The value of French luxury brands grew over the past year, sending the likes of Louis Vuitton and Chanel to the top of a newly released brand valuation index. In fact, almost 100 of the top 150 French companies saw the value of their brand-specific assets increase over the past year, according to Brand Finance. The value of the tangible assets (i.e., the “names, terms, signs, symbols, logos, and designs” that it uses to identify and distinguish its “goods, services or entities” from those of others) of Louis Vuitton, for example – which tops the brand valuation consultancy’s annual France 150 ranking – rose by 19 percent to €30.1 billion from 2023 to 2024.

Meanwhile, the brand value of Chanel – which took the number 2 spot on the France 150 ranking – rose to €24.3 billion (up 30 percent year-over-year). The value of the brand-specific assets of Hermès, which nabbed the number 5 position on the 2024 list, increased to €15.6 billion (up 14 percent from last year); Dior (in number 8 again) rose to €13.7 billion (up 8 percent); and Cartier, which rounded out the top 10, rose to €12.7 billion (up 5 percent).

Brand Finance calculates each “brand valuation” – or the value of the legal rights to the income stream derived from a company’s relevant trademark assets – by estimating the future revenue attributable to a brand and calculating a royalty rate that would be charged for the use of the brand. In furtherance of this, the consultancy considers brand specific revenues based on companies’ publicly available financial information, brand strength, and royalty rate ranges for the respective brand sectors, among other things.

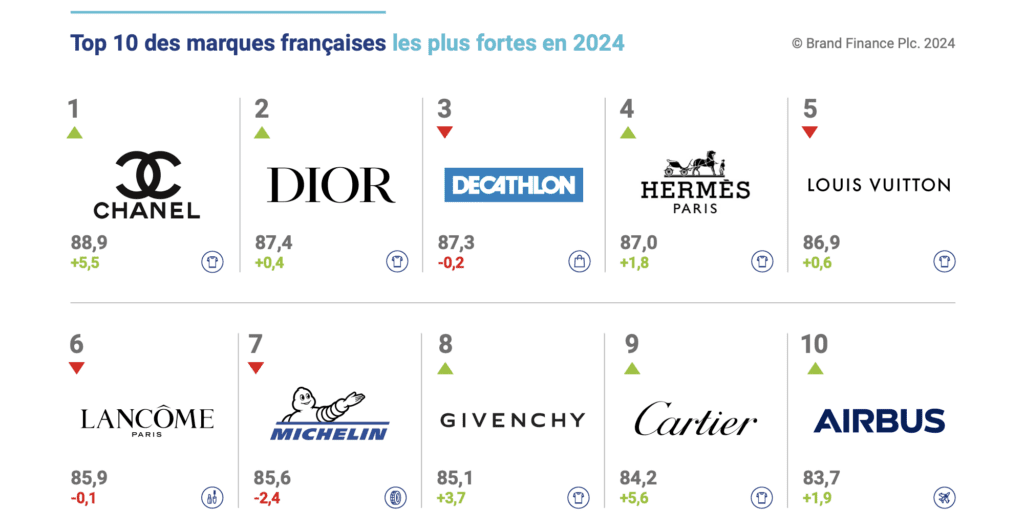

> Brand Strength: While brand value increased for most of the companies that topped Brand Finance’s latest index, the same trend was not seen across the board when it comes to “brand strength,” a separate metric that is measured by focusing on intangible/goodwill-centric factors like “marketing investment, stakeholder equity, business performance, corporate reputation” (as distinct from the focus on trademark-tied royalties for overall brand valuation.)

According to Brand Finance, the brand strength index for French brands as a whole is “growing less quickly than [other] European peers or the world’s largest brands.” In particular, the London-based consultancy found that over the last 4 years, the average of the Brand Strength Indices for French brands increased 12 times slower the same index for than the 100 most valued global brands, and the average of the Brand Strength Indices of the 100 French brands decreased by 0.6 points while the equivalent index increased by 0.1 point in Germany and decreased by 0.4 points in the United Kingdom.

This overall drop in brand strength – an element that is “essential in protecting and winning market share” – demonstrates “a gradual erosion of the competitiveness of French brands,” per Brand Finance, which states that this could reflect “a slowdown in investment in [French] brands, a degradation of the image of [those] brands, and therefore, of the performance of major French brands compared to global competition.”

Looking specifically at luxury names from a “strength” perspective, Brand Finance noted that not all is lost, as Chanel nabbed the title of the strongest French brand, thanks, in part, to “higher scores on environmental, social, and governance metrics and [rising] performance scores.” Chanel is followed by Dior (number 2), which gained one place from last year’s ranking thanks to “a strong growing brand presence” – and global brand “familiarity” and “consideration” – despite “a slight decline in image brand and performance.”

Also in the top 10: Hermès (4); Louis Vuitton (5), which saw its brand reputation “decline slightly despite its numerous societal commitments, such as its partnership with UNICEF or the sponsorship of 200 million euros for the rescue and restoration of Notre-Dame de Paris;” Givenchy (8); and Cartier (9).

> Perception of Sustainability: In addition to ranking brands by value and strength, Brand Finance also recently introduced a sustainability-focused metric to gauge just how “sustainable” brands are in the eyes of consumers. As distinct from making determinations on how sustainable a brand actually is, Brand Finance aims to identify brands that consumers “consider to be the most committed to sustainability and the proportion of brand value attributable to perceptions of sustainable development.”

Luxury brands take the top 5 spots on Brand Finance’s ranking of “sustainability perception value,” with €3.56 billion of Louis Vuitton’s total brand value being attributable to consumers’ perceptions of its sustainability credentials.

Chanel – which took the number 2 spot, with €2.98 billion in value tied to its perception of sustainability – stands out here, according to Brand Finance, thanks to its “net zero plan for 2040” and its investment in “upskilling internally through its Sustainability Academy to embed [a] mindset [of sustainability] into its business operations.” Delving in further here, Brand Finance states that Chanel could “potentially generate up to €696 million in additional value through better communication about its impact and achievements in terms of sustainable development.”