This story was co-written with Amanda Montgomery and Laura Veras.

In today’s marketplace, there is no doubt that one of the toughest avenues to establish a viable career is as a songwriter.

The 9.1c mechanical royalty—which has not been adjusted for inflation since 2006—has become less significant due to the emergence of streaming and the plunge of physical sales and downloads. Now, the impact of COVID-19 has contrived new challenges for songwriters and their publishers to tackle as alternative revenue streams, such as touring, continue to erode in the virus’ wake.

To give a general idea of how COVID-19 has trickled down to the publishing community, the International Confederation of Societies of Authors and Composers (CISAC) projected that global music publishing collections will fall by as much as 35% in 2020, for a total loss of $4.11 billion. Although this new data seems doom-and-gloom, there are areas of hope as the publishing industry looks to contain and absorb the losses. Here are a few areas to monitor as we head into 2021.

Music Consumption Continues to Grow, Yet The Value Of The Mechanical Royalty Remains Status Quo.

Music streaming has seen an increase in subscribers during the COVID-19 crisis, equal to or in some cases exceeding expectations prior to the onset of the pandemic. For instance, when examining Spotify’s Q2 earnings report, the company reported an increase of 29% YoY and 5% QoQ in Total Monthly Active Users (299 Million in Q2 2020). This increase was found across the board, as Premium subscribers increased by 27% YOY and 6% QOQ.This success also mirrors a report by the Recording Industry Association of America (RIAA), which found that total streaming revenues—including subscription, ad-supported, on-demand, and “lean back”—grew 12% to $4.80 billion in the first half of 2020—up by $512.3 million on the first half of 2019.

Although streaming activity continues to triumph despite a crippling pandemic and economic recession, this growth of streaming has only reinforced the status quo of the mechanical royalty because the mechanical rate per stream is much less than that of the mechanical rate per sale or download. Therefore, the discrepancy in rates has yet to fill the gaping hole that songwriters face due to the unbundling of albums and drops in physical sales.

Adding another layer of complexity to the situation is the impending January 1st, 2021 instatement of the Music Modernization Act, enforcing all mechanical royalties to be collected and distributed by the Mechanical Licensing Collective (MLC). While the legislation and royalty collection service should improve on a flawed system in theory, it is certainly going to take time for the myriad independent composition rights holders to properly register their metadata with the collection agency, adding another hurdle to the growing list of intricacies that songwriters face in today’s market.

Performing Rights Organizations Feel The Adverse Effects of Live Event and Public Gathering Restrictions.

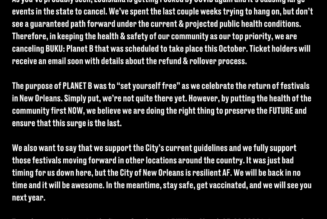

Live music has been one of the most resilient segments of the music industry in the past two decades, but COVID-19 has taken a massive toll on this part of the business. The concert business has been so heavily impacted that Live Nation’s Q3 financial report noted that the company only generated $184 million, marking a 95% year-over-year decline compared with the $3.77 billion the company generated in Q3 2019 from concerts, ticketing, and sponsorship. Moreover, the National Independent Venue Association noted that 90% of their 2,500 members will go out of business without the enactment of a government stimulus.

Aside from music venues, other important areas where public performance royalties are collected are from the tens of thousands of bars and restaurants across the US. Unfortunately, the pandemic has crippled them as well. According to new data from the National Restaurant Association, one in six restaurants—or a total of 100,000 establishments nationwide—have “closed either permanently or long-term.” With so many public performance spaces shuttering, it seemed to be a matter of time until the payouts made by PROs across the world started to see some level of constriction. This notion was most evident when Andrea Martin, CEO of British collecting society PRS, noted in July that there will likely be “a further reduction in the royalties usually seen from Live, Public Performance, Commercial Radio, and International from October 2020 onwards.”

Even this month, Australian PRO Apra shared new data that royalty payments in November will be down 11% compared to the same quarter last year. Although US PROs ASCAP and BMI have yet to release any formal data indicating a potential drop in public performance royalty collection revenue, it seems like other major territorial PRO figures indicate that the decrease is a global phenomenon that will undoubtedly impact the bottom line of both publishers and songwriters.

Despite a Global Pandemic, Publishing Catalogs Remain High Value to Hedge Fund Managers and Wall Street Investors.

It should be no surprise that investing in music publishing is one of the hottest commodities on Wall Street and across the venture capital landscape. Consider the fact that valuable publishing catalogs are finding new ways to monetize their performing arts copyrights. For example, there are new social media platforms, such as TikTok and Triller, along with other more established destinations, such as Facebook, who are starting to license music from rights holders, creating new sources of monetization for the music publisher.

These new sources of monetization combined with the hockey stick-like growth of the global music streaming industry have created a market that is favoring the music publishing community. In turn, music catalogs are being evaluated in the multi millions of dollars range. Just in the last year alone, leading catalog acquisition companies have forked up enormous sums, such as Hipnosis Songs Fund, who spent nearly $700 million to acquire 42 catalogs. Shamrock Holdings recently purchased the rights to Taylor Swift’s first six albums for around $300 million.

It is clear that the market for music rights is hot and any valuable catalog that has a proven track record of generating revenue can be a target for many different types of investors. Today’s rights marketplace is certainly a sellers market for the copyright owners.