Columnists

Why inflation is the biggest danger to stock market

Friday May 05 2023

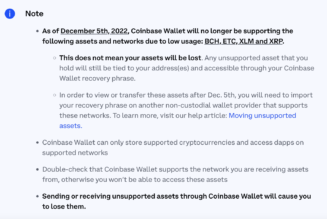

The Nairobi Securities Exchange. FILE PHOTO | DIANA NGILA | NMG

No good news from the Spring Meetings for emerging markets this year. No new funds of any scale will be committed to countries dealing with high debt and empty coffers.

Instead, we got powerful reminders about where we stand and the problems that we have to solve. All this is captured in IMF’s flagship report; Global Financial Stability Report 2023, released at the same time.

Today, I will highlight a few excerpts from the report with my accompanying commentary. Note: Spring meetings refer to the annual early April gathering of the International Monetary Fund (IMF) and the World Bank Group.

“International bond spreads for frontier markets remain high at 885 basis points, more than 300 basis points above their long-term average. More than 40% of frontier bonds maturing through 2025 are trading at distressed spreads (above 1,000 basis points), and nearly 80% are trading at spreads of more than 700 basis points.”

At these rates, it’ll be too expensive to borrow internationally. Keen to note, all our six Eurobonds are currently trading at over 1,000 points with the 10-year (issued in 2014) trading a notch higher over the 2,000-point level – this is a junk level.

All this means more local currency bonds and increased borrowing from banks (like the Sh32 billion syndicated loan expected later this month) to make up for the shortfall.

Crowding out of the private sector should be expected – already February 2023 Monthly Economic Indicator report by the Central Bank shows private sector credit growth slowing down to 11.7% (February 2023), down from a twelve-month high of 14.2% (July 2022).

“While debt-to-GDP levels are high in both frontier and emerging markets after the pandemic compared with those over the last two decades, frontier markets have significantly less fiscal space given much higher interest-to-revenue ratios.”

Should this status quo remain, there are three possible outcomes: The good; the government keeps its promise and divests from a number of essential/non-essential parastatals and shifts ownership to private hands.

The bad; we see mass retrenchments, higher taxes and delayed salaries becoming the norm. The ugly; Kenyan government defaults.

This would put us right in the same class as Ghana, Malawi, Sri Lanka, Russia and Belarus (although the last two can be counted out due to artificial constraints related to international sanctions).

“Portfolio flows have stalled since mid-February 2023, with modest outflows from local currency bonds and equities resuming after a strong rebound from late 2022 through January.”

For Kenya, the equity portfolio outflows have been particularly severe. Cumulatively, foreign investors have on a net basis pulled out over Sh100 billion in the past seven years (with the exception of one year).

As noted in the IMF report, foreign portfolio investments in emerging markets have yet to fully recover. If advanced economies remain unstable, negative outflows mean a subdued market.

To date, we are already down some 15% on the Nairobi All Share Index.

All in all, we’ve been here before. We’ve learnt the lessons of previous cycles.