Crypto investment giant Grayscale has published a bullish report on metaverses, estimating that the “market opportunity” for bringing the metaverse to the mainstream may be worth over $1 trillion in the next few years.

The November report titled “The Metaverse, Web 3.0 Virtual Cloud Economies” was authored by Grayscale head of research David Grider and research analyst Matt Maximo. The duo explores the burgeoning sector primarily from the perspective of open metaverse worlds backed by an “interconnected crypto-economy” such as Decentraland.

The report highlights that metaverse platforms integrated with crypto tokens, decentralized finance services such as staking and lending, nonfungible tokens (NFT), decentralized governance and decentralized cloud storage have “created a new online experience” that’s rapidly attracting new users.

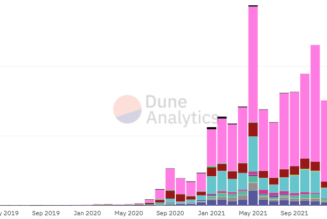

Analyzing “global all-time active metaverse wallets” data since the start of 2020, it found the user base has grown by 10x since that time to sit at around 50,000 as of June 2021.

“Compared to other Web 3.0 and Web 2.0 segments, Metaverse virtual world users are still in their early innings, but if current growth rates remain on their current trajectory, this emerging segment has the potential to become mainstream in the coming years.”

The report highlights that there’s no shortage of venture capitalists taking a punt on the sector’s potential. According to the report, fundraising totaled $1 billion for blockchain gaming in Q3. That represented 12% of total fundraising for the entire crypto sector in the quarter, ranking it as the “top sub-sector” within the Web 3.0 and NFT category.

Market opportunity

The researchers note a range of key dynamics that could significantly contribute to the growth of the metaverse sector, including growing average leisure time and money spent on digital hobbies, a cultural shift from premium games to free-to-play gaming, and Web 3.0 innovations such as play-to-earn.

Global revenue from virtual world gaming totaled $180 billion in 2020, with “premium spending” accounting for around $40 billion, with estimates the sector could pull in more than $400 billion by 2025, primarily driven by the in-game spending model.

The report argues that this shift is “accelerating further with the transition from Web 2.0 closed corporate Metaverses to Web 3.0 open crypto Metaverse networks” due to the play-to-earn potential they represent.

“Web 3.0 Metaverse virtual worlds have benefited from rapid innovation and productivity gains. Crypto virtual worlds have created a multi-million dollar primary and secondary market for creators and asset owners by eliminating capital controls and opening their digital borders to free-market capitalism,” the report reads.

Related: Metaverse and blockchain gaming altcoins rally while Bitcoin looks for support

The prices of the native tokens for open metaverse platforms such as Decentraland (MANA) and The Sandbox (SAND) have been on a tear of late, gaining 49% and 102% each to sit at $5.03 and $7.60, respectively, at the time of writing.