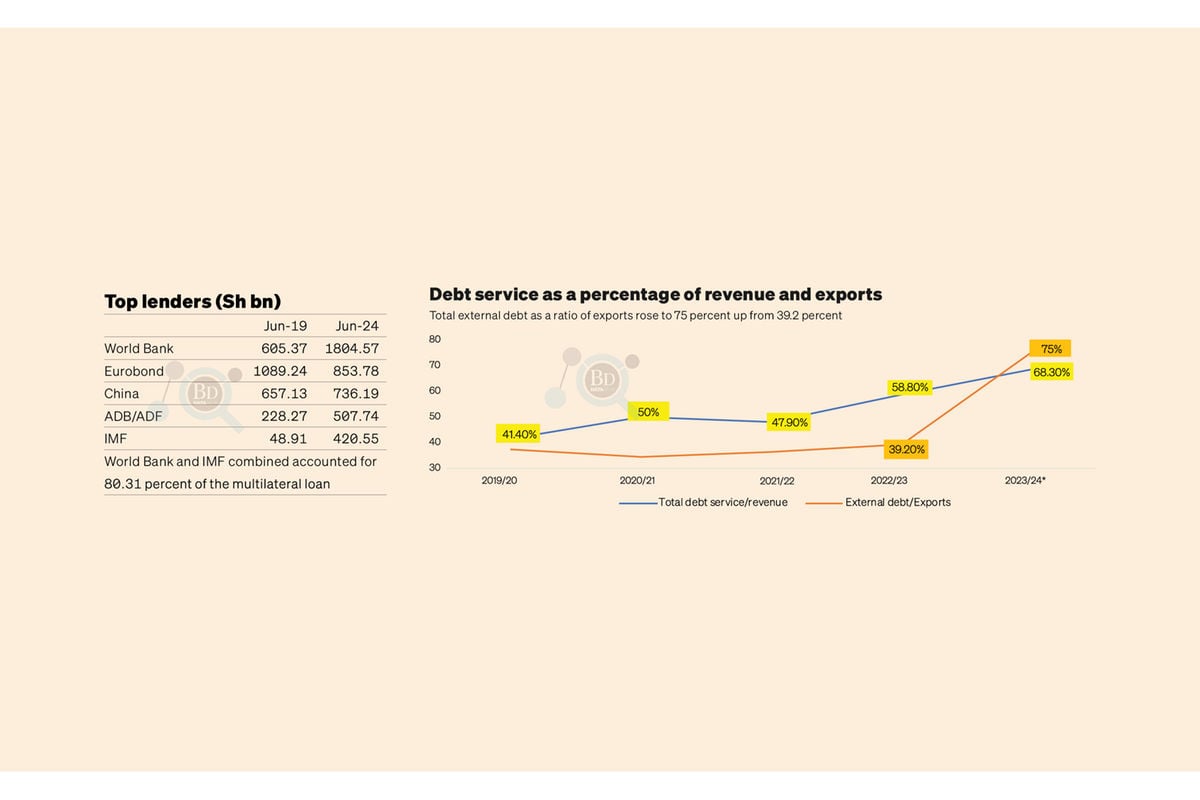

The share of loans from the World Bank and the International Monetary Fund (IMF) more than doubled hitting a record of 43.3 percent of foreign loans, strengthening the hands of the two institutions in influencing economic policy in Kenya.

Loans to the two Bretton Wood’s institution has increased from Sh654 billion in June 2019 to Sh2.2 trillion in June, Treasury documents reveal, as Chinese continue to cutback.

This has seen their share of loans grow from 21.8 percent in 2019 in a period that has seen both World Bank and IMF influence policy directives like introduction of new taxes, freeze on non-essential hiring in government and public sector reforms The growth of the loans from the western-backed lenders emerges as China—Kenya’s hitherto top lender—ends its lending frenzy to emerging nations.

China’s outstanding loan to Kenya dropped by Sh218.17 billion to Sh736.19 billion on repayment of earlier debt and reduced lending from Beijing.

“The share of multilateral debt increased to 53.9 percent in FY2023/24.This was due to government’s strategy to maximise on concessional financing and reduce risks,” notes Treasury in the Annual Public Debt Management 2023/24 report.

Towards the end of October 2024, the IMF board approved the seventh and eighth review paving the way for the cash strapped government to access $606 million.

“The Extended Fund Facility/ Extended Credit Facility (EFF/ECF) arrangements aim to support Kenya’s programme to address debt vulnerabilities, while safeguarding resources for priority social and developmental needs; build resilience to shocks; improve governance and transparency; and support broader economic reforms to realise the country’s medium-term potential,” notes IMF.

Notably, Kenya’s debt service as a percentage of ordinary revenue stood at 68.3 percent up from 58.8 percent in 2022/23. This implied that for every Sh100 collected as taxes, Sh68.3 went to service debt. The bulk of multilateral debt which accounts for the largest share of the external debt rose to 53.9 percent from 48.7 percent.

According to the report, the outstanding Eurobond at the end of 2023/24 was Sh853.78 billion. Other lenders to Kenya that posted significant growth over the one year are IMF (71.8 percent) and ADB (11.2 percent).