XMR

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

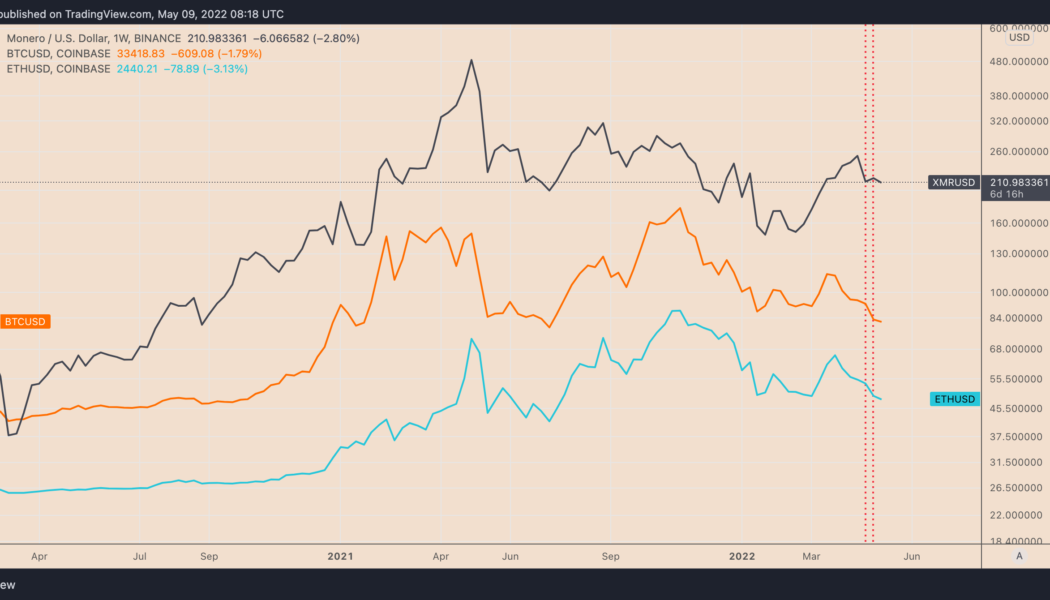

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Monero ‘falling wedge’ breakout positions XMR price for 75% rally

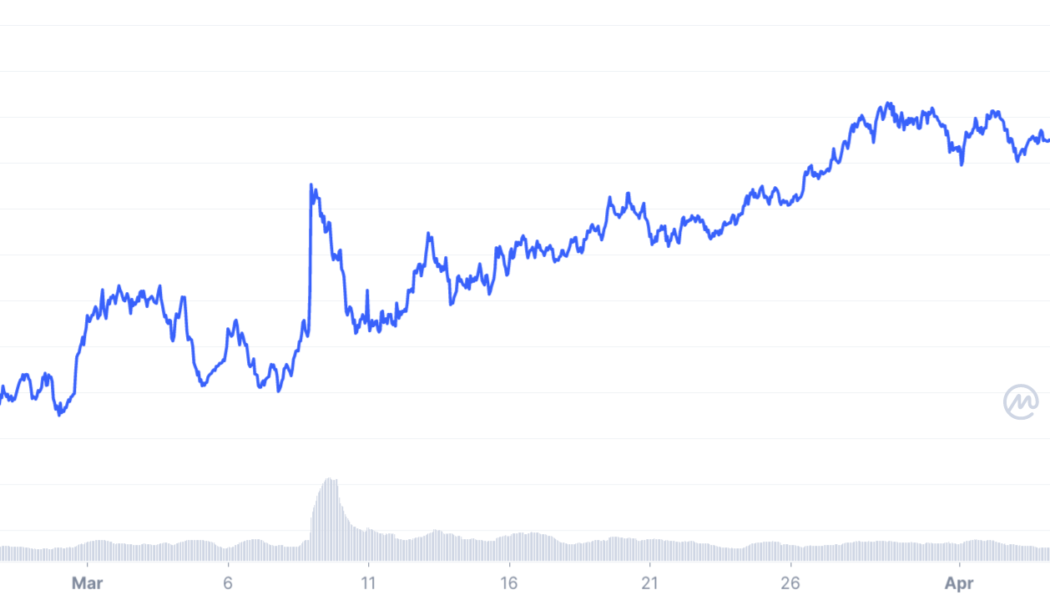

Monero (XMR) price dropped by nearly 10% three days after establishing a week-to-date high around $290 on April 24. Nonetheless, several technical indicators suggest that the XMR/USD pair is poised to resume its uptrend over the next few months. Falling wedge breakout underway Notably, XMR’s price broke out of its “falling wedge” structure in late March. It continued its move upside in the later daily sessions, with rising volumes indicating bullish sentiment among Monero traders. Traditional analysts consider falling wedges as bullish reversal patterns, i.e., the price first consolidates within a contracting, descending channel, followed by a strong bounce to the upside. As a rule, the falling wedge’s breakout target comes to be near the level at length equal to th...

Monero defies crypto market slump with 10% XMR price rally — what’s next?

