Wealthy Americans reveal what it’s like to retire with $6 MILLION in savings: $100k-a-year on travel and more money they can spend – but they live in modest homes and drive old cars

- A retired Air Force pilot saved up over $6million by living ‘below my means’

- A doctor still makes $300,000 a year working part-time well spending thousands traveling the world

- A Montana man says he hasn’t bought a new sport coat in 20 years despite having more than he can spend in his lifetime

Wealthy Americans have revealed how they’ve managed to accrue healthy-figure savings accounts for their retirements – and how they spend their cash.

To be a retiree in the top 0.1 percent wealth bracket, you need to have about $5 million in the bank.

And now a fascinating Wall Street Journal profile has detailed six such retirees, who’ve shared tips on building a huge retirement war chest, even if you’re on a humble salary – and how they make economies despite being flush with cash.

Pilot, $6.1M: Says 13 years in US Air Force helped him strategize for retirement

After flying commercial planes and a 13-year stint in the Air Force in a 40-year career, Paul Shemwell, 65, was set up well for his December retirement.

Despite the millions he had ready for the rest of his life, he has struggled to adjust to a more casual living style.

‘My plan is to continue living within or below my means, stay invested and have something to leave to my kids,’ he said.

Paul Shemwell landed in retirement in December after four decades flying commercial planes and jet fighters.

He claims his military service has led him to try and be pragmatic and careful in retirement, owning a Texas home valued by Zillow at just around $724,000, which he has roughly $300,000 left on the mortgage for.

The property was bought with a 2.9 percent interest rate, with Shemwell saying he’s in no rush to pay it off.

Shemwell is continuing to travel in his retirement, with four trips totaling around $12,000 set for the fall while still giving the government and insurance companies $9,000 a month.

His other passions include tennis, working out, skiing and scuba-diving. Shemwell, a divorcee with two kids, spends time visiting them at school and hanging out with friends.

The former pilot has been asked several times to come back to work but says he doesn’t need the cash, especially after $40,000-a-year in social security once he hits full retirement age.

‘I like to keep things simple,’ he added.

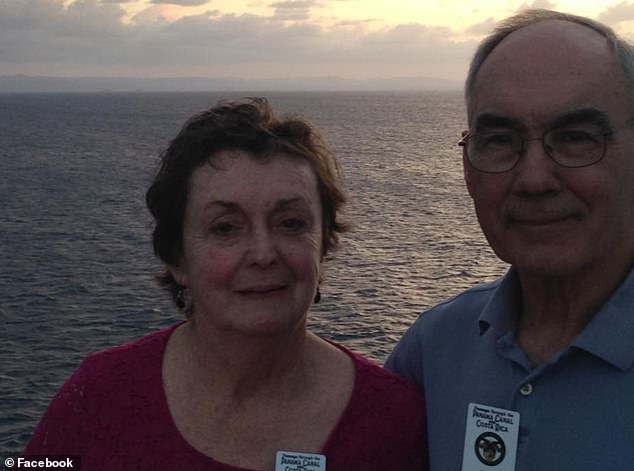

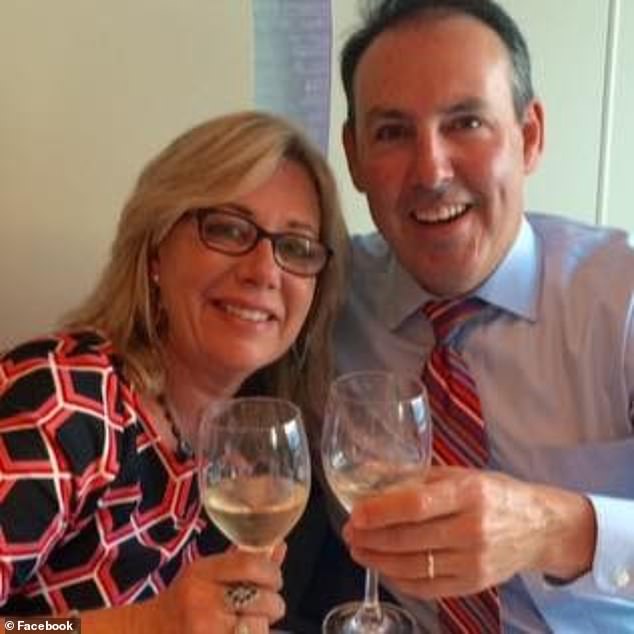

Veterinarian and nurse, $6.1M: More money than they can spend in their lifetimes

Bob Frey, 80, and wife Pat, 75 were able to save away $6.1 million despite years of worry over money and at one point, his decision to borrow $150,000 to start his veterinary practice.

Bob also spent 26 years as a reserve officer after graduating West Point, maxing out retirement plan contributions in his 30s, earning $60,000 a year in military pension and $14,000 in disability from losing hearing when he served in Vietnam.

Bob and Pat collect a combined $56,000 in Social Security and have a total of $6.1 million in retirement accounts.

