Last Wednesday’s ruling by the Court of Appeal to declare the Finance Act, 2023 has made the waters murkier for John Mbadi, the nominee for the Treasury Cabinet Secretary.

Quashing of the Act affected several new taxes in the VAT Act, Excise Duty Act and Miscellaneous Fees and Levies Act, Income Tax Act, Kenya Revenue Authority Act, and the Retirement Benefits Act, among others.

The decision created a new hole of Sh214.2 billion, according to an appeal filed in the Supreme Court by Treasury Principal Secretary Chris Kiptoo, adding to the Sh346 billion attributed to the scrapping of the Finance Bill, 2024 in what has added to the headache facing officials at the National Treasury who now have a wider Sh560 billion budget hole to fill.

And just before Mr Mbadi appeared for vetting in Parliament for the Treasury CS position, another blow struck — Fitch downgraded Kenya’s credit rating further into junk territory, becoming the second major rating agency to sour on its sovereign debt—a sign of the darkening fiscal backdrop in Kenya and a move that risks a broader market selloff.

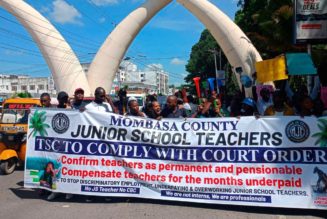

The Treasury now says funding to key sectors would have to be chopped if the Court decision on the Finance Act, 2023 is upheld with the education sector set to take the biggest hit of Sh71.4 billion targeted at key spending items such as the hiring of junior secondary school teachers on permanent and pensionable terms (Sh18 billion), Higher Education Loans Board (Sh10 billion), secondary schools’ capitation (Sh18 billion) and scholarships (Sh16.9 billion).

Others are free primary education at Sh4 billion, and capitation for Technical and Vocational Education and Training Authority and technical training institutes at Sh4.5 billion.

Further, the state now eyes a Sh59 billion cut in the allocation towards payment of interest on public loans, signalling a potential default on its obligations. At the same time, pensions and gratuities face a Sh20 billion hit.

On Saturday, Fitch cut Kenya’s credit rating to “B- with a stable outlook,” having rated the sovereign debt default risk at “B” since December 2022 and following a similar downgrade from Moody’s on July 8. The firms have grown gloomier on Kenya’s ability to pay debts, largely as a result of anti-government protests that pushed President William Ruto to scrap proposed tax hikes in June that would have netted Sh346 billion in additional government revenue.

As Mr Mbadi appeared before lawmakers on Saturday for his vetting, these piling challenges defined the toughening reality he must address if cleared for the role.

Critics have argued that Mr Mbadi’s nomination is a poisoned chalice given the country’s economic challenges, which have now been exacerbated by the nullification of the two Finance Acts, are nearly impossible.

Mr Mbadi will have to rely on the revenue-raising measures of the Finance Act, 2022. This means that a majority of the taxes will be collected at lower rates while others that were introduced under by the Finance Act, 2023 and Finance Bill, 2024 will be stopped.

These realities mean that Mr Mbadi, an accountant by profession, might be forced to swallow his earlier criticism on tax raises and take on the path of increased taxation—a path that could trigger protests as evidenced in the events that started two months ago leading to the dropping of the Finance Bill, 2024.

“We agree that the debt level is unmanageable, but the mistake the government is making is to imagine it will collect more from Kenyans by increasing taxes. The moment you start attacking people’s salaries, they stop spending,” he said in October last year.

On Saturday, Mr Mbadi maintained his stand against tax raises, proposing a raft of changes including remodelling the operations of the Kenya Revenue Authority (KRA).

“I don’t think coming up with new taxes is the solution to revenue mobilisation. The solution should be targeting the tax collector. KRA is like a cow that we milk without feeding. The system KRA is using at the moment needs engineering,” Mbadi told the vetting committee.

He also pointed out that the government could leverage on climate financing models to support the Ministry of Environment’s budget and by extension create jobs.

“We must now think through methods that would generate revenue off balance sheets, one of them is climate change financing. Climate change has about Sh167 trillion, we must tap into that money to reduce pressure on the budget,” Mr Mbadi said. “(Environment CS nominee) Aden Duale’s budget should be heavily funded by climate change financing. Kenya has already applied and succeeded in securing $259 million which will go to 47 counties. It should also help us create jobs for our youths” he added.

Mr Mbadi on Saturday also told Parliament that one of his priorities would be to tame costly borrowing that has put pressure on the economy.

“My focus is to have commercial debts at no more than five per cent of our external debt portfolio and have 75 per cent of our debt under multilateral debt and 20 per cent on bilateral debt. With that, you can reduce the cost of debt,” he said.

The Treasury CS nominee further vowed to cut wasteful spending in government to free funds for development.

“I hear you, [there is] a lot of opulence. Even the reconstitution of this Cabinet is a direct consequence of a show of opulence which made some Kenyans mad to the extent that the President was forced to do certain things that he shouldn’t have done. We must contain wastage. We shouldn’t be mechanical about it but contain it practically. One of them is to reduce our operating expenditure, we must make our budget transparent,” he told Parliament.