Click here to learn about Lit Vodka’s crowdfunding campaign, and how to invest!

When it comes to vodka, there is regular vodka and then there is Grain-Neutral Spirit (GNS) based vodka. With the latter the grain is germinated, fermented and then distilled and that’s it, allowing the natural flavors to come through with clarity and purity.

That is the space where you’ll find Lit Ultra Premium Vodka, the brainchild of Nick Smith and Tony Villegas, close friends from Columbus, Georgia. Their goal in launching a high-end vodka is to provide an American-made Georgia-based blend that doesn’t compromise on taste.

It’s All In The Process

Lit Vodka is distilled ten times using a carbon-filtration process and boasts 40% alcohol by volume. The company isn’t only about offering premium vodka at an affordable price, it’s also creating a lifestyle brand aimed at reaching consumers across demographics seeking to live their best lives. To do that Lit Vodka leverages several channels including social media, the Internet and in-person sponsorships.

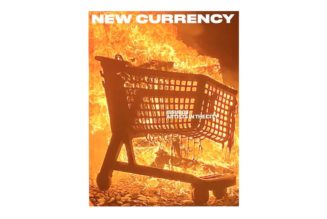

That’s important in the spirits market, especially when it comes to vodka. There’s little distinction in taste and quality of top vodkas, so branding is a key way to stand out. Lit Vodka believes it has an edge in that department, and its team of industry leaders with deep relationships in sales, supply chain and distribution give it a clear advantage. Take CEO Trinidad Villegas for one example. Tasked with expanding the brand through several media platforms, under Villegas’s charge the company sold over 4,000 cases within the first 14 months of business.

Lit Vodka, which previously raised $1.7 million in funds and boasts a valuation of $21 million, is offering shares through a crowdfunding raise that has already reached nearly $300,000. In the first seven days, the company raised $239,224.

Breathing Life Into A Stagnant Market

With the launch of its GNS premium vodka, Lit Vodka aims to capitalize on a trend towards premium spirits. The company believes there have not been enough innovations in the space and wants to change that with its award-winning flavors.

While the vodka market is expected to grow annually by a CAGR of 2.27% from 2023 through 2028, the premium spirits category worldwide is growing at a double-digit rate between 2023 and 2029. People’s drinking habits are changing and customers are becoming more willing to pay a premium for high-quality alcoholic drinks. North America is the largest market for premium spirits globally, and vodka by itself is also a large market – it accounted for the largest amount of volume sales of spirits in the U.S. in 2022. As of 2020, the liquor store segment represented a $62 billion market, while bars and nightclubs represented a $19.9 billion opportunity.

Sales Growing

Since its official launch in 2019, the company has seen sales growth driven by branding deals with popular concerts, sports venues and professional sports teams. For example, it recently became the premier vodka of the Atlanta Braves. It’s the second major sponsorship in Georgia. That could be a bigger opportunity for Lit Vodka since the Braves are hosting the 2025 All-Star game. Lit Vodka plans to ink more partnerships like that to grow the brand. With distribution in place in Georgia and Tennessee, Lit Vodka is also gearing up to expand into more territories in the coming year.

It’s not just the Atlanta Braves that sees value in Lit Vodka. In its short time in the marketplace, it has won several awards including the 2020 San Francisco World Spirits Competition Silver Medal, the 2020 Ultimate Spirits Challenge Great Value Award and scored 93 points in the 2020 Ultimate Spirits Challenge.

With its award-winning premium GNS vodka and bold branding strategy, Lit Vodka plans to shake up the vodka space and give customers a premium experience – at an affordable price.

Click here to learn about Lit Vodka’s crowdfunding campaign, and how to invest!

Featured photo by Gary Meulemans on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. Benzinga may receive monetary compensation from the issuer, or its agency, for publicizing the offering of the issuer’s securities. This content is for informational purposes only and is not intended to be investing advice. This is a paid ad. Please see 17(b) disclosure linked in the campaign page for more information.