-

MATIC, LINK, and AXS are the go-to tokens for December 28.

-

Chainlink’s trading volume increased by 17% in the last 24 hours.

-

AXS saw an increase in trading volume by 36% in the last 24 hours.

Polygon is a protocol as well as a framework used for building and connecting blockchain networks that are Ethereum-compatible.

Chainlink is a decentralized blockchain oracle network that is built on and runs on top of Ethereum.

Axie Infinity is an NFT-based online video game that uses Ethereum-based cryptocurrencies.

Should you buy Polygon (MATIC)?

On December 28, Polygon (MATIC) had a value of $2.641.

To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high-value point as well as its performance last month.

The all-time high value of the MATIC token was on December 27, when it reached a value of $2.92.

On November 3, the token had its highest value point at $2.1198.

Its lowest point of the month was on November 18, when the token decreased in value to $1.4795. Here, we can see that the token decreased in value by $0.6403 or by 30%.

However, from November 18 to December 28, the token increased in value by $1.1615 or by 78%.

With this in mind, we can expect MATIC to reach a value of $2.8 by the end of January 2022, making it a solid token to buy.

Should you buy Chainlink (LINK)?

On December 28, Chainlink (LINK) had a value of $22.37.

To see what this value point means for the LINK token, we will go over the performance in November, as well as its all-time high value.

The all-time high value of the LINK token occurred on May 10, when it reached a value of $52.70. Here, we can see that at its ATH value point, the token was $30.33 higher in value or by 135%.

When we go over the performance of the LINK token throughout the previous month, on November 10, the token saw its highest value point at $38.12.

Its lowest value point was on November 28, when the token decreased in value to $23.23. Here, we can see that the token decreased in value by $14.89 or by 39%.

However, at its price point of $22.37, LINK is a solid buy as it has the potential to reach $25 by the end of January 2022.

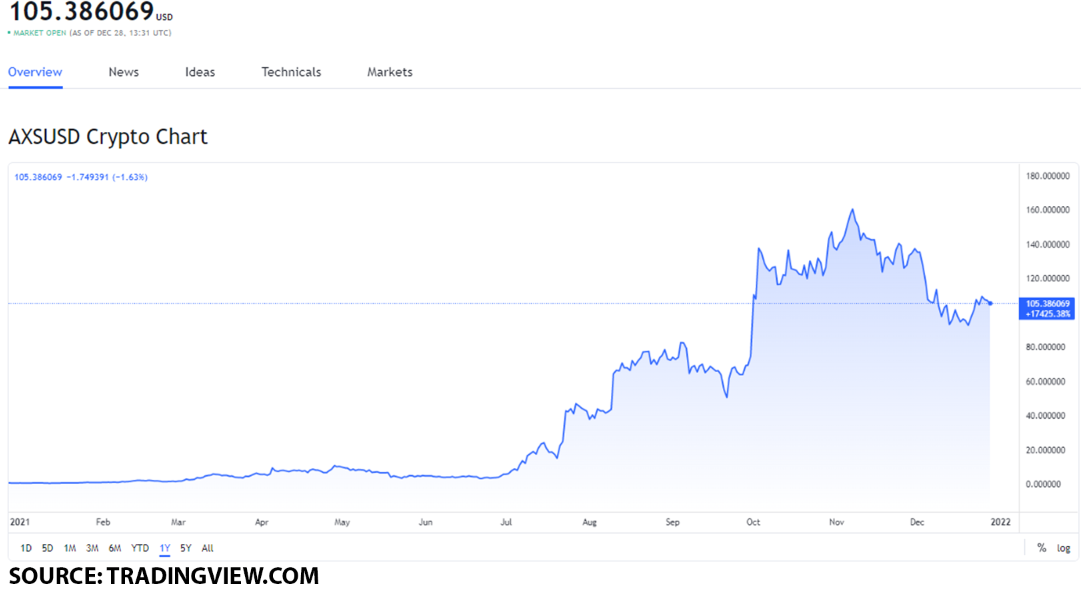

Should you buy Axie Infinity (AXS)?

On December 28, Axie Infinity (AXS) had a value of $105.38.

To get a better estimation as to what this value point means for the AXS token, we will go over its all-time high value as well as its performance last month.

AXS had its all-time high value on November 6, when the token reached $164.90 in value. Here, we can see that the token was $59.52 higher in value at its ATH point, or by 56%.

When we go over the performance of the AXS token last month, we can see that the token had its highest value point on November 6 at $163.48.

Its lowest value point was on November 19, when it dropped in value to $123.09. Here, we can see that the token decreased in value by $40.39 or by 24%.

With all of this in mind, AXS is a solid buy at $105.38 as it has the potential to reach $110 by the end of January 2022.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, crypto blog, Crypto news