‘We have more money than we can spend in our lifetimes,’ Bob said.

The pair moved to a $1.2million home in Bozeman, Montana 30 years ago to be with nature as both continued working, Pat as a nurse, while Bob changed careers to become a financial planner.

The couple, who between them have five children, do not spend lavishly, with Bob pointing out he hasn’t even bought a new sport coat in two decades.

They prefer living in jeans and sneakers and being around nature, as opposed to wearing formal clothing.

Among their $35,000-a-year in travel costs, Bob often goes on hunting trips with buddies, while Pat often takes a friend on treks to Europe.

What will they spend some of that money on? Around $1.5 million to educate their nine grandchildren and $40,000 a year to charity. Their plan is to donate $1 million when both pass away.

The Freys have no debt and don’t mess around with investing in retirement, though they keep 70 percent invested in stocks.

The couple have no debt and don’t tinker much with their investments, of which 70 percent is in stocks.

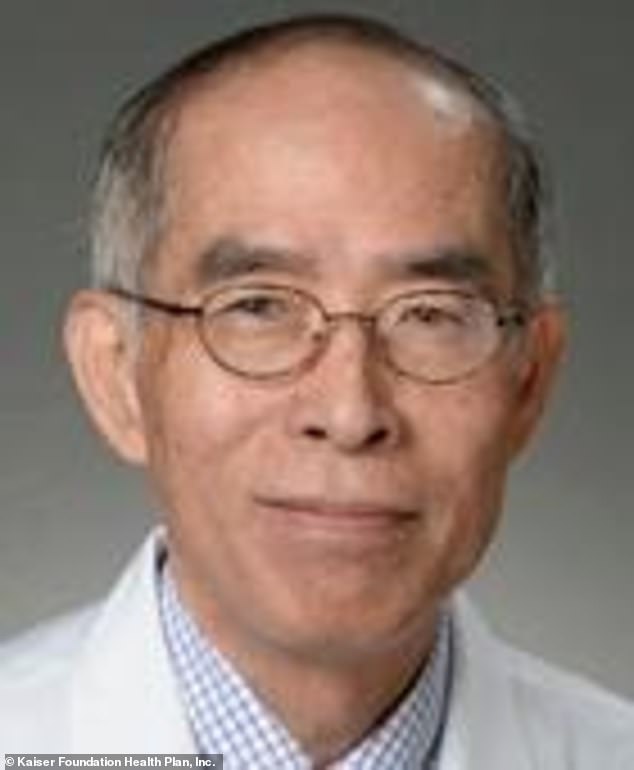

Doctor, $4.1M: Still works part time and earns $300,000-a-year

Dr. Henry Hwu takes a somewhat different tactic to Shemwell, still earning a six-figure salary each year despite millions in assets when he retired in 2018.

He owns two properties worth a combined $2.7 million, and has a million dollars in his pension fund, while also making a further $300,000-a-year from part-time work.

Hwu, 72, admitting that he does ‘like to travel’ away from his Irvine, California home, now plans trips around his part-time work, which is well down from the 80 hours a week he used to put in. His travel budget sits at around $100,000-a-year.

His wife, whom he emigrated to America with in 1979, passed away shortly after retirement and said he ‘didn’t like’ the feeling of not knowing what to do with himself.

The widower has picked up popular sports for seniors like golf and pickleball and attempted to reinvigorate his love for the guitar and hiking.

He’s traveled through many countries in Europe – a visit to Switzerland left him with enough chocolate to break his suitcase – but he still sees his mother, 98, in Taiwan.

Hwu, who lives in an estimated $2.3million-estate in California, according to Zillow -missed work and began accepting assignments at his former practice.

Software technician and dental nurse, $4.1M: ‘Buy what they knew’ with stocks

A husband-and-wife who spent their lives preparing for this moment, retired software technician Jay Myer and wife Anita benefitted from maxing out contributions to his 401(k) for decades.

Jay Myer, 61, started preparing for retirement at 25 by reading books that led him to play the stock market, hitting big on Home Depot at an original price of $3 a share, following the advice of ‘buy what you know.’

‘I was young to be reading about retirement, but it made a lot of sense to me. If you lower your investment cost, you’ll keep more of the profits,’ said Myer.

Both he and wife Anita, 60, operated on a strict budget that saw them drive used cars.

It allowed Jay to retire early, but the couple continued to fret about money, especially when the pandemic hit.

He initially worried and marked every purchase he and his ex-dental assistant wife made before realizing it was foolish with so much saved and a $925,000 house in North Carolina after selling their first home in Atlanta.

The couple spends about $20,000 a year on traveling and $130,000 annually, with $5,000 on property taxes.

They still stay on a budget somewhat, with $700 on food and $1,000 on health insurance each month.

While they love cooking and gardening, Jay Myer claims he’s learning to love doing nothing at all.

‘Now that I have more time, I have learned to embrace boredom and slow down and accept sometimes that reading a book or riding my bike is enough,’ he said.