-

LUNA saw an increase in its trading volume by 22% in the last 24 hours.

-

ANC’s trading volume increased by 44% in the last 24 hours.

-

MIR’s trading volume saw an increase of 27% within that same time frame.

Terra (LUNA) is a blockchain protocol that uses FIAT-pegged stablecoins in order to create price-stable global payment systems.

Anchor Protocol (ANC) is a savings protocol that offers low volatility returns when it comes to Terra’s stable currency deposits.

Mirror Protocol (MIR) is a synthetic asset creation platform that is powered by the Terra network.

Should you buy Terra (LUNA)?

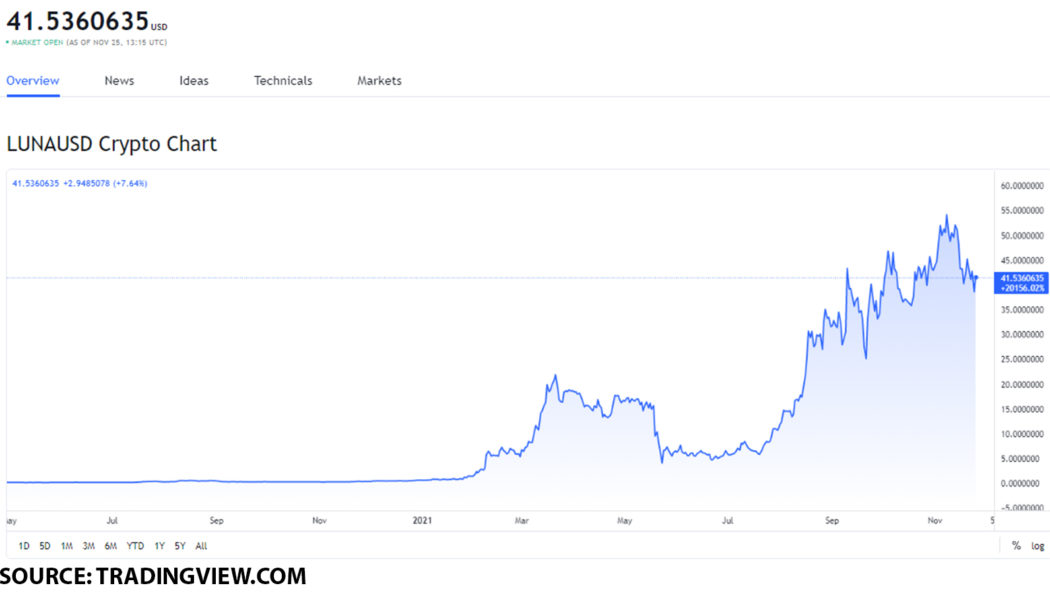

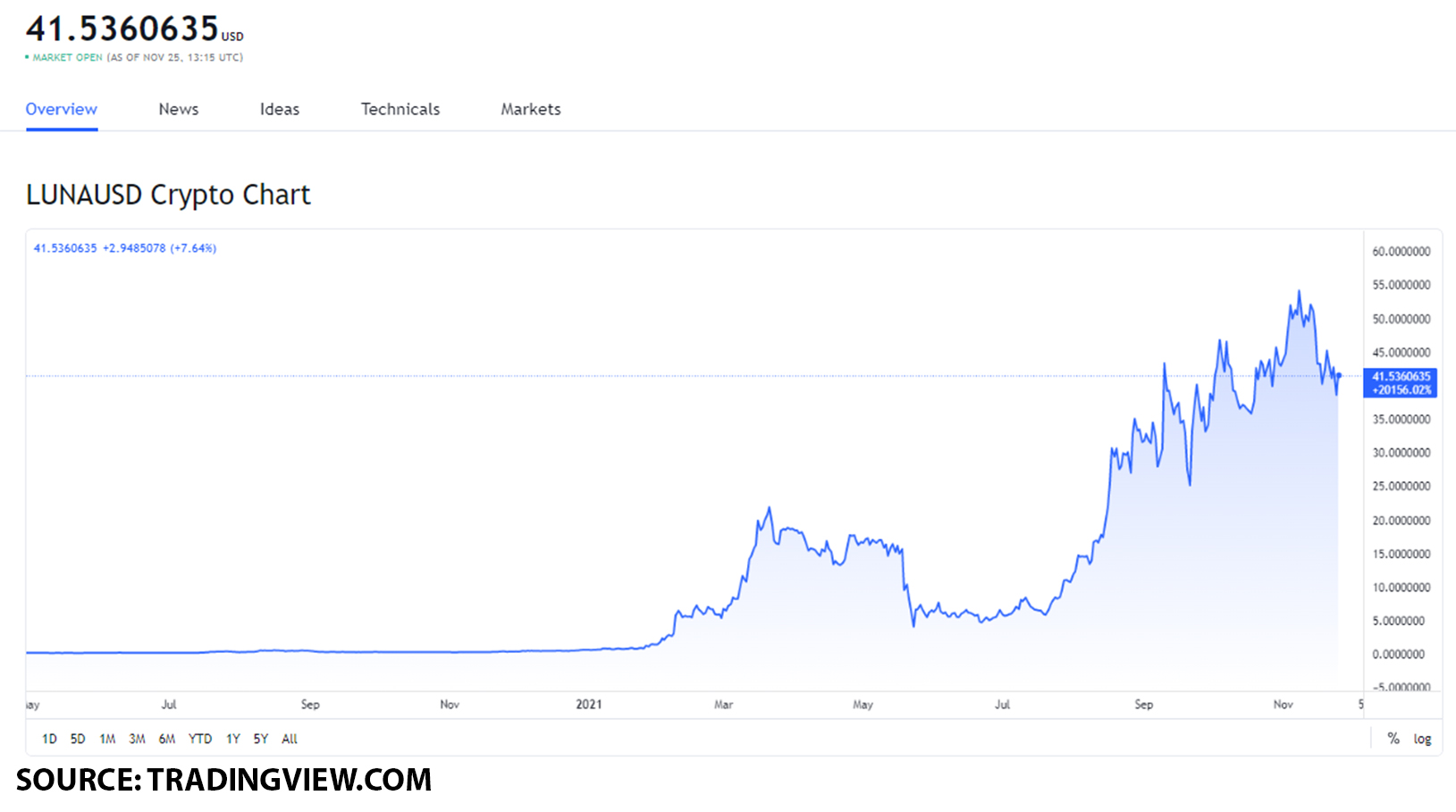

On November 25, Terra (LUNA) had a value of $41.53.

With the goal of establishing what kind of value point this is for the token, we will go over its all-time high value as well as its performance in October.

In terms of its all-time high value, the token had its ATH point on November 8, with a value of $54.77. Here, we can see that the token’s ATH value was $13.24 higher in value than its value on November 25.

In terms of the value in October, on October 4, LUNA had a value of $46.6, which was its highest value point.

On October 17, the token had a value of $35.38, which was its lowest point of value.

Here we can see that the token dropped in value by 24% or by $11.22 before climbing back up to its $41.53 value point.

With this in mind, we can expect Terra (LUNA) to climb to $50 by the end of December, making it a worthwhile purchase.

Should you buy Anchor Protocol (ANC)?

