warner music group

Major Labels Ink Licensing Deal with AI Music Startup Klay

Universal, Sony, and Warner have signed deals with AI music startup Klay to train a "Large Music Model." Major Labels Ink Licensing Deal with AI Music Startup Klay Eddie Fu

Warner Music Initiating Layoffs To Bolster “Core Business”

Warner Music's CEO Robert Kyncl sent out an internal memo informing the staff that the company was going to layoff 600 of its employees, severing their ties with digital brands such as Uproxx and HipHopDX.

Warner Music Shareholder Who Named Label in Sexual Misconduct Suit Fails to Win Board Seat

Former Atlantic Records employee Dorothy Carvello lost her bid for a seat on Warner Music Group’s board of directors last month after failing to comply with certain requirements in the company’s bylaws, spokespeople for Carvello and the record label said on Tuesday (Jan. 3). Under a new rule passed by the U.S. Securities and Exchange Commission last year that makes it easier for minority shareholders to wage campaigns for board seats, Carvello sought to nominate herself for a seat on WMG’s board, to be voted on at the next shareholder meeting. The activist and author, who alleged in her memoir, Anything for a Hit: An A&R Woman’s Story of Surviving the Music Industry, that she was subjected to sexual abuse and misconduct while working at Atlantic from 1987 to 1990, plans to run again ne...

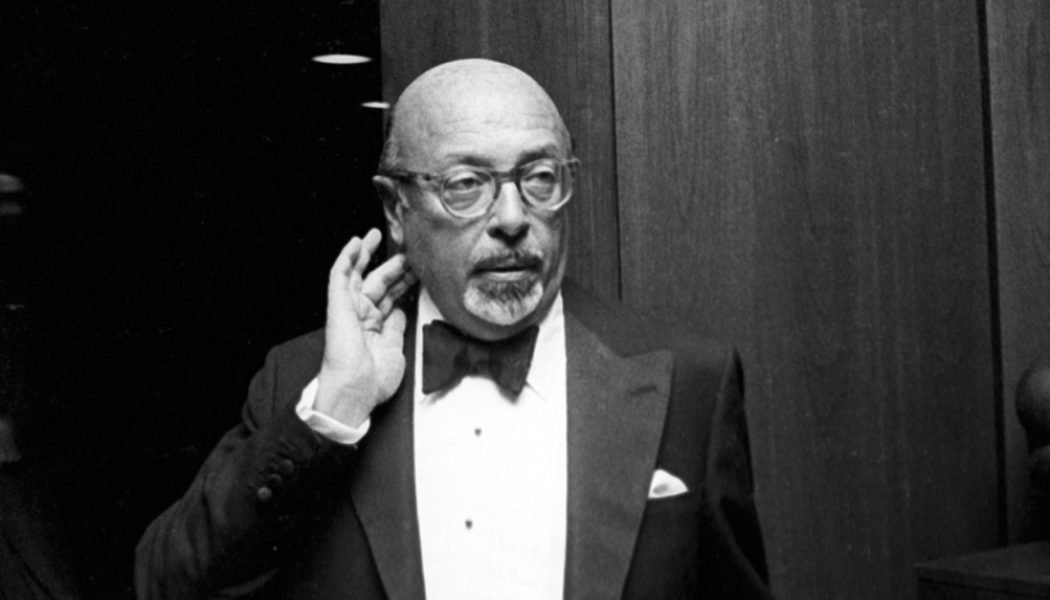

Atlantic Records, Ahmet Ertegun Estate & Others Hit with Sexual Misconduct Suit by Former Employee, Dorothy Carvello

Just days after Atlantic Records and the estate of its late co-founder Ahmet Ertegun were hit with a sexual assault lawsuit filed by a former employee, the entities are now facing a second complaint detailing similar allegations of abuse –– only this one casts a wider net. On Sunday (Dec. 4), Dorothy Carvello – a