Willy Woo

Why the Bitcoin ‘mid-halving’ price slump will play out differently this time

Some analysts believe the four-year market cycle is changing and that the halving schedule may no longer determine cyclical conditions as Bitcoin closes in on the mid point between halvings. The halving is when the amount of Bitcoin (BTC) rewards issued per new block mined is reduced by half. The next halving will happen around May 5, 2024, andl reduce block rewards to 3.125 BTC. According to author @Alerzio on the Santiment blog on April 4, “the important resistance on the way is $50K.” The blog stated that breaking this level by or around the next mid-halving on April 11 would cast off many doubts as to the possibility that the traditional market cycle has been broken. “If the price (stabilizes) above this level, then we can give more credit to the thesis that says: ‘this cycle is differ...

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

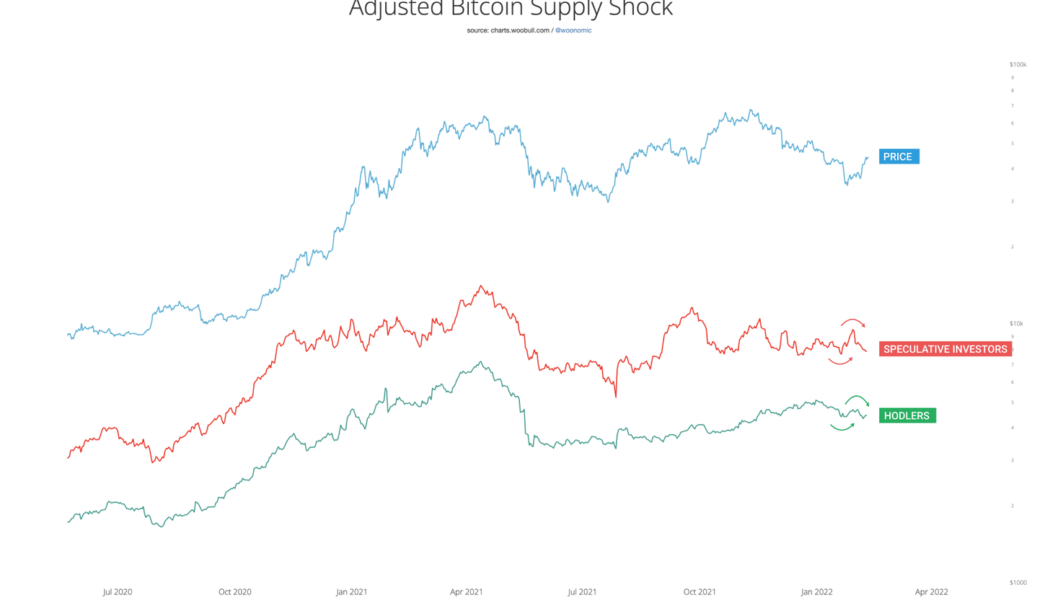

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

Willy Woo: ‘Peak fear’ but on-chain metrics say it’s not a bear market

Bitcoin analyst and co-founder of software firm Hypersheet Willy Woo believes that on-chain metrics show that BTC is not in a bear market despite observing “peak fear” levels. Speaking on the What Bitcoin Did podcast hosted by Peter McCormack on Jan. 30, Woo cited key metrics such as a strong number of long term holders (wallets holding for five months or longer) and growing rates of accumulation suggest that the market has not flipped the switch to bear territory: “Structurally on-chain, it’s not a bear market setup. Even though I would say we’re at peak fear. No doubt about it, people are really scared, which is typically […] an opportunity to buy.” I guess BTC is in demand lately pic.twitter.com/5h1IeMT2lK — Willy Woo (@woonomic) January 29, 2022 In the short term, Woo noted that ...

Bitcoin holdings of public companies have surged in 2021

The quantity of Bitcoin held by private corporations has increased significantly during 2021, building on increases from the previous year. In a Jan. 3 tweet, on-chain analyst Willy Woo claimed that public companies holding “significant BTC have gained market share from spot ETFs as a way to access BTC exposure on public equity markets”. This has been more noticeable since MicroStrategy’s “Bitcoin for Corporations” conference on Feb. 3 and 4, 2021. The online seminar aimed to explain the legal considerations for firms seeking to integrate Bitcoin into their businesses and reserves. Michael Saylor’s MicroStrategy is a leading business intelligence firm and is known for being particularly bullish on BTC, owning almost $6 billion in crypto assets. On Dec 30, Saylor’s firm pu...