why are crypto prices down

How long will the bear market last? Signs to watch for a crypto market reversal

The current crypto bear market has induced panic, fear and uncertainty in investors. The dire situation started when the global market capitalization of crypto dropped below the $2 trillion mark in January 2022. Since then, the price of Bitcoin (BTC) has decreased by over 70% from its all-time high of $69,044.77, reached on Nov. 10, 2021. Similarly, the values of other major cryptocurrencies such as Ether (ETH), Solana (SOL), Avalanche (AVAX) and Dogecoin (DOGE) have decreased by around 90%. So, does history tell us anything about when the bear market will end? Let’s start by examining the causes of the 2022 bear market. Catalysts of the 2022 bear market There are several factors that caused the current bear run. First off, the build-up to the bear market started in 2021. During this...

3 emerging crypto trends to keep an eye on while Bitcoin price consolidates

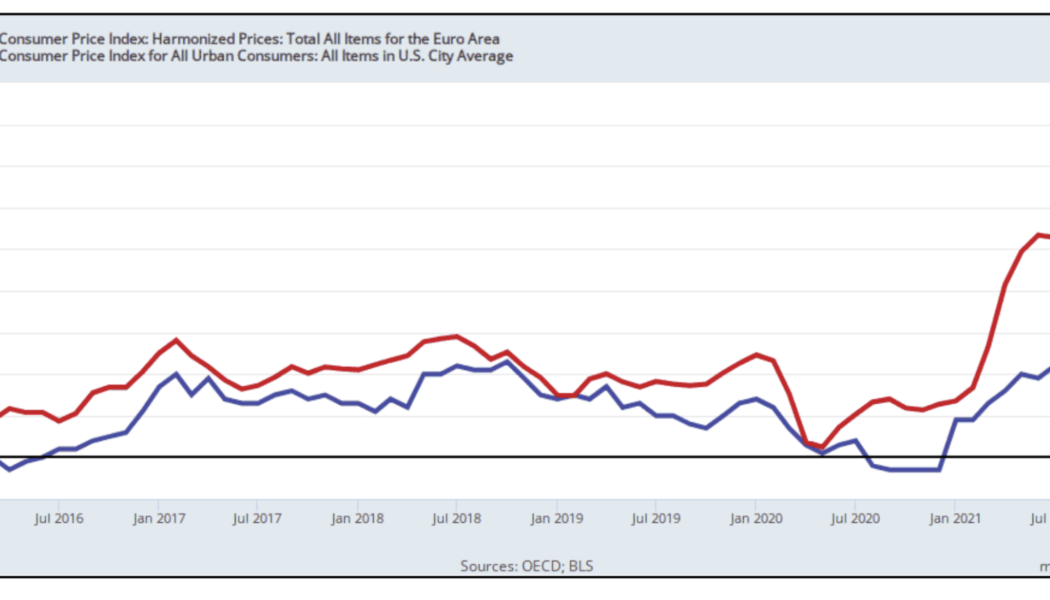

This week, Bitcoin’s (BTC) price took a tumble as a hotter-than-expected consumer price index (CPI) report showed high inflation remains a persistent challenge despite a wave of interest rate hikes from the United States Federal Reserve. Interestingly, the market’s negative reaction to a high CPI print seemed priced in by investors, and BTC’s and Ether’s (ETH) prices reclaimed all of their intraday losses to close the day in the black. A quick look at Bitcoin’s market structure shows that even with the post-CPI print drop, the price continues to trade in the same price range it has been in for the past 122 days. Adding to this dynamic, Cointelegraph market analyst Ray Salmond reported on a unique situation where Bitcoin’s futures open interest is at a record high, while its volatilit...

Bitcoin miner profitability under threat as hash rate hits new all-time high

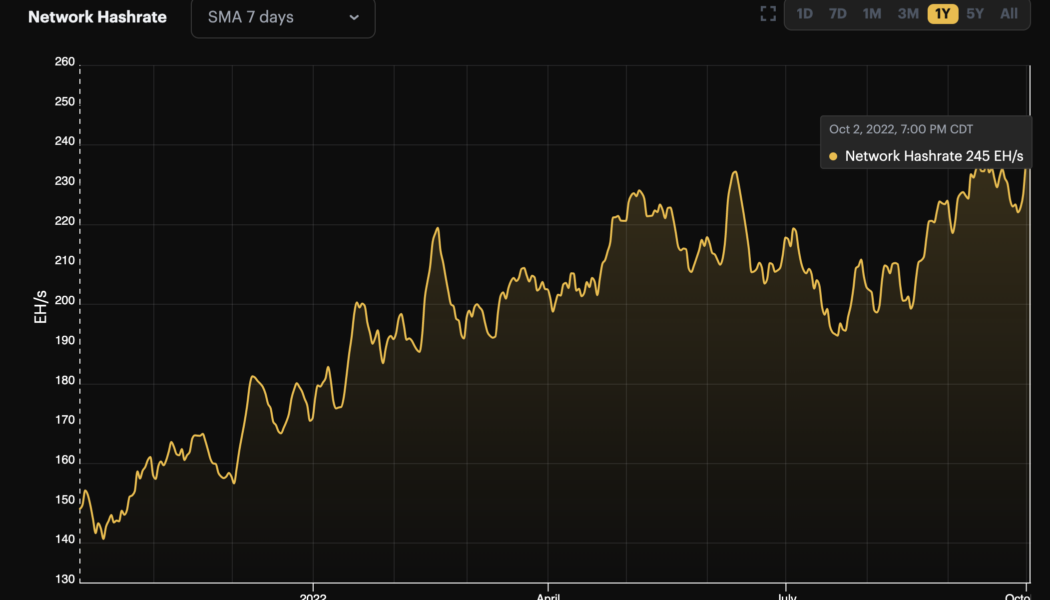

The Bitcoin hash rate hit a new all-time high above 245 EH/s on Oct. 3, but at the same time, BTC miner profitability is near the lowest levels on record. With prices in the low $20,000 range and the estimated network-wide cost of production at $12,140, Glassnode analysis suggests “that miners are somewhat on the cusp of acute income distress.” Bitcoin network hash rate. Source: Hashrate Index Generally, difficulty, a measure of how “difficult” it is to mine a block, is a component of determining the production cost of mining Bitcoin. Higher difficulty means additional computing power is required to mine a new block. Utilizing a Difficulty Regression Model, the data shows an R2 coefficient of 0.944 and the last time the model flashed signs of the miners’ distress was during BTC...

So what if Bitcoin price keeps falling! Here is why it’s time to start paying attention

For bulls, Bitcoin’s (BTC) daily price action leaves a lot to be desired, and at the moment, there are few signs of an imminent turnaround. Following the trend of the past six or more months, the current factors continue to place pressure on BTC price: Persistent concerns of potential stringent crypto regulation. United States Federal Reserve policy, interest rate hikes and quantitative tightening. Geopolitical concerns related to Russia, Ukraine and the weaponization of high-demand natural resources imported by the European Union. Strong risk-off sentiment due to the possibility of a U.S. and global recession. When combined, these challenges have made high volatility assets less than interesting to institutional investors, and the euphoria seen during the 2021 bull market has largel...