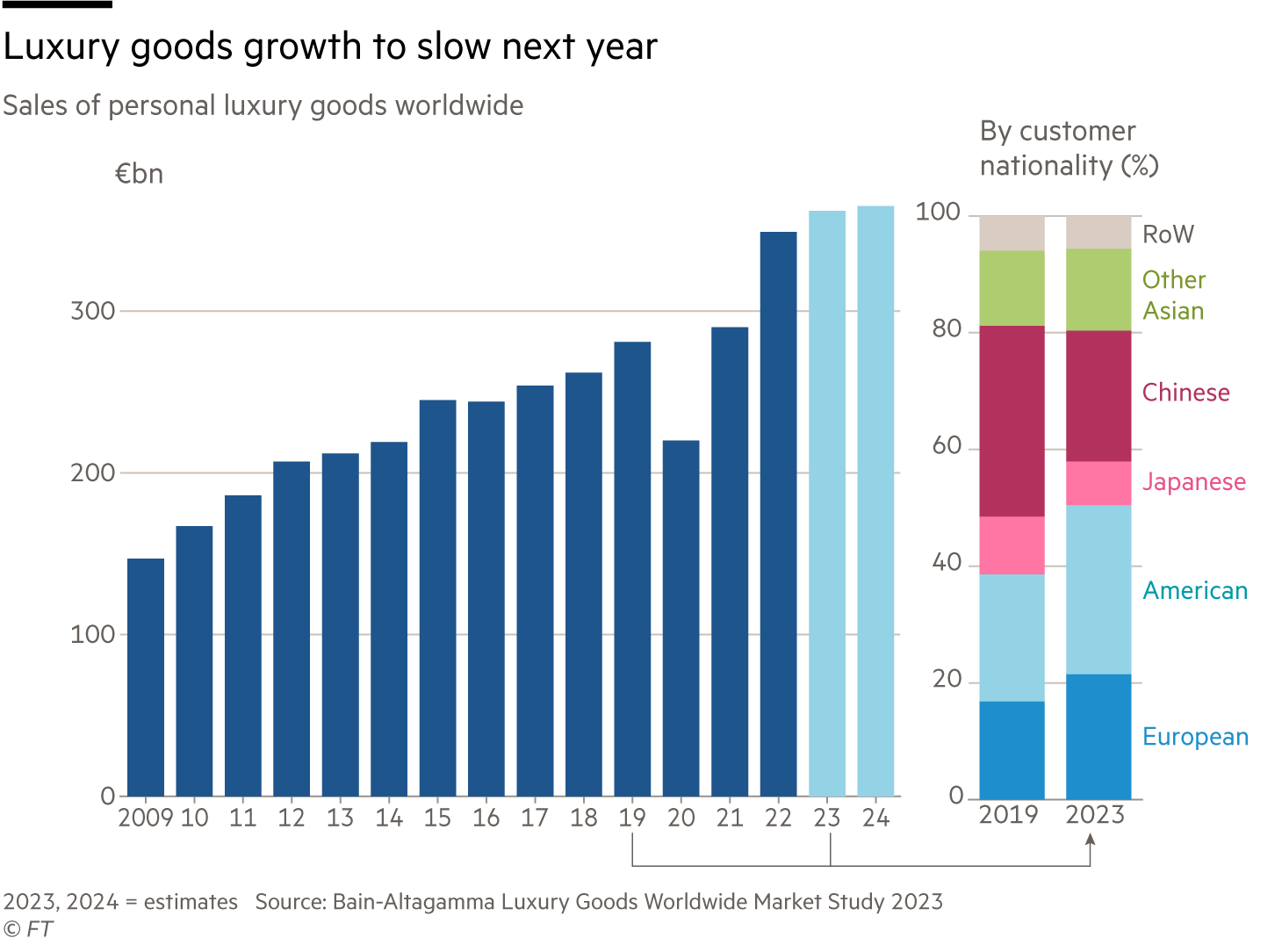

For the €362bn personal luxury goods sector, 2023 may go down as the year that the post-Covid bubble finally burst.

Despite the reopening of China at the start of the year, demand for personal luxury products slowed to 8 per cent at constant currency rates according to Bain, narrowly outpacing global inflation and marking a significant deceleration after three consecutive years of 20 per cent sales growth on average. Investors took note: for the first time in seven years, luxury stocks did not outperform the broader equity market.

“There were two reasons luxury underperformed: one is China, which was OK rather than great this year,” says Thomas Chauvet, head of luxury goods equity research at Citi. While Chinese spending on luxury has surpassed pre-Covid levels, the increase has been more moderate than the US’s, and international tourism — one of the big drivers for Chinese spending — is nowhere near what it was in 2019, largely because travel has become so much more expensive. The big tours that ferried Chinese visitors around on tax-refundable shopping sprees at Galeries Lafayette in Paris or Harrods in London have not resumed en masse.

“The other reason it underperformed is that [there was finally] a reconnect between the high-end consumer [who had continued to spend in spite of inflation and a worsening property market] and the economy,” Chauvet says.

