Yearn Finance

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

Finance Redefined: DeFi ‘Godfather’ Cronje quits, CAKE launches $100M venture arm and more

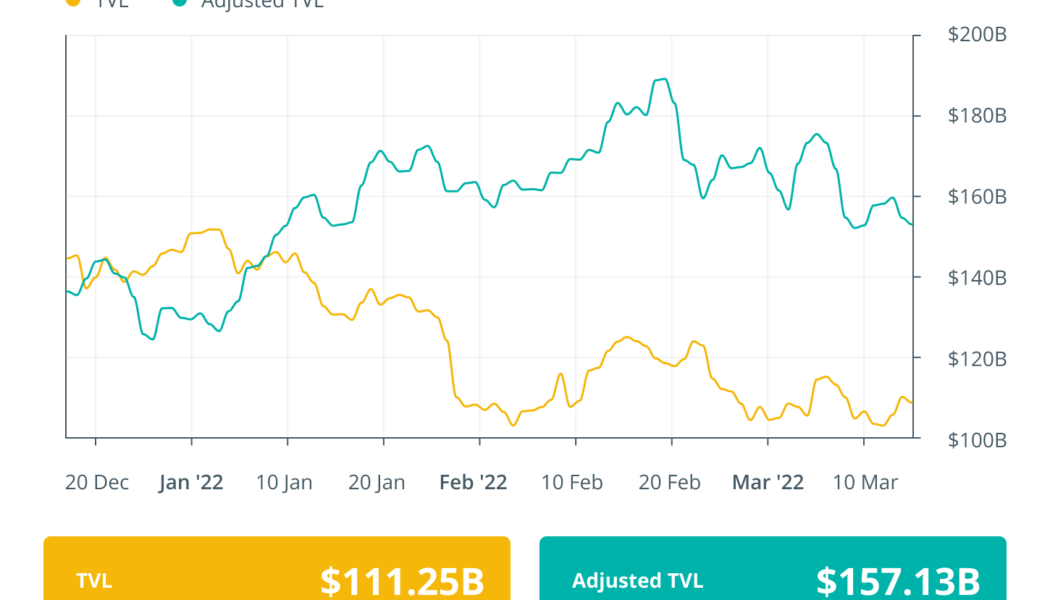

The decentralized finance (DeFi) ecosystem had quite an eventful week with several new developments and price action. The week started with DeFi “Godfather” Andre Cronje announcing his departure from most of his projects, leading to a massive drop in prices of projects that Cronje was associated with. CAKE DeFi launched a new $100 million venture fund to support Web3 initiatives, ThorChain spiked over 34% after activating synthetic assets and Polygon network suffered an extended outage post new upgrade that impacted its price momentum. DeFi “Godfather” Cronje quits as TVL and tokens tank for related projects DeFi architect, Fantom Foundation technical adviser and Yearn.finance founder Andre Cronje has left the decentralized finance space reeling after deactivating his Twitter account. Cron...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...

YFI, HXRO and AR post gains even as Bitcoin price dips to $45.5K

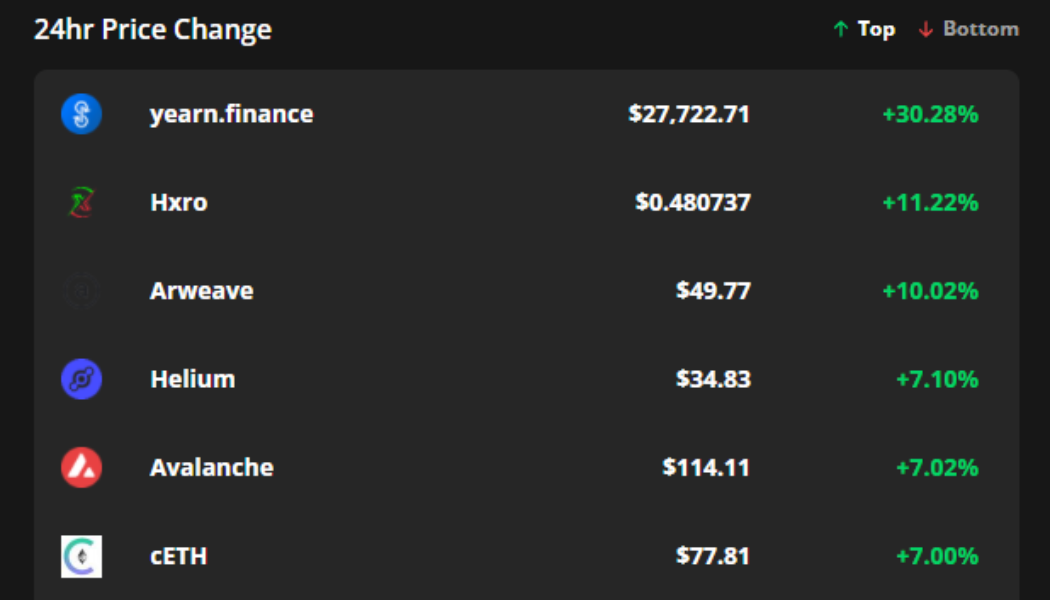

Bitcoin (BTC) bulls took another beating on Dec. 17 as a midday onslaught dropped the price to $45,500. The price did manage a quick bounce back to $47,000 but sweeping a new daily low could be a sign that additional downside is in store. Amid the wider market downturn, several altcoins provided weary traders with a source of refuge as token buybacks and increased network activity helped bolster their prices and provide shelter from the storm. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Yearn.finance (YFI), Hxro (HXRO) and Arweave (AR). YFI benefits from token buybacks Yearn.finance is a decentralized finance (DeFi) aggregator service that ...

YFI price gains 46% in just four days after Yearn Finance’s $7.5M buyback

Yearn Finance (YFI) emerged as one of the best performers in the crypto market this week, rallying by over 46% in just four days to reach a two-week high above $29,100. YFI/USD daily price chart featuring its four-day bull run. Source: TradingView The gains surfaced primarily as Yearn Finance revealed that it has been buying back YFI en masse since November in response to a community vote to improve the YFI token’s economics. The decentralized asset management platform purchased 282.40 YFI at an average price of $26,651 per token — a total of over $7.50 million. Furthermore, Yearn Finance noted that it has more than $45 million saved in its Treasury and has “stronger than ever” earnings. As a result, it would — in the future — could deploy its income to buy...