The Treasury has stepped up its lobbying of Parliament to adopt punitive tax measures contained in the Finance Bill, saying they will help narrow Kenya’s budget deficit and cut the appetite for borrowing.

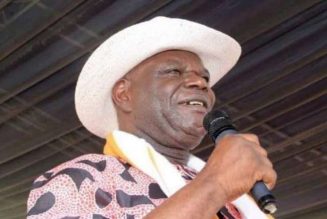

The Principal Secretary for Treasury, Chris Kiptoo, said the higher taxes and new ones proposed in the Bill are necessary to control mounting public debt levels and support economic growth.

“We need to raise our own revenues to avoid relying on borrowing. We don’t have room to take more debt because it will worsen our situation,” Dr Kiptoo told the Finance and Planning Committee Tuesday night before it retreated to write its report.

“We need to up our revenue and reduce expenditure so that we live within our means. We must do aggressive revenue mobilisation in terms of tax collection.”

Kenya plans to cut its budget deficit for the fiscal year starting July while also trying to preserve growth-supporting expenditure, like on infrastructure projects.

This is in line with plans to shift to a balanced budget within three years.

The country has in the past decade been running wide fiscal deficits to fund a range of ambitious infrastructure projects, but the stance nearly backfired when markets started to question the government’s ability to repay the debts.

The Treasury seeks to raise an additional Sh323 billion in taxes in the financial year that starts in July, with the measures drawing sharp criticism from political opponents, the church, workers and industry groups.

Dr Kiptoo told the committee that rejection of the tax measures would increase Kenya’s budget deficit and place the country on a collision course with the International Monetary Fund (IMF).

The Treasury has a deal with the IMF, which has recently provided billions of shillings in financial aid to Kenya, to reduce the country’s debt vulnerability through increased taxation and spending cuts.

“The law requires that the best sustainable debt would be if we are at 55 percent. When we were coming to Parliament to seek the change of the law, we were at 67 percent,” Dr Kiptoo said.

Apart from cutting spending and reducing the budget deficit, President Willia Ruto’s government, which took office in 2022, has also been introducing new taxes, angering some individuals and groups who have challenged the tax measures in court.

In the fiscal year starting July, the government plans to spend Sh3.92 trillion, with a big chunk of the budget being recurrent spending for items like paying salaries and fuelling cars.

Development spending will take another Sh687.9 billion while counties have been allocated Sh446.1 billion.

To finance this budget, the Treasury has given the Kenya Revenue Authority (KRA) a tax collection target of Sh2.91 trillion, an increase from Sh2.45 trillion for the current financial year ending this month.

This leaves the Treasury with a budget hole of Sh514.7 billion that will be plugged through borrowing from foreign and domestic creditors.

The fiscal deficit has been significantly narrowed from the current Sh908.6 billion contained in the second mini-budget.

The Treasury defended the additional taxes and an expanded tax base, arguing Kenya’s debt situation could worsen in the medium term.

“Our capacity to carry more debt is not sustainable so we have to raise revenue and cut expenditure. Any further accumulation of debt would mean we will have no fiscal space,” Dr Kiptoo said

To collect the additional taxes, the Treasury has come up with various contentious amendments through the Finance Bill 2024.

These proposals, including a 2.5 percent car tax, 16 percent value-added tax (VAT) on banking services and a new eco levy, have kicked up a storm from the business community, consumers, NGOs and churches.

There is also the proposal to introduce VAT on bread and 25 percent excise duty on both crude and refined vegetable oils.

A majority of Kenyans and interest groups who appeared before the Finance and Planning Committee asked it to reject the new taxes.