Privacy-focused cryptocurrency Monero (XMR) rallied by nearly 9.5% in the past week compared with the crypto market’s decline of 8.5% in the same period. What’s more, the XMR/USD pair has broken above a strong, multi-month resistance trendline, hinting at more upside ahead. XMR price action XMR’s price was down by a modest 0.87% on April 10 from its two-month-high of $245 established a day before. However, the cryptocurrency still outperformed its top rivals, including Bitcoin (BTC) and Ether (ETH), on a weekly timeframe. Speculations about entities using Monero to bypass sanctions could have boosted its appeal among investors. Meanwhile, The American research group Brookings warned last month that Monero, the first in the line of privacy coins, could...

Haven Protocol (XHV) shows strong signs of bottoming out after crashing 90%

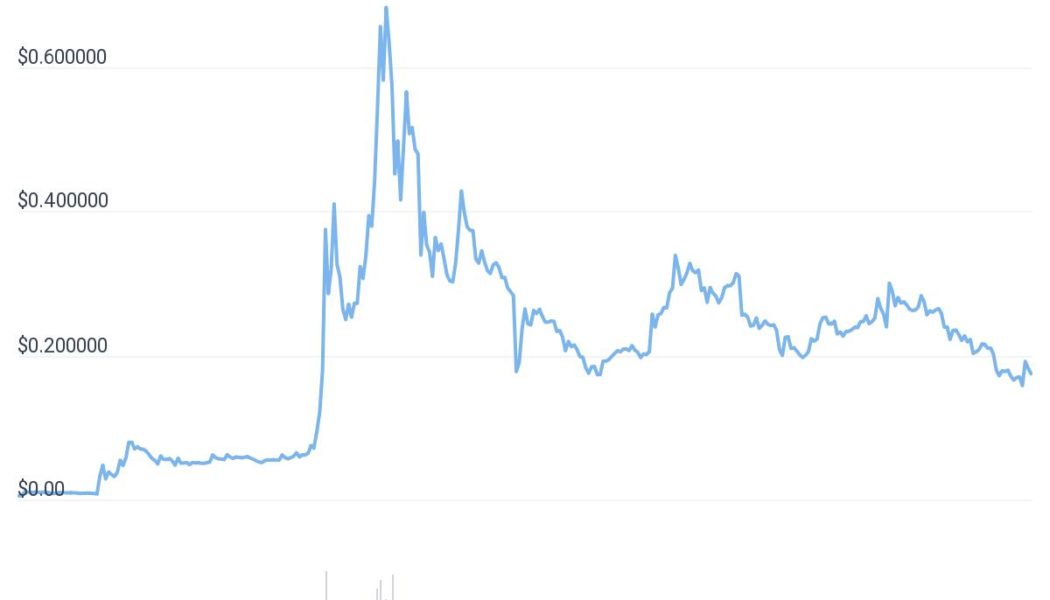

Haven Protocol (XHV) showed signs of returning to its bullish form as its price doubled in just five days of trading. What’s pumping Haven Protocol? XHV’s price surged by up to 107% week-to-date to climb above $3.60 on March 11, its highest level in more than three months. Interestingly, the move upside followed a period of aggressive selloffs that saw XHV’s value dropping from nearly $20 in November 2021 to as low as $1.60 in early February 2022 — an approximately 90% decline. XHV/USD weekly price chart. Source: TradingView Traders started returning to the Haven Protocol market against the prospects of two macroeconomic scenarios: U.S. President Joe Biden’s executive order that focuses on cryptocurrencies and hardline western sanctions on Russian oligarchs amid an ...

Monero community concerned as leading mining pool nears 51% of ecosystem’s total hash rate

On Tuesday, privacy coin Monero (XMR) mining pool MineXMR’s hash rate surpassed over 1.4 GH/s, accounting for 44% of the hash rate of the XMR network. MineXMR has about 13,000 miners and charges a 1% pool fee. According to a screenshot from Archive.org last August, the pool only contributed to 34% of the hash rate of the XMR network. The rapid rise in the network’s hash rate has spooked some XMR enthusiasts, with Reddit user u/vscmm writing: “We need to talk with MineXMR to take some action right now! Please send an email for support@minexmr.com to MineXMR admins to take action; a 51% pool is not in the best interest of the community or the pool.” If a 51% attack were to occur, the bad actors involved could potentially overturn network transactions to double-sp...

Top crypto winners and losers of 2021

The year 2021 has undoubtedly been a bull market with Bitcoin (BTC) raising the all-time high price bar several times this year. But not all crypto assets have performed equally. There have been a number of losers in addition to the majority of winners in terms of price gains. Since the beginning of 2021, total crypto market capitalization has gained 190% from just under $800 million to over $2.3 trillion today. It hit an all-time high of just over $3 trillion in early November. Top 3 crypto gainers in 2021 The crypto top-ten in terms of market capitalization looked a little different on Jan. 1, 2021, as it contained Litecoin (LTC), Chainlink (LINK), and Bitcoin Cash (BCH). These have dropped out and have given way to Solana (SOL), USDC, and Avalanche (AVAX) by the year’s end. Dogecoin (DO...