The tariffs largely target key clean energy technologies and critical minerals.

The Biden administration announced much higher tariffs today on key goods from China that the US will need to meet its climate goals. The move targets transportation, clean energy technologies, raw materials, and more.

“To encourage China to eliminate its unfair trade practices regarding technology transfer, intellectual property, and innovation, the President is directing increases in tariffs across strategic sectors such as steel and aluminum, semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products,” a White House fact sheet says.

It’s the latest move the US has taken amid efforts to ramp up domestic manufacturing while escalating trade tensions with China. All in all, the increased tariffs are expected to affect around $18 billion in annual imports.

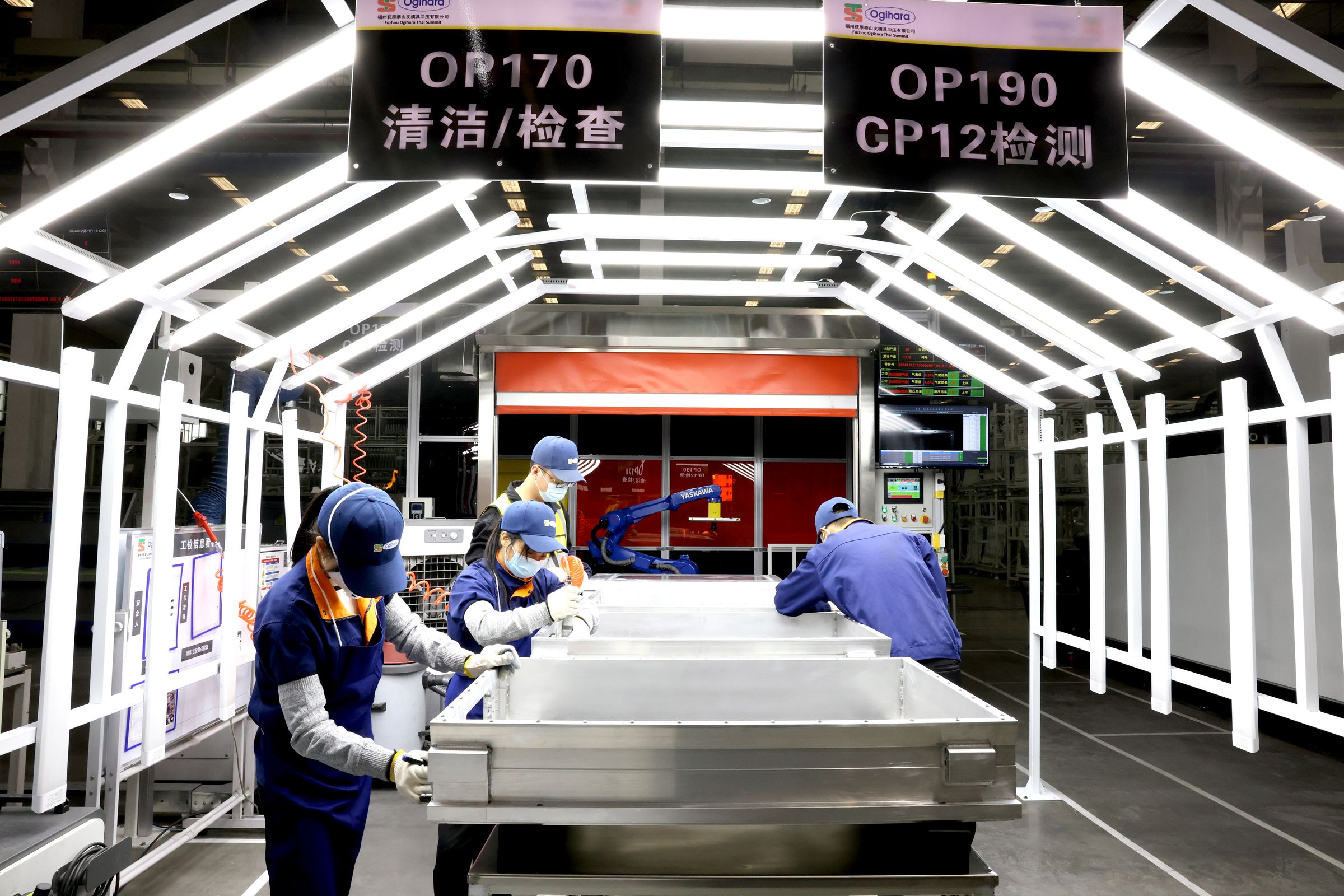

When it comes to EVs, the Biden administration is doubling down on tactics to lock Chinese manufacturers out of the US. Chinese-made EVs are a lot more affordable than other options — around $10,000 for BYD’s Seagull compared to close to $40,000 for the cheapest Tesla model. But high tariffs have effectively blocked China from importing its EVs to the United States. Now, that tariff rate is jumping to 100 percent from the current level of 25 percent.

Higher tariffs on batteries, semiconductors, and critical minerals could also affect the US EV industry. Tariffs on battery parts and lithium-ion batteries for EVs will increase to 25 percent from 7.5 percent this year. A similar increase for non-EV lithium batteries will go into effect in 2026. By 2025, the tariff rate on semiconductors from China will double to 50 percent.

Tariffs on permanent magnets, natural graphite, and certain other critical minerals are also set to rise to 25 percent from zero over the next couple of years. Graphite is used in batteries, solar panels, and steelmaking. Certain steel and aluminum products will see tariffs rise to 25 percent from today’s zero to 7.5 percent.

Meanwhile, US-based solar manufacturers are celebrating the decision to raise tariffs on solar cells to 50 percent from the previous 25 percent. “The Administration made the right decision to strengthen protections for solar components we seek to build in the U.S.,” Mike Carr, executive director of the Solar Energy Manufacturers for America Coalition, said in an emailed petition.

The US already blocks solar imports from China’s Xinjiang region, where roughly 40 percent of solar-grade polysilicon manufacturing takes place, over concerns about forced labor and human rights violations along the supply chain.

Solar manufacturers in the US urged the Biden administration to impose tariffs on solar panels from four countries in Southeast Asia earlier this year, after a Commerce Department investigation determined that Chinese companies were circumventing tariffs by moving goods through other countries.

Still, enforcing those measures has proven tricky for US officials, as has building up domestic manufacturing capabilities. Biden invoked the Defense Production Act back in 2022 to boost manufacturing of solar panels and other clean energy technologies. The CHIPS and Science Act included $52 billion in federal funding for domestic semiconductor manufacturing in 2022. The Inflation Reduction Act signed into law that year also pushes EV manufacturers to ditch battery materials from China if they want to qualify for consumer tax credits.