what is decentralized finance

Here is why strong post-Merge fundamentals could benefit Ethereum price

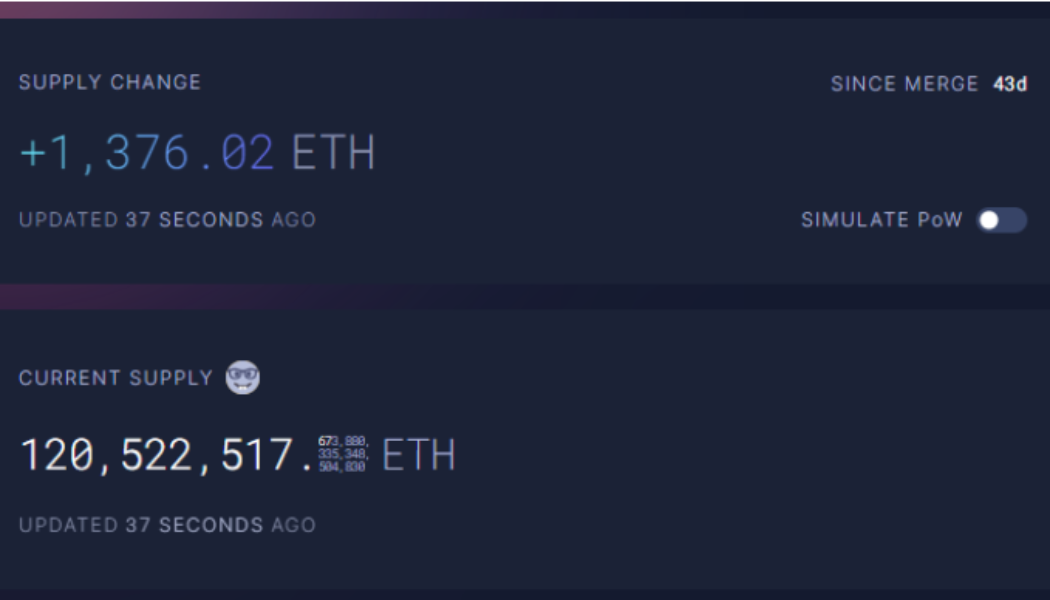

The shift of the Ethereum blockchain to a proof-of-stake (PoS) protocol opened new opportunities for developers and investors to explore, including the burning of Ether (ETH). Now, Ethereum transactions are validated through staking rather than mining. Staking impacts the supply and price dynamics of Ether in ways that are different than mining. Staking is expected to create deflationary pressure on Ether, as opposed to mining, which induces inflationary pressure. The increase in the total amount of funds locked in Ethereum contracts could also push ETH’s price up in the long term, as it affects one of the fundamental forces that determine its price: supply. The percentage of newly issued Ether versus burned Ether has increased by 1,164.06 ETH since the Merge. This means that sin...

3 reasons why DeFi investors should always look before leaping

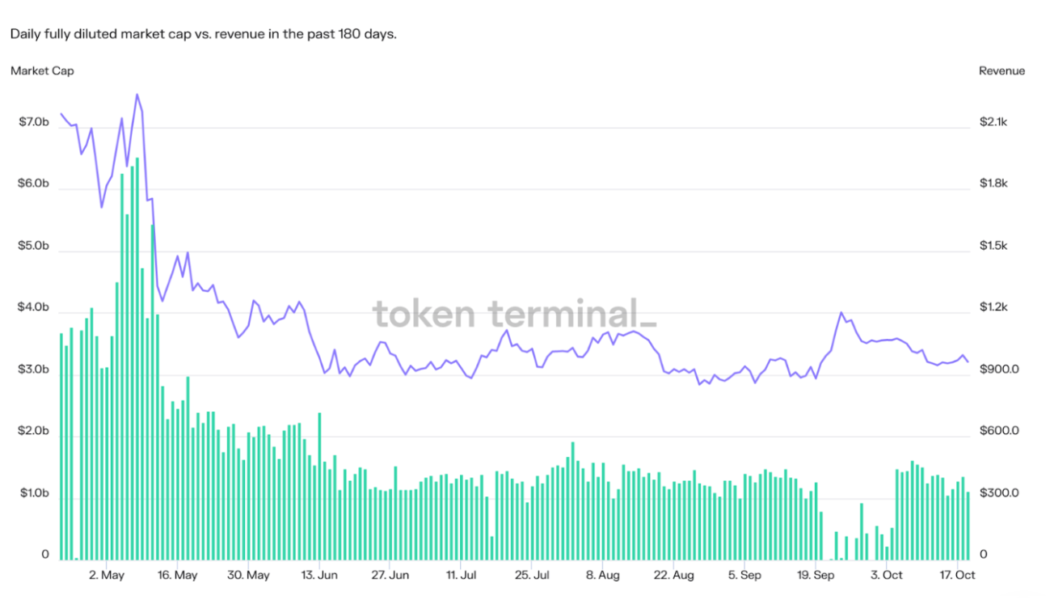

Welcome readers, and thanks for subscribing! The Altcoin Roundup newsletter is now authored by Cointelegraph’s resident newsletter writer Big Smokey. In the next few weeks, this newsletter will be renamed Crypto Market Musings, a weekly newsletter that provides ahead-of-the-curve analysis and tracks emerging trends in the crypto market. The publication date of the newsletter will remain the same, and the content will still place a heavy emphasis on the technical and fundamental analysis of cryptocurrencies from a more macro perspective in order to identify key shifts in investor sentiment and market structure. We hope you enjoy it! DeFi has a problem, pump and dumps When the bull market was in full swing, investing in decentralized finance (DeFi) tokens was like shooting fish in a ba...