why is crypto falling

How long will the bear market last? Signs to watch for a crypto market reversal

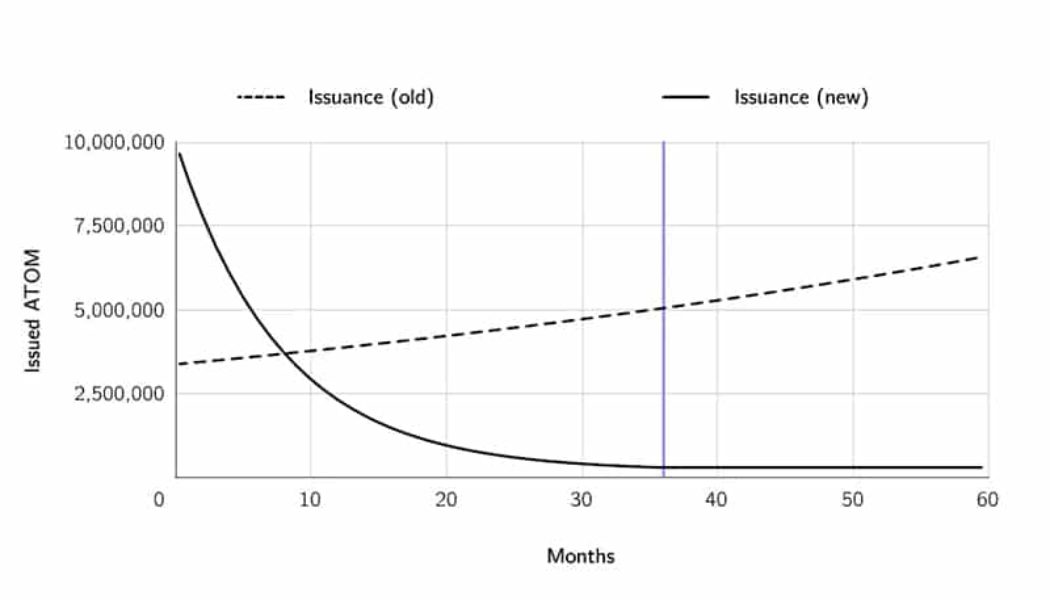

The current crypto bear market has induced panic, fear and uncertainty in investors. The dire situation started when the global market capitalization of crypto dropped below the $2 trillion mark in January 2022. Since then, the price of Bitcoin (BTC) has decreased by over 70% from its all-time high of $69,044.77, reached on Nov. 10, 2021. Similarly, the values of other major cryptocurrencies such as Ether (ETH), Solana (SOL), Avalanche (AVAX) and Dogecoin (DOGE) have decreased by around 90%. So, does history tell us anything about when the bear market will end? Let’s start by examining the causes of the 2022 bear market. Catalysts of the 2022 bear market There are several factors that caused the current bear run. First off, the build-up to the bear market started in 2021. During this...

3 emerging crypto trends to keep an eye on while Bitcoin price consolidates

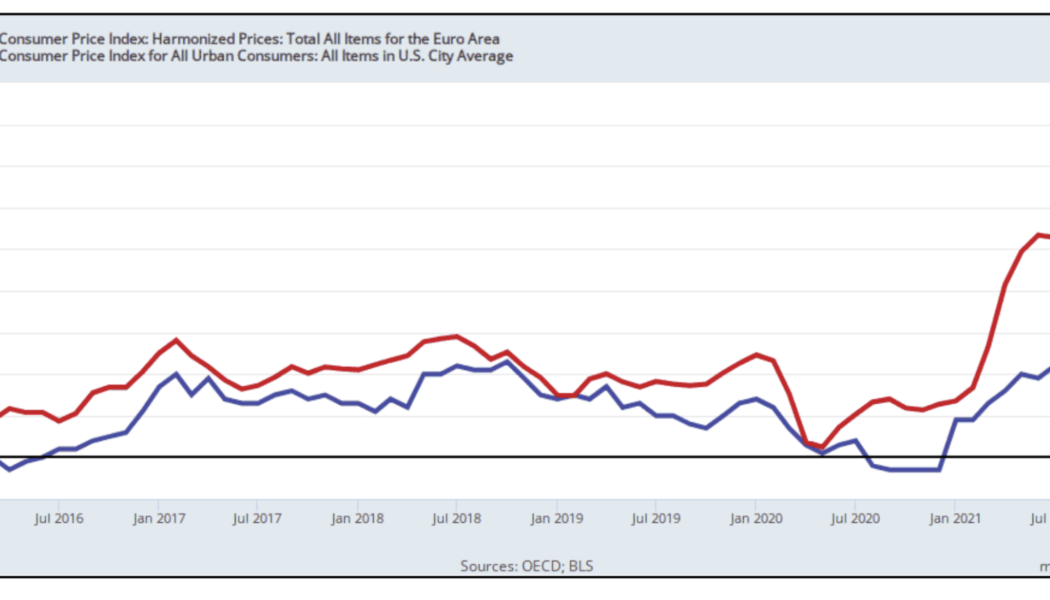

This week, Bitcoin’s (BTC) price took a tumble as a hotter-than-expected consumer price index (CPI) report showed high inflation remains a persistent challenge despite a wave of interest rate hikes from the United States Federal Reserve. Interestingly, the market’s negative reaction to a high CPI print seemed priced in by investors, and BTC’s and Ether’s (ETH) prices reclaimed all of their intraday losses to close the day in the black. A quick look at Bitcoin’s market structure shows that even with the post-CPI print drop, the price continues to trade in the same price range it has been in for the past 122 days. Adding to this dynamic, Cointelegraph market analyst Ray Salmond reported on a unique situation where Bitcoin’s futures open interest is at a record high, while its volatilit...