Next year will be tougher, with analysts at Bain and Citi forecasting growth of between 4 and 6 per cent on average — “just enough to cover inflation in the industry, [as] the cost of doing business in luxury has increased a lot,” says Chauvet, citing rises in wages and store rents.

A slowdown ‘everywhere’

What is unusual about the present luxury slowdown, Burberry chief Jonathan Ackeroyd observed on a call with investors last month, is that it’s happening everywhere. “This has been something that is quite unique, because historically you get softness in one region, you’ll be able to pick it up in the other,” he said.

Chanel, which has a higher concentration of wealthy customers than Burberry, has observed a similar trend. “What we are seeing is a down economy everywhere, in every single country,” Bruno Pavlovsky, Chanel’s president of fashion, told the FT earlier this month. “I don’t have a crystal ball, but the situation will be tougher [next year] than what we saw in 2023.”

Still, he cautioned that such slowdowns are part of a normal cycle and that luxury “can’t be in permanent two-digit growth”.

The sector is still expected to outperform the broader fashion market, which is more susceptible to economic pressures, and which analysts at McKinsey expect will grow between 2 and 4 per cent next year.

Turnaround brands will struggle

Bain partner Claudia D’Arpizio says that luxury is entering a “Darwinian phase”, with some brands — particularly those catering to older, high net-worth individuals rather than Gen Z, and those that are well diversified across categories, such as fashion brands with strong hospitality and beauty businesses — poised to continue outperforming their peers.

Brands that are in the middle of a turnaround or creative transition, such as Gucci, Burberry or Ferragamo, will have a tougher time. As will smaller brands that cannot compete with the marketing and retail budgets of the big players.

“Scale is a big topic,” says Citi’s Chauvet. “If Ferragamo or Tod’s spend 10 per cent on marketing, you’re looking at a budget of €100mn, but at Louis Vuitton that’s about €2bn.”

Multibrand retail will take a hit

The end of 2023 has been an especially difficult period for department stores, independent boutiques and other multibrand retailers, with many of them struggling under significant debt and too much inventory — the effects of which will be felt well into 2024.

Last month Saks Fifth Avenue parent company Hudson’s Bay Company raised $340mn in funding after months of unpaid invoices reportedly led several vendors to halt holiday shipments. Farfetch, whose stock had fallen 97 per cent from its peak by mid-December, was rescued from administration at the final hour thanks to a $500mn bridge loan from South Korean retailer Coupang and Greenoaks Capital Partners. And a group of investors recently put forward a $5.8bn offer to take Macy’s private after its stock fell to a near three-year low.

When retailers struggle, so do the brands that sell to them. Young designers in particular are often subject to contracts that make them financially liable for any goods left unsold or sold at a discount.

Designs will get more casual

After a post-lockdown-induced “return to dressing up”, customers are back to investing in casual luxury basics such as cashmere hoodies, drawstring trousers and flat shoes, buyers say. Just don’t call it “athleisure” or “streetwear” — Net-a-Porter’s preferred terms are “The Extraordinary Everyday” and “Chic Sportif”.

Another category where demand is expected to soften? That would be handbags, which are suffering from a combination of lower consumer confidence among first-time buyers, particularly in China, and substantial price increases over the past two to three years, which have made certain styles less attainable.

Top customers will get all the attention

While “aspirational” and first-time luxury shoppers are zipping their wallets shut, luxury executives say that their loyal customers continue to splash out — and will thus remain a priority in 2024.

That will mean more high-end, limited-edition product; more extravagant shows; and greater investment in events and private shopping spaces dedicated to wooing VICs (Very Important Clients).

Price hikes will continue — but at a slower rate

When the 2008 global economic recession hit, brands were forced to slash prices to move inventory — kick-starting a discount cycle that took the better part of a decade to recover from, particularly in the US. (One reader recently regaled me with an account of the “significant boost” her Chanel jacket collection received “during the Saks fire sales of that time”.)

Most major luxury brands have since reduced their exposure to department stores and other channels where their wares might be sold at a discount, and such drastic price cuts are unlikely to come around in 2024, analysts say.

Instead, inflation — which the IMF forecasts will drop from 6.8 per cent in 2023 to 5.2 per cent in 2024 — is likely to drive prices up again next year, albeit at a lower rate than years previous.

While top spenders might be able to absorb the increases, analysts say brands need to think hard about what products they can offer at the entry-level. Mini bags, T-shirts and trainers have become both more expensive and received less creative attention amid a hyper-focus on top-end customers, says Bain’s D’Arpizio. That could result in the introduction of new entry-level categories such as tech accessories and fashion jewellery.

That may be one of the silver linings of the slowdown, executives at smaller, more traditional heritage brands say. After years of snapping up trendy, logo-heavy products marketed via celebrities and big-budget campaigns, they believe customers are poised to become more discerning about the quality and longevity of the individual items they’re spending their money on — which is where they believe they have an advantage.

Find out about our latest stories first — follow @financialtimesfashion on Instagram — and subscribe to our podcast Life and Art wherever you listen