- Justin Sun says USDD would be backed by a $10 billion crypto reserve

- Proper algorithms would be used to retain the USDD tie with the dollar at 1:1 despite volatility

31-year-old crypto figure Justin Sun has revealed plans to launch the first token of the Stablecoin 3.0 era – Decentralised USD (USDD). According to an open letter sent out last week, Sun explained that TRON DAO had initiated efforts with top figures in the blockchain space to launch USDD as the most decentralised stablecoin.

The stablecoin will boast a $10 billion backing in a crypto reserve, a figure that Sun said will be raised by the newly-established TRON DAO Reserve over the next six months to one year. The reserve will be made of highly liquid assets and derived from leading entities in the blockchain scene.

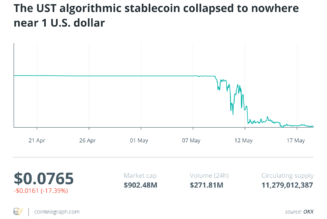

USDD would be powered by “the capabilities of mathematics and algorithms” to tie its peg to the US dollar. With the belief that a decentralised ecosystem will need decentralised stablecoins, the TRON founder argues that eventually, all blockchains will go the decentralised stablecoin way.

“Blockchain believers pursue to decentralise everything centralised, on the strong faith in the capabilities of mathematics and algorithms rather than violence and power in creating a desirable future for the world. Today, we see the possibility of decentralising the blockchain world’s most centralised territory,” he wrote.

The Stablecoin 3.0 era

Sun explained that the launch of USDD will signal the start of the Stablecoin 3.0 era. He noted that the TRON-based USDD would be the most efficient and cheapest stablecoin platform in the DeFi space.

The stablecoin 3.0 era, he continued, would be characterised by the same exceptional speeds and affordability synonymous with stablecoin 2.0, an era he says was led by TRON-based USDT. This period brought transaction costs to a few cents down from as high as $100, which was seen during stablecoin 1.0. The transaction time was also cut from more than 30 minutes to a fraction of a second.

In the stablecoin 3.0 era, tokens will not rely on centralised institutions for custodial, management, and redemption services. Instead, in the case of USDD, TRON’s TRX token would be used for full on-chain decentralisation. Also, proper algorithms will be employed, in a decentralised way to maintain the stability of USDD at 1:1 again the dollar, despite the volatility.

To shield itself from risk, the TRON DAO Reserve will establish a basic interest rate of 30% per annum.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Stablecoin, technology, Tron