What is Ethereum price

Why is Ethereum (ETH) price down today?

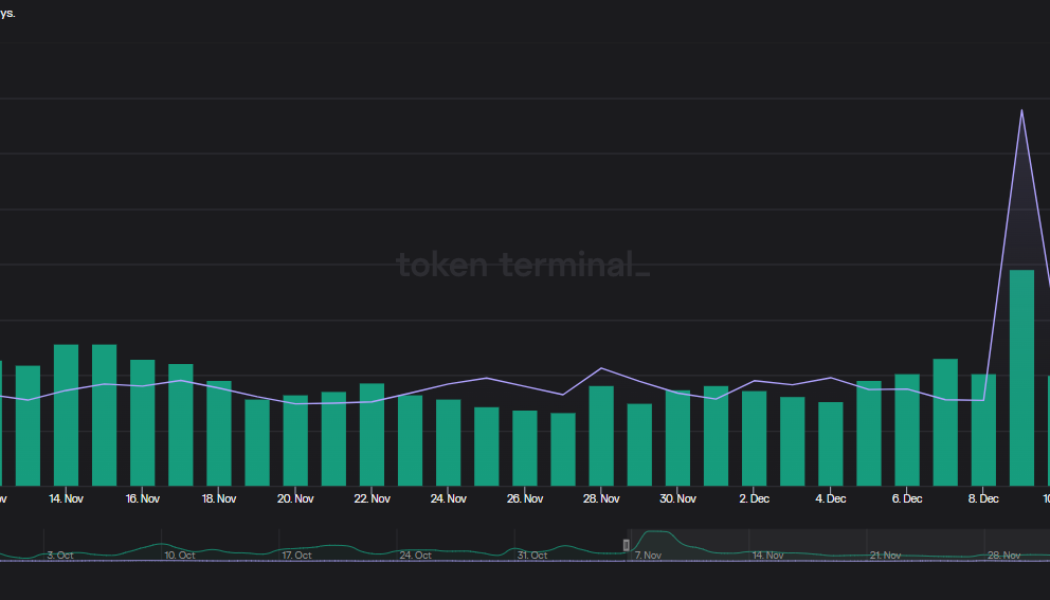

Ether (ETH) price is down on Dec. 16 and the pre-FOMC rally to $1,350 was obliterated after Federal Reserve chair Jerome Powell issued hawkish statements following a 0.50% hike in interest rates. The Ether sell-off follows a market-wide decline that has sent Ethereum network fees plummeting by 39.90% in the past 30-days. Daily Ethereum network fees and daily active users. Source: TokenTerminal The total value locked in Ethereum-based smart contracts also decreased by decentralized finance by 4.49% in 24-hours. Following the FTX exchange scandal, regulators are attempting to fast-track new regulations on the cryptocurrency sector. Total USD value locked on the Ethereum network. Source: DefiLlama While some analysts believe Ethereum still possesses multiple bullish catalysts that warrant inv...

Bitcoin and Ethereum gave back their gains, but has anything actually changed?

Crypto markets threw a nice head fake this week by rallying into resistance on a “positive” Consumer Price Index (CPI) report, before retracing the majority of those gains right after Federal Reserve Chair Jerome Powell took on a surprisingly hawkish tone during his post-rate-hike presser. The Fed hiked interest rates by 0.50%, which was well within the expectation of most market participants, but the eyebrow-raiser was the Federal Open Market Committee consensus that rates would need to reach the 5%–5.5%+ range in order to hopefully achieve the Fed’s 2% inflation target. This basically threw cold water on traders’ lusty dreams of a Fed policy pivot taking place in the first half of 2023, and the damper on sentiment was felt throughout crypto and equities markets. As the charts below...

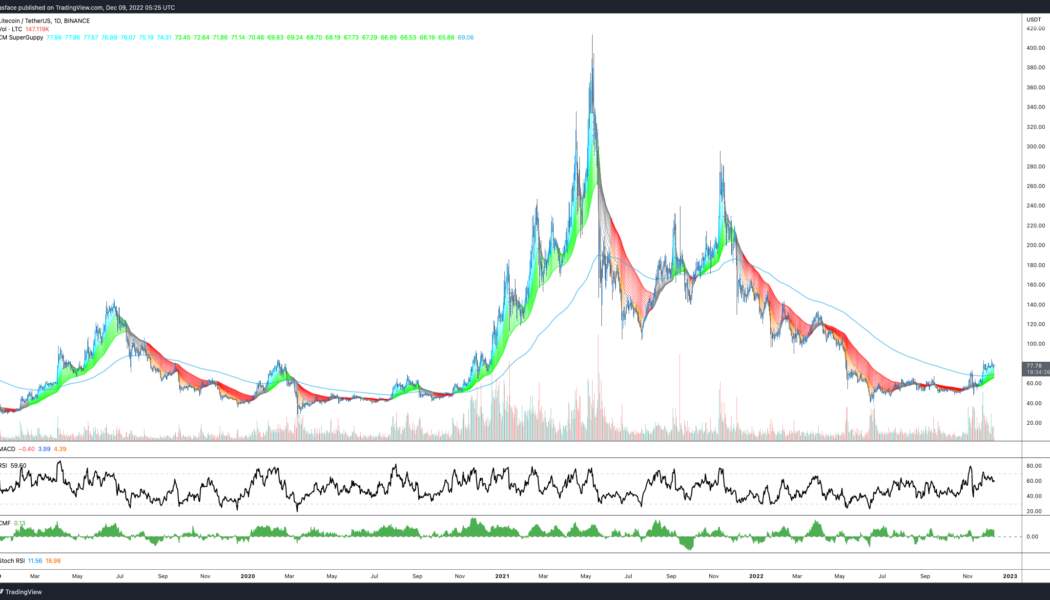

Ethereum and Litecoin make a move while Bitcoin price searches for firmer footing

Crypto price action has been rough over the past few months, but a few green shoots are finally beginning to emerge. While Bitcoin (BTC) remains in a downtrend, its price has recently found support at the $17,000 level, and ping-pong price action in the $16,700–$17,300 range appears to be allowing traders to pursue some interesting setups in a few altcoins. Let’s take a quick peek at some enticing patterns showing up on the weekly time frame. Time for Litecoin’s halving hopium? LTC/USDT 1-day chart. Source: TradingView As a fork of Bitcoin, Litecoin (LTC) tends to turn bullish several months before its reward halving takes place, as was the case in 2015 and 2019. Litecoin’s next reward halving is 237 days away, and it appears that the altcoin is undergoing a little pre-halving hype. Since ...