The first question you are likely to consider when planning your trading monitor setup is whether multiple monitors are necessary. The answer to this varies, but traders tend to favor using multiple monitors for several reasons.

Trading can be a stressful task, and it is a trader’s job to transform charts, indicators, and tickers into information that supports our trading objectives. This task is easier to achieve with the right tools, and the monitors you use can create an efficient working environment where you can focus on key details and break down unpredictable trend patterns.

Here’s what you need to know about using multiple screens.

5 main benefits of using multiple screens

Traders use multiple screens because:

1. Stay up to date on current events

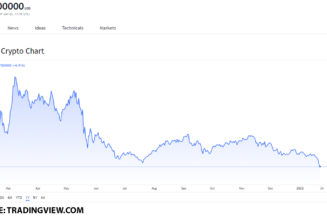

Macroeconomic factors can significantly influence the prices of securities. As a result, traders enjoy reading the news to stay up to date on current events. Knowing things as they happen can give you a significant competitive advantage and help you become a more profitable trader.

Having multiple monitors allows you to keep up with relevant news while carrying out trading activities. If you discover that a particular event could positively or negatively affect an asset, using different monitors enables you to act on it immediately and see in real-time how such information affects the market.

Keeping up with financial news from trusted sites like Bloomberg and Reuters is also necessary.

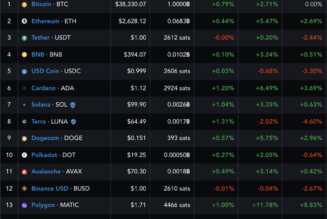

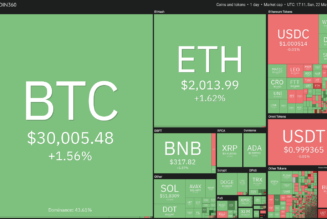

2. To keep track of different markets

Some traders trade on multiple stock exchanges worldwide. For such a trader, having multiple screens showing the trends of securities on different exchanges is critical to success.

Finding the best entry point is essential for trading success and passively tracking stocks across multiple screens can be advantageous. When you use the best trading monitors in the market, it amplifies your trading experience and makes it easier to notice movement on a screen and determine if there is a profitable trade to be had.

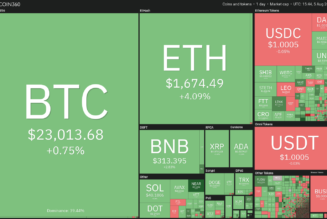

3. Trading on multiple time frames

Keeping track of multiple time frames is critical for day traders. You must have multiple points of view at all times to decide on which investment in the crypto market is better. There may be a primary time frame for tracking ongoing positions which could be a two-hour time frame that shows the stock movement over the previous two hours.

A longer time frame may also assist you in tracking key support and resistance points and performing other analyses. If you have multiple screens or split a screen, it is much easier to keep track of multiple time frames.

With multiple monitors, you can look at shorter time frames to help you identify appropriate entry points for short-term trades.

4. To keep track of the flow of orders

Traders use order flow to identify market buying and selling pressure, which can aid in price prediction. Order flow is frequently used in conjunction with technical analysis to determine better entry and exit levels, as well as the type of order to place in the market (this could be a market order, stop order, or limit order).

Day traders and scalpers use an old stock trading technique called reading the order flow. The order flow shows market depth, which is the depth of supply (ask/offer) and demand (bid) in the market. In other words, the order flow shows the market’s buy and sell limit orders.

By reading the order flow, a trader can identify price levels with large buy or sell orders. If a trader wants to place a market order, he can check to see if there is enough liquidity at the current price level to fill the order without significantly moving the price.

It should be noted, however, that order flow can only display limit orders and not stop orders. As a result, order flow is used in conjunction with other technical analysis methods to help traders make trading decisions.

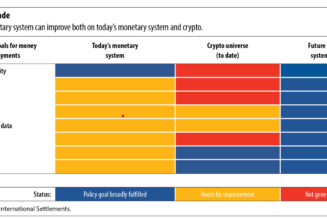

5. Sentiment analysis

You can use sentiment indices to track current market sentiment about the assets you are interested in when trading with easy access to detailed information.

Sentiment analysis can assist in determining the percentage of traders who have taken specific market positions. Competent traders then use this information to forecast the direction of the market.

For example, sentiment analysis can help predict a price reversal. It is more useful for securities traded on standard exchanges, such as stocks, futures, and options, where complete data is available.

Creating the ideal trading monitor setup

To create the ideal monitor setup, you’ll need the following:

1. A comfortable and ergonomic setup

A desk with adjustable heights is essential for a healthy work environment in trading. You can adjust the height to suit your needs or even choose to stand when sitting becomes tiring.

This makes it easier to remain healthy when trading for long hours.

A comfortable chair, in addition to the ideal day trading desk, is essential. To capitalize on the optimal investment time, you must remain focused from the start to the end of the business day.

As a result, because it provides adequate neck support, relieves back pain, and is extremely comfortable, an ergonomic chair is ideal for the day trading computer setup.

2. The neccessary trading software

You’ll need the required trading software and tools in order to keep an eye on the markets, evaluate data, and place trades. This might contain risk management software, a trading platform, and graphing software.

3. Monitors

You’ll be able to choose a day trading computer monitor once you’ve gathered all of the necessary components for your trading monitor setup. How many screens are too many?

There is no silver bullet; it is simply a situation of experimentation and observation. View what you require on display and upgrade as needed. However, you must consider its resolution and size.

Invest in high-resolution screens to ensure proper zooming and display of content. A minimum resolution of 1080P (1920×1080) would be ideal. The size of your setup is determined by how you want it to appear. You can choose between three 27-inch screens and two 32-inch screens.

Aside from that, you can give the setup a more modern look by installing additional mounts to keep your multiple monitors in place.

Monitor Arms and Mounts:

Invest in desk mounts, wall mounts, monitor stands, or monitor arms to save space for multiple-day trading monitors. It’s a great option for configuring multiple trading monitors. They can mount two to three monitors on your desk or on the wall.

You’ll have a clear workspace to conduct business in this manner. Aside from that, a perfect day trading computer setup calls for an adjustable monitor arm that can be adjusted to fit your neck.

How many monitors do traders need?

How many monitors are required for at-home traders to effectively monitor the markets? As monitor prices have dropped significantly, and graphics cards now routinely support multiple monitor setups, the answer has evolved over time.

Given the low cost, it makes sense to install as many monitors as you can comfortably fit in the space designated for the function without exceeding your budget or your ability to quickly analyze the information displayed on them.

Furthermore, the trading style influences the use of multiple monitors. For instance, a swing or position trader may need multiple monitors to have enough time to analyze the market and access various data feeds. If you are using different crypto platforms to take your trades to the next level, you may also need multiple monitors.

Traders use multiple monitors for different reasons, but in some instances, less is more. If you are just starting out with a small budget, invest in a good laptop and your skills. A good laptop allows you to run several tabs at once and work with little lag in performance. You can do what you need with one laptop and later create a setup when the profits start rolling in.

Conclusion

Traders use multiple monitors for different reasons, but in some instances, less is more. If you are just starting out with a small budget, invest in a good laptop and your skills. A good laptop allows you to run several tabs at once and work with little lag in performance. You can do what you need with one laptop and later create a setup when the profits start rolling in.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Featured