Bitcoin’s (BTC) bullish sentiment received a minor setback on Nov. 12 afte the Securities and Exchange Commission (SEC) rejected VanEck’s Bitcoin exchange-traded product that planned to track Bitcoin’s spot price.

However, this negative development was followed by the successful activation of the Taproot soft fork on November 13. Bitcoin developer Hampus Sjöberg, who runs a Taproot dedicated website, told Cointelegraph that the “greatest win” was that Taproot showed that Bitcoin could do network upgrades and that was important for the longevity of the network.

Analysts from Decentrader also pointed out that Bitcoin’s last major upgrade was the implementation of Segwit in August 2017 and this was followed by a sharp rally from $4,000 to $20,000 in four months.

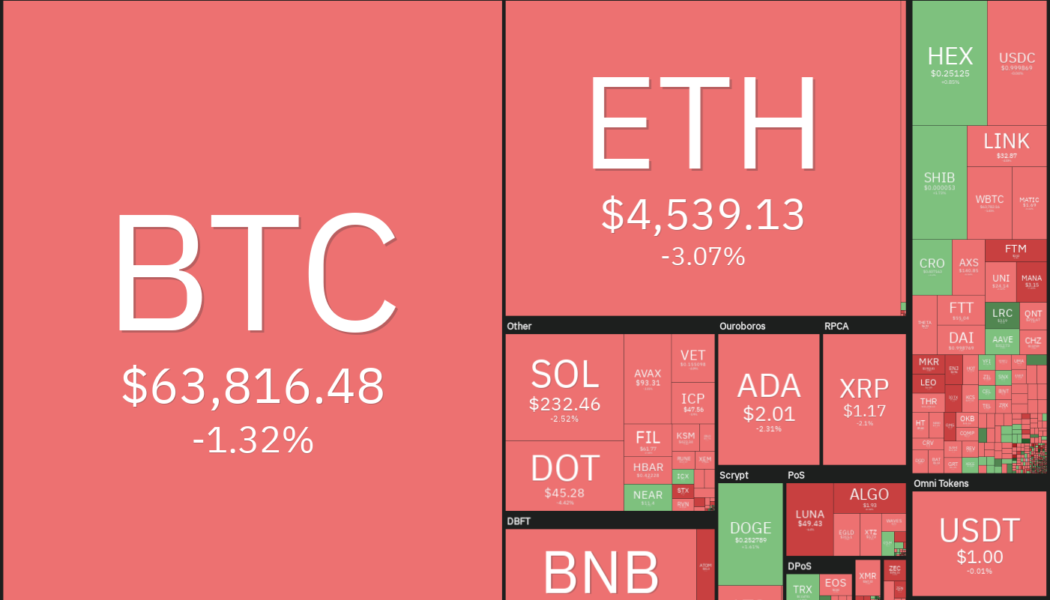

Could Bitcoin repeat its previous bullish performance following the Taproot upgrade and pull altcoins higher? Let’s study the charts of the top-5 cryptocurrencies that may resume the uptrend in the next few days.

BTC/USDT

Bitcoin has pulled back to the 20-day exponential moving average ($62,954), which is an important support to keep an eye on. Traders generally buy the dip to the 20-day EMA in a strong uptrend.

The upsloping moving averages indicate that buyers have the upper hand but the negative divergence on the relative strength index (RSI) warns that the bullish momentum may be weakening.

If the price rebounds off the 20-day EMA, the bulls will try to push the price above the all-time high at $69,000 and resume the uptrend. The BTC/USDT pair could then rally to $75,000.

Alternatively, a break and close below the 20-day EMA will indicate that traders may be rushing to the exit. The pair could then drop to the 50-day simple moving average ($57,938). A break below this support could signal the start of a deeper correction to $52,920.

The 4-hour chart shows that the pair is consolidating between $60,000 and $67,000. Although the bulls pushed the price above the resistance of the range, they could not sustain the higher levels. The pair has again dipped back into the range.

The 20-EMA is sloping down marginally and the RSI is just below the midpoint, suggesting that the price may gradually drift down to $60,000. A strong bounce off this level could extend the range-bound action for some more time but a break below it could signal a trend change.

Alternatively, if the price turns up from the current level, the bulls may challenge the overhead resistance zone at $67,000 to $69,000.

LTC/USDT

Litecoin (LTC) completed a rounding bottom formation when it broke and closed above the overhead resistance at $225.30. The price quickly picked up momentum and rose to the psychological barrier at $300 where the bears mounted a stiff resistance.

