Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

Chainalysis chief scientist shared his views on the Tornado Cash saga and said that the incident has left a void for illicit fund mixing services, but the real impact of the sanctions could be determined in the long run.

The staking ecosystem of Ethereum post Merge could have a significant impact on the crypto economy, according to a new report. Institutional lending platform Mapple Finance launched a $300 million lending pool for Bitcoin mining farms.

The Tribe DAO, a decentralized autonomous organization, voted in favor of repaying affected users of the $80 million exploit on DeFi platform Rari Capital’s liquidity pools. BNB Chain launched a new community-led security initiative called Avenger DAO.

Top-100 DeFi tokens by market cap have a mixed week in terms of price action, where many tokens traded in red while a few others showed weekly gains.

Tornado Cash left a void, time will tell what fills it — Chainalysis chief scientist

The sanctions on cryptocurrency mixer Tornado Cash have left a vacuum for illicit fund mixing services, but more time is needed before we’ll know the full impact, according to Chainalysis’ chief scientist.

During a demo of Chainalysis’ recently launched blockchain analysis platform Storyline, Cointelegraph asked Chainalysis chief scientist Jacob Illum and country manager for Australia and New Zealand Todd Lenfield about the impact of the Tornado Cash ban.

Tribe DAO votes in favor of repaying victims of $80M Rari hack

After months of uncertainty, the Tribe DAO has passed a vote to repay affected users of the $80 million exploit on DeFi platform Rari Capital’s liquidity pools.

Following several rounds of voting and governance proposals, Tribe DAO, which consists of Midas Capital, Rari Capital, Fei Protocol and Volt Protocol, took the decision to vote on Sunday with the intent to fully reimburse hack victims.

Staking providers could expand institutional presence in the crypto space: Report

The Ethereum blockchain’s carbon footprint is expected to reduce by 99% following last week’s Merge event. By positioning staking as a service for retail and institutional investors, the upgrade could also have a significant impact on the crypto economy, according to a report from Bitwise on Tuesday.

The company said it projects potential gains of 4%–8% for long-term investors through Ether (ETH) staking, while J.P. Morgan analysts forecast that staking yields across PoS blockchains could double to $40 billion by 2025.

Maple Finance launches $300M lending pool for Bitcoin mining firms

On Sept. 20, institutional crypto lending protocol Maple Finance and its delegate Icebreaker Finance announced that they would provide up to $300 million worth of secured debt financing to public and private Bitcoin mining firms. Qualified entities meeting treasury management and power strategies standards located throughout North America, as well as those in Australia, can apply for funding.

On the other hand, the venture seeks to deliver risk-adjusted returns in the low teen percentages (up to 13% per annum) to investors and capital allocators. The pool is only open to accredited investors who meet substantial income and/or net worth qualifications within a jurisdiction.

BNB Chain launches a new community-run security mechanism to protect users

BNB Chain, the native blockchain of Binance, has launched AvengerDAO, a new community-driven security initiative to help protect users against scams, malicious actors and possible exploits.

The security-centric DAO has been developed in association with leading security firms and popular crypto projects such as Certik, TrustWallet, PancakeSwap and Opera, to name a few.

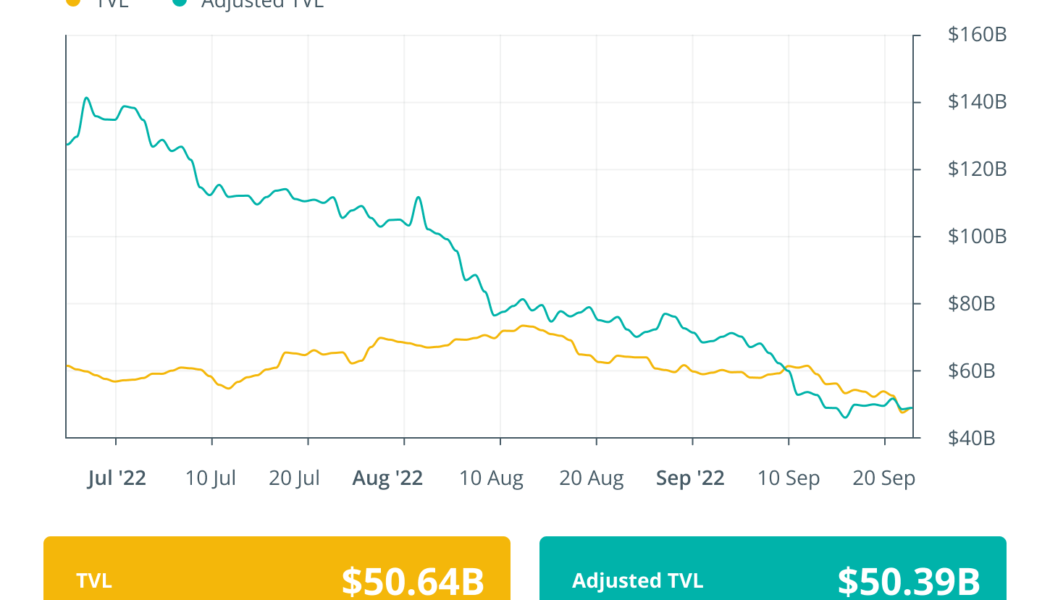

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a minor dip from the past week. The TVL value was about $50.64 billion at the time of writing. Data from Cointelegraph Markets Pro and TradingView show that DeFi’s top 100 tokens by market capitalization had a mixed week, with many tokens making a recovery toward the end of the week while a few others traded in red on the weekly charts.

Compound (COMP) was the biggest gainer, registering a 15% gain over the past seven days, followed by PancakeSwap (CAKE) with an 8.8% gain. Theta Network (THETA) was another token in the top 100 to post a 5% weekly gain.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education in this dynamically advancing space.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Chain, crypto blog, Crypto news, cryptocurrencies, cryptocurrency exchange, DAO, Hacks