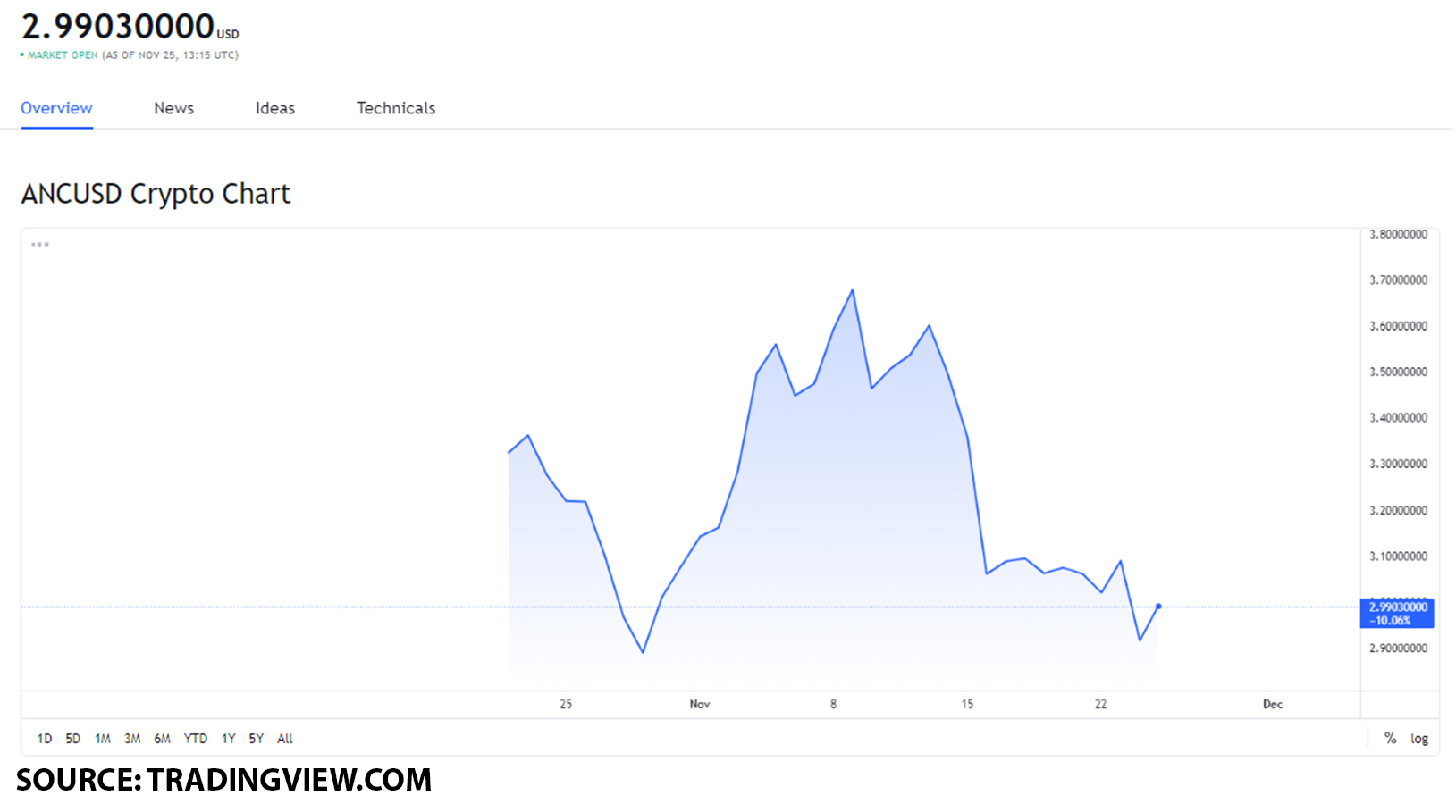

On November 25, Anchor Protocol (ANC) had a value of $2.99.

To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high value as well as its performance in October.

It’s all-time high value was on March 19, when ANC had a value of $8.23. At its ATH value point, the token was $5.24 higher in value or by 175% when compared to its value on November 25.

The token’s highest value point was on October 4, when it reached a value of $3.42.

When we look at ANC’s lowest value point, it was on October 13 when the token fell to $2.7.

Here, we can see that the token decreased in value by $0.72 or 21% before climbing back up to $2.99 on November 25.

With that in mind, ANC has the potential to reach $3.2 by the end of December, making it a solid bay.

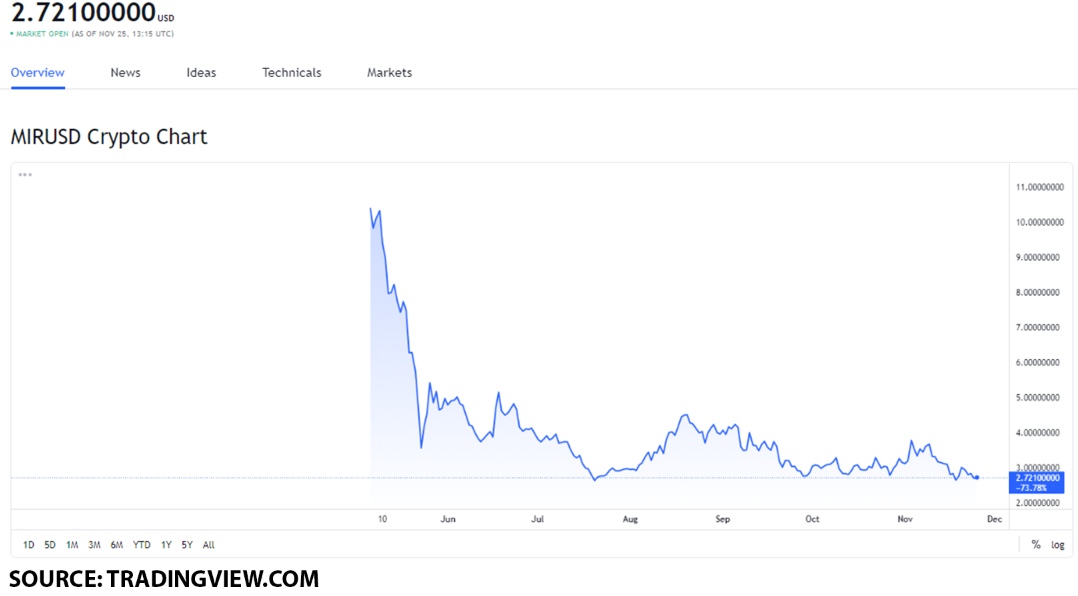

Should you buy Mirror Protocol (MIR)?

On November 25, Mirror Protocol (MIR) had a value of $2.72.

To get an indication as to what kind of value point this is for the token, we will go over its all-time high value as well as its performance in October.

In terms of the all-time high value, on April 10, MIR reached a value of $12.90. Here we can see that on April 10, the token was $10.18 higher in value, or by 374% when compared to its value on November 25.

When we go over the token’s performance in October, its highest point was on October 7, when it reached a value of $3.54.

Its lowest point was on October 12, where it reached $2.7. Here we can see that the token decreased in value by $0.84 or by 23%.

However, the token has the potential to reach $3.5 by the end of December, making it a solid buy at $2.72.