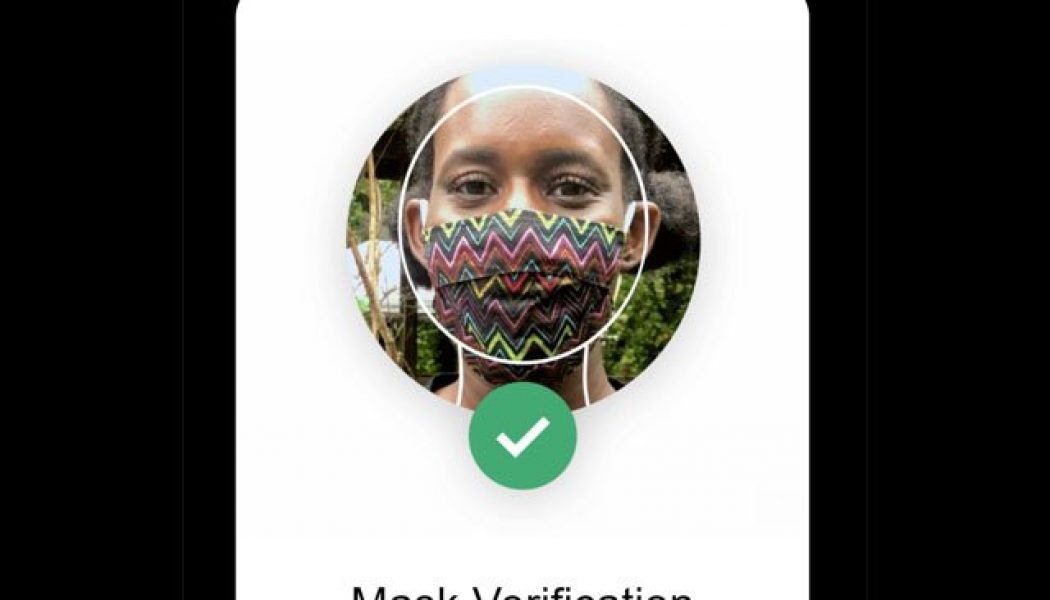

Uber South Africa has launched its Mask Verification tool in an attempt to ensure all passengers wear a mask when taking a ride.

Passengers may be required to take a selfie while the mask verification tool ‘detects whether a mask is within the frame of the portrait and allows access to Uber if this is the case,’ reports MyBroadBand.

“Masks are mandatory for riders and drivers, and both of you can leave feedback if the other isn’t wearing one,” reads an email from Uber to its South African users.

“If we receive feedback about anyone consistently violating our mask policy, they will be blocked from the Uber app.”

/* custom css */

.tdi_3_f66.td-a-rec-img{ text-align: left; }.tdi_3_f66.td-a-rec-img img{ margin: 0 auto 0 0; }

Uber Cash Digital Wallet Launched in Sub-Saharan Africa

Uber is launching its Uber Cash digital wallet feature in Sub-Saharan Africa through a partnership with Nigerian founded fintech Flutterwave.

The arrangement will allow riders to top up Uber wallets using the dozens of remittance partners active on Flutterwave’s Pan-African network. Flutterwave operates as a business-to-business payments gateway network that allows clients to tap its APIs and customize payments applications.

According to TechCrunch, Uber Cash will go live for Uber’s ride-hailing operations in South Africa, Kenya, Nigeria, Uganda, Ghana, Ivory Coast and Tanzania.

“Depending on the country, you’ve got different top-up methods available. For example, in Nigeria, you can use your Verve Card or mobile money. In Kenya, you can use M-Pesa and EFT and in South Africa, you can top up with EFT,” says Alon Lits, GM of Uber for Sub-Saharan Africa.

In Africa, Uber Cash will also accept transfers from Flutterwave’s Barter payment app, launched with Visa in 2019.

It is believed that this move could increase Uber’s traffic on the continent by boosting the volume of funds sent to digital wallets and reducing friction the payments process. Uber still accepts cash in Africa — which has one of the world’s largest unbanked populations — but has made strides on financial inclusion through mobile money.