The altcoin has been correcting for the past few days but the 20-day EMA ($224) has started to turn up and the RSI is just below the overbought zone, indicating that bulls have the upper hand. If the price turns up from the current level or rebounds off $225.30, the buyers will attempt to resume the uptrend.

A break and close above $300 could open the doors for a further rally to $340. The bears are likely to have other plans as they will try to pull and sustain the price below the breakout level at $225.30. If they can pull it off, the LTC/USDT pair may drop to the 50-day SMA ($192).

The 4-hour chart shows that the pair is trading inside a falling wedge pattern. The 20-EMA has flattened out and the RSI is near the midpoint, indicating a balance between supply and demand.

This equilibrium could tilt in favor of the bulls if they push and sustain the price above the wedge. The pair could then rise to $280 and later to $295.70. This level may act as a stiff resistance but if bulls overcome this hurdle, the pair could rally to the target objective at $302.10.

Alternatively, if the price breaks below the 50-SMA, the selling could intensify and the pair may drop to the strong support at $225.30.

LINK/USDT

The bulls drove Chainlink (LINK) above the overhead resistance at $35.23 on Nov. 9, 10 and 11 but could not sustain the price above it. This suggests that bears are defending this level with vigor.

Both moving averages are sloping up and the RSI is above 55, suggesting that bulls have a slight edge. If the price rebounds off the 20-day EMA ($32.27), the buyers will make another attempt to clear the overhead hurdle.

If they manage to do that, the LINK/USDT pair could signal the start of a new uptrend. The first target on the upside is $42.50 and then $47.50. This bullish view will be negated if the price breaks below the 20-day EMA. Such a move could pull the price down to the 50-day SMA ($28.83).

The pair has been rising inside an ascending channel for the past few days. The bulls attempted to push the price above the channel on Nov. 10 but failed. This may have prompted profit-booking by the bulls and shorting by the aggressive bears.

The price could now drop to the support line of the channel where buying may emerge. A strong rebound off this support will suggest that bulls continue to buy at lower levels. The pair may then continue to move up inside the channel. A break and close below the channel will signal a possible change in trend.

Related: Bitcoin sets up nail-biting weekly close after Taproot goes live

VET/USDT

VeChain (VET) broke above the stiff overhead resistance at $0.15 on Nov. 4, indicating that bulls had overpowered the bears. The price has dipped back to the breakout level and the bears are attempting to pull the price below it and trap the aggressive bulls.

The 20-day EMA ($0.15) is sloping up and the RSI is in the positive territory, indicating a minor advantage to the bulls. If the price rebounds off the current level, the bulls will try to push the VET/USDT pair above $0.19 and resume the up-move. The pair could then rally to $0.24.

Contrary to this assumption, if the price breaks and sustains below $0.15, it will suggest that markets have rejected the higher levels. The pair could then drop to the 50-day SMA ($0.12) and later to $0.10.

The 4-hour chart shows that bulls pushed the price above the resistance line of the ascending channel pattern but they could not build upon this advantage. This indicates that demand dries up at higher levels.

The price has again dipped back into the channel and the moving averages have completed a bearish crossover. This suggests that the pair could gradually slide to the support line of the channel.

A strong rebound off the support line could keep the uptrend intact and the price may continue to trade inside the channel. The bears will have to pull and sustain the price below the channel to gain the upper hand.

AXS/USDT

Axie Infinity (AXS) is correcting in an uptrend and has been trading inside an ascending channel pattern for the past few days. The price has dipped to the 20-day EMA ($141) where the bulls are trying to arrest the decline.

The 20-day EMA has flattened out and the RSI has dropped near the midpoint, suggesting that buyers may be losing their grip. A break below the 20-day EMA could pull the price to the support line of this channel.

The buyers are expected to defend this level aggressively. If the price rebounds off the support line, it will suggest that the up-move remains intact. The AXS/USDT pair will then try to rise to the all-time high at $166.09.

A break and close above the all-time high could clear the path for a possible rally to the resistance line of the channel at $183. This positive view will invalidate on a break and close below the ascending channel.

The pair has been consolidating between $166.09 and $131.18. The price has been trading below the 20-EMA on the 4-hour chart, indicating that bears are defending this resistance aggressively. This increases the possibility of a drop to the support of the range at $131.18.

If the price rebounds off this support, it will suggest that bulls continue to accumulate at lower levels. The pair may then extend its range-bound action for a few more days.

Conversely, a break and close below $131.18 could signal a possible change in the short-term trend. The pair may then drop to the $115 to $120 support zone. If this zone also cracks, the decline could extend to the psychological support at $100.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.