yg entertainment

As Music Stocks Keep Slipping, This One K-Pop Company Is Bucking the Trend

South Korean music company SM Entertainment, home to such groups as NCT 127 and SuperM, stands apart in a competitive music business for withstanding stock market downturns that have hit all other publicly-traded music companies. Since December, stocks have been on a downward trend, sparked by the Federal Reserve’s intention to raise the federal funds rate to prevent the economy from overheating and rein in inflation. And while music is often said to be recession-proof, music companies’ stocks are not immune from larger economic trends and investors’ desires for safer options during chaotic times. Even though the global music industry is posting double-digit revenue growth, the share prices of publicly traded music companies have followed the broader trends and stumbled in the face ...

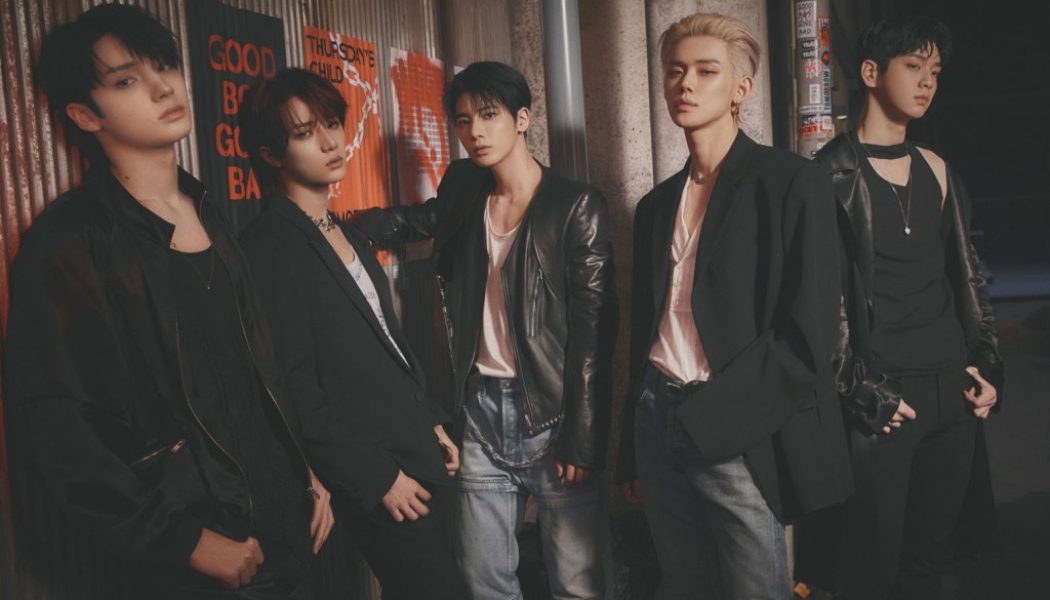

The Ledger: Buying Into the K-Pop Craze Just Got Less Risky for US Investors

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. An exchange-traded fund, or ETF, focused on Korean music started trading on the NYSE Arca exchange on Thursday, giving American investors a means to buy shares of companies that trade on exchanges in South Korea. But the ETF stands out for another reason: a bundle of K-pop stocks will carry less risk than standalone companies that rely on dozens of labels, each with a handful of top artists as well as deep catalogs. Trading under the aptly named ticker KPOP, the ETF includes the stocks of 30 corporations, including several music companies: HYBE, the home of K-pop megastars BTS and up-and-coming acts Tomorrow X Together ...