The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online.

From streaming services to concert promoters and ticket sellers, music companies have reported encouraging first-quarter earnings results that show consumers continue to adopt subscription services and eagerly return to live events after COVID restrictions were lifted in late 2021. The same companies’ stock prices tell another story, however. While music companies posted double-digit gains in subscription growth, revenue, ticket sales and many other metrics, their share prices are down by double-digits in 2022. That’s not a surprise given the state of the economy: Inflation is at a 40-year high ; rising interest rates sent investors looking for value stocks and safety in bonds; and consumers are starting to miss credit card and auto loan payments. Right now, investors are looking beyond mere growth to margins and profitability.

In the wake of these earnings reports, Billboard is highlighting three factors that are influencing the music business in 2022. First, growth in subscription services is reshaping labels and publishers’ revenues; growth may be slowing, and it could disappoint some investors, but it’s there. Second, publishing revenues saw especially strong growth in the first quarter and contributed more to parent companies’ growth than record labels (given their relatively smaller size). Third, live music is going to have a strong 2022, which will impact not just touring artists but record labels that sell merchandise on the road.

Subscription growth was strong (but it’s slowing).

Spotify’s subscriptions grew 15% to 182 million, an annual increase of 24 million and 2 million more than the fourth quarter of 2021. While second-quarter growth was below Spotify’s guidance, the company said it was above expectations if “involuntary churn” of 1.5 million subscriptions from the company’s exit from Russia weren’t counted. (Spotify expects another 600,000 lost subscribers in Russia in the second quarter.)

The second-quarter guidance is 6 million net new subscribers, which would take Spotify to roughly 188 million, up 14% from the second quarter of 2021. That would represent a smaller annual gain in subscribers (23 million versus 27 million in the second quarter of 2021) and a lower annual growth rate (14% versus 20%).

Smaller streaming services posted higher growth rates in the first quarter. Even though Tencent Music Entertainment revenue fell 15% due to losses in social entertainment, its music subscriptions grew 31.7% to 80.2 million, an annual increase of 19.3 million and up 4 million from the fourth quarter of 2021. Anghami’s subscription revenue grew 26% year over year. Chinese music streaming service Cloud Village reports first-quarter earnings on May 24.

Publishing and merchandising were higher in the revenue mix.

At Universal Music Group, recorded music accounted for 78.3% of revenue but delivered only 61% of first-quarter revenue growth despite strong gains in subscription royalties. UMG’s publishing division accounted for 17.1% of total revenue but 26.7% of total revenue growth. Merchandising was 4.9% of UMG’s total revenue and 12.3% of its revenue growth. At Warner Music Group, publishing’s share of revenue grew to 16.7%, up from 15.4% a year earlier, and accounted for 30.2% of the revenue growth. At Sony Music, publishing increased its share of quarterly revenue from 16.4% to 18.3%. Recorded music grew from 58% to 60% as the “visual media and platform” division fell from 25.6% to 19.2%.

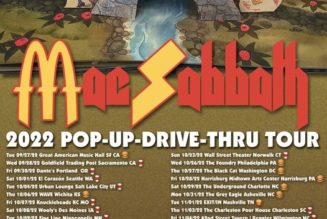

Live events companies are seeing double-digit growth.

At Live Nation, which claimed to have its best first quarter ever, revenue jumped more than six-fold in the first quarter after the lifting of COVID-19 restrictions. More importantly, the company expects double-digit growth this year compared to 2019, the best year for comparison because COVID affected every quarter in 2020. Live Nation has sold 70 million tickets for shows in 2022, a 36% increase from the same point in 2019, and committed show count is up 44% through late April. At the same time, no-show rates appear to be a non-issue, falling “generally in the mid-single digits,” the company said in its earnings release.

MSG Entertainment’s entertainment (live event) revenue grew more than six-fold to $194.6 million thanks to the lifting of COVID restrictions. Minus MSG Networks, which merged with MSG Entertainment in July 2021, the company had $292.5 million in revenue, up 17% from the same period in 2019.

Vivid Seats’ first-quarter revenue was up 442% from the prior-year period. The company increased second-quarter guidance for both revenue (its cut of total revenue) and gross order value (total ticket sales value). Music accounted for 53.1% of revenue, up from 31.9% in the prior-year period. Marketplace order volume increased 589%. At Eventbrite, first-quarter paid tickets rose 78% year over year, and net revenue per ticket increased 13.6%.

STOCKS

Through May 20, the % change over the last week, and the year-to-date change.

Spotify (NYSE: SPOT): $107.19, +1.0%, -54.2% YTD

Universal Music Group (AS: UMG): 20.41 euros, 0%, -17.6% YTD

Warner Music Group (Nasdaq: WMG): $29.76, +2.3%, -31.1% YTD

HYBE (KS 352820): 221,000 KRW, +2.8%, -36.7% YTD

Live Nation (NYSE: LYV): $89.16, -2.3%, -25.5% YTD

iHeartMedia (Nasdaq: IHRT): $12.13, -5.2%, -42.3% YTD

Cumulus Media (Nasdaq: CMLS): $12.50, -2.5%, +11.1% YTD

Tencent Music Entertainment (NYSE: TME): $4.07, -0.7%, -40.6% YTD

NYSE Composite: 15,072.58, -1.2%, -12.2% YTD

Nasdaq: 11,354.62, -3.8%, -27.4% YTD

S&P 500: 3,901.36, -3.0%, -18.1% YTD

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: business, Business news, Earnings Reports, entertainment blog, eventbrite, Live Nation, music blog, Sony Music Entertainment, Spotify, universal music group, warner music group