wETH

What is wrapped Ethereum (wETH) and how does it work?

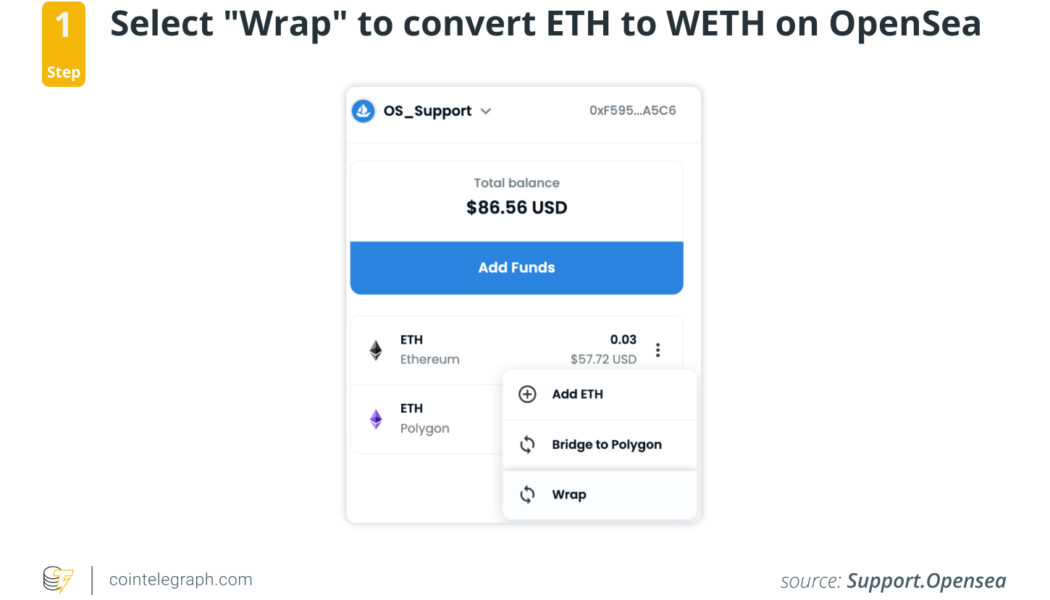

Traders who use the Ethereum network are familiar with the ERC-20 technical standard and have most likely traded and invested in tokens that utilize it. After all, its practicality, transparency and flexibility have made it the industry norm for Ethereum-based projects. As such, many decentralized applications (DApps), crypto wallets and exchanges natively support ERC-20 tokens. However, there’s one problem: Ether (ETH) and ERC-20 do not exactly follow the same rules, as Ether was created way before ERC-20 was implemented as a technical standard. So, why does wrapped ETH matter? Briefly put, ERC-20 tokens can only be traded with other ERC-20 tokens, not Ether. In order to bridge this gap and enable the exchange of Ether for ERC-20 tokens (and vice versa), the Ethereum network introduced wr...

Blockchain enthusiast allegedly losses $500k by sending WETH to contract address

In a now-deleted deleted profile, an anonymous Reddit user allegedly lost close to $500 thousand on Sunday after sending wrapped Ether (WETH) directly into a WETH wrapping smart contract. WETH came into existence as a way for Ether (ETH) to conform to the ERC-20 token standard so that it can be traded directly with altcoins minted on the Ethereum blockchain. To wrap Ether, users first send ETH to the WETH smart contract address and receive an equivalent token in return. However, to unwrap WETH, users must either swap for ETH on a decentralized exchange like Uniswap (UNI) or call the withdrawal function in the WETH smart contract. Instead, the anonymous Reddit user sent the WETH directly back into the WETH smart contract address in the hopes of receiving ETH back. Unfortunately for the user...