The judge in the class-action lawsuit filed in the Southern District of New York against stablecoin issuer Tether and crypto exchange Bitfinex has granted motions to dismiss many of the claims in the case.

According to court documents filed Tuesday in the Southern District of New York, District Judge Katherine Polk Failla has granted motions from Tether’s and Bitfinex’s parent company iFinex to dismiss key claims in the plaintiffs’ case that the two firms manipulated the crypto market. Altogether, Judge Failla granted motions to dismiss five complete claims and part of one, while denying six others.

Specifically, the judge said she would not allow investors to bring claims against Tether and Bitfinex under the Racketeer Influenced and Corrupt Organizations Act, or RICO, nor allegations related to racketeering or using the proceeds of racketeering for investments. She also said Tether and Bifinex investors could not “inadequately allege” the companies’ monopoly power in the stablecoin market.

“This case is doomed,” said Tether in a Wednesday blog post. “Even for the remaining claims, the Court’s order raises substantial issues that will ultimately be fatal to the plaintiffs’ case.”

The firm added:

“Litigation will expose this case for what it is: a clumsy attempt at a money grab, which recklessly harms the whole cryptocurrency ecosystem.”

Related: Bitfinex Market Manipulation Lawsuit Refiled in New York and Joined by Second Case

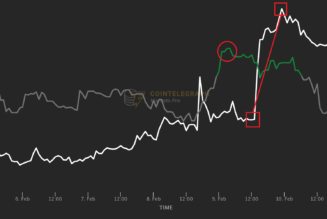

The initial complaint against iFinex in October 2019 alleged that the firm manipulated the crypto market by issuing unbacked Tether (USDT) “in an effort to signal to the market that there was enormous, organic demand for cryptocommodities.” The plaintiffs allege that the firm wanted to inflate the price of cryptocurrencies like Bitcoin (BTC), “thereby creating and sustaining a ‘bubble’ in the cryptocommodity market.”

While Bitfinex and Tether settled its case with the Office of the New York Attorney General in February over mismanagement of USDT reserve funds, the civil action with a group of aggrieved crypto investors continues. In the former case, Bitfinex and Tether agreed to pay $18.5 million for damages to New York and submit to periodic reporting of their reserves in addition to stopping service to customers in the state.