So what if Bitcoin price keeps falling! Here is why it’s time to start paying attention

For bulls, Bitcoin’s (BTC) daily price action leaves a lot to be desired, and at the moment, there are few signs of an imminent turnaround. Following the trend of the past six or more months, the current factors continue to place pressure on BTC price: Persistent concerns of potential stringent crypto regulation. United States Federal Reserve policy, interest rate hikes and quantitative tightening. Geopolitical concerns related to Russia, Ukraine and the weaponization of high-demand natural resources imported by the European Union. Strong risk-off sentiment due to the possibility of a U.S. and global recession. When combined, these challenges have made high volatility assets less than interesting to institutional investors, and the euphoria seen during the 2021 bull market has largel...

Bitcoin ‘great detox’ could trigger a BTC price drop to $12K — Research

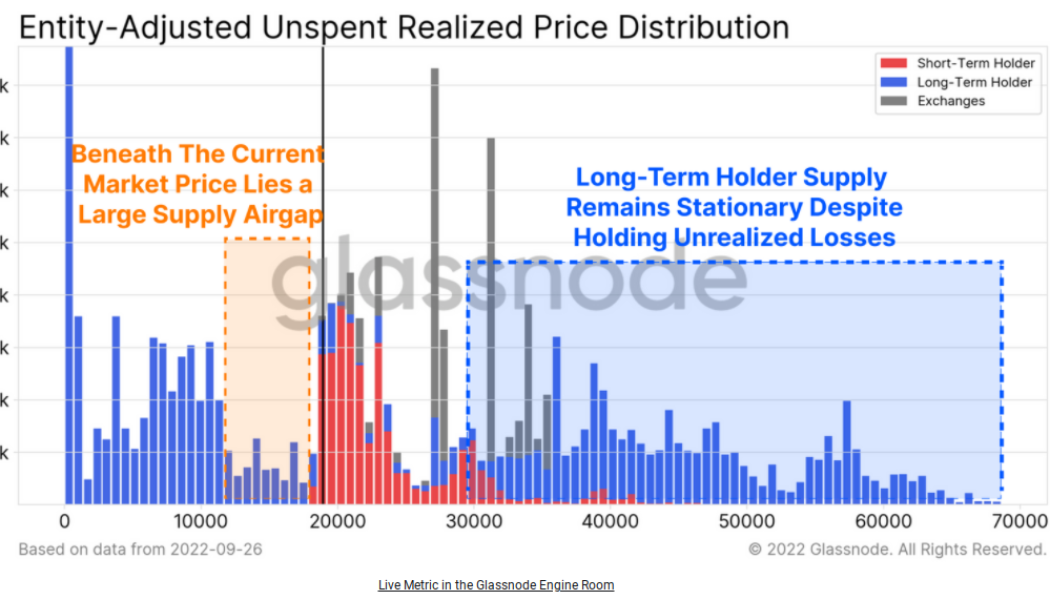

Bitcoin (BTC) is in a “dire condition” when it comes to adoption — but a silver lining is already visible, new research says. In the latest edition of its weekly newsletter, the Week On-Chain, crypto analytics firm Glassnode said that Bitcoin was going through a “great detox.” Bitcoin adoption returns to March 2020 Current BTC price action is pressuring everyone from long-term holders (LTHs) to miners, and relief is hard to come by. Macro turmoil and resistance at $20,000 is keeping BTC/USD at levels visited only once since 2020. With this week’s push above $20,000 accompanied by major profit-taking, warnings remain that more pain is due for the market first before a recovery takes place. For Glassnode, sustained lower levels are causing a seismic shift in the Bitcoin investor profile, wit...

Why is the crypto market down today?

Crypto prices keep falling, but why? This year’s market crash has turned most winning portfolios into net losers, and new investors are probably losing hope in Bitcoin (BTC). Investors know that cryptocurrencies exhibit higher than average volatility, but this year’s drawdown has been extreme. After hitting a stratospheric all-time high at $69,400, Bitcoin price crumbled over the next 11 months to an unexpected yearly low at $17,600. That’s a nearly 75% drawdown in value. Ether (ETH), the largest altcoin by market capitalization, also saw an 82% correction as its price tumbled from $4,800 to $900 in seven months. Years of historical data show that drawdowns in the 55%–85% range are the norm after parabolic bull market rallies, but the factors weighing on crypto prices today differ from tho...