Companies

Tax cut reversals hit Old Mutual earnings

Friday March 31 2023

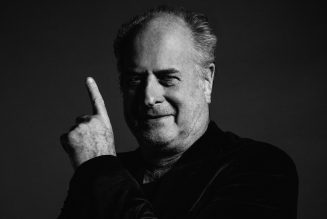

The UAP-Old Mutual Tower in Nairobi. FILE PHOTO | COURTESY

Insurance group Old Mutual Holdings has issued a profit warning for the year ended December 2022, citing the write-off of deferred tax assets.

The firm said it anticipates its earnings to decline by at least a quarter, indicating that it will make a net loss larger than the Sh1.1 billion it reported the year before.

The company is, on Friday, expected to report a net loss of at least Sh1.3 billion for the review period.

Read: Old Mutual to sell stockbroking unit

“The board brings to the attention of the public that the earnings for the current financial year are expected to be lower by at least 25 per cent than the earnings reported for the same period in 2021,” the company said in a statement.

“Whilst profits from operations improved by more than 40 percent compared to 2021 and a profit before tax recorded as compared to loss after tax in 2021, we have written off a significant portion of deferred tax assets from the balance sheet resulting in a significant increase in the corporate tax expense.”

Deferred tax assets are used to lower taxes in the future when a company makes a profit. The tax assets usually accrue in years when a company makes losses.

Old Mutual recorded a net loss of Sh813 million in the six months to June 2022.

The statement said the board was confident with the turnaround processes adopted and implemented by the company.

Old Mutual is engaged in the business of insurance both life and non-life, investment management, and property and stockbroking services.

Read: Old Mutual to cover critical illness for Zamara clients

These activities are carried out through subsidiaries in Kenya, Uganda, Tanzania, South Sudan, Mauritius and Rwanda.