Forex is a virtual market, not restricted to any location, be it London or Johannesburg. This trading platform is available 24 hours a day, as the world’s banks operate in different time zones. This is the key difference between Forex and the “traditional” stock exchange.

All you need to work on the financial market is a stable Internet connection and access to the platform offered by the intermediary. For most clients, a prime broker represents such a guarantee. All rights and responsibilities of the client and the intermediary are stipulated in the contract.

Forex exchange rates change rapidly during the trading day. Positive or negative tendency is shaped by various factors, such as global political changes, economic performance, policy of national financial institutions and force majeure circumstances, including emergencies in leading countries, accidents at enterprises, terrorist attacks, natural disasters, etc. Besides, rumours have a great influence on the market, generating expectations and affecting the mood of traders.

However, Forex has been distinguished by its enviable stability for many years now, as the platform has been always keeping a certain balance. The fall in one exchange inevitably leads to an improvement in the other. And a successful trader can get a lot of profit from it.

/* custom css */

.tdi_3_d5a.td-a-rec-img{ text-align: left; }.tdi_3_d5a.td-a-rec-img img{ margin: 0 auto 0 0; }

What are the Features of Forex Robots?

A Forex robot is a trading software designed according to many trading signals, which allow you to determine the best time for selling or buying a currency pair. Successful robots are designed with drawdown allowance. The value may range from 5 to 60 per cent, depending on the selected strategy. Some robots can distinguish the price dynamics in a time interval of 2-3 seconds, being able to make a deal and gain profit. Obviously, it’s impossible to achieve such a result in manual mode.

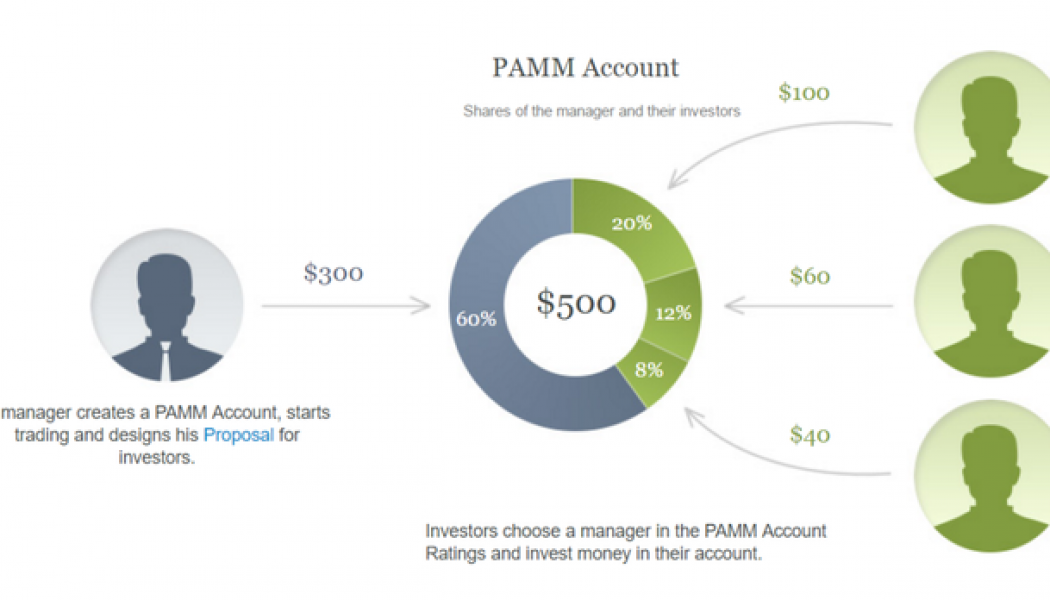

PAMM Account Features

Investing in PAMM accounts allows everyone to increase their own income from the foreign exchange market. The main thing is to choose a skilled manager without attempting to trade independently, fully relying on an expert advisor.

A PAMM account is a tool that makes it possible to adopt the trading model of a managing trader through automatic transfer of all his transactions to the investors’ capital. As a result, the joint money account, consisting of investors’ deposits and trader’s personal funds, undergoes changes: participants of the PAMM-account make profits and losses proportionally to their shares.

Just a few years ago, PAMM accounts were uncommon and only selected brokers worked with them. Given the growing popularity of the tool, most of today’s companies offer to use a PAMM account for profitable investing and earning on Forex.

Staff writer

/* custom css */

.tdi_4_e19.td-a-rec-img{ text-align: left; }.tdi_4_e19.td-a-rec-img img{ margin: 0 auto 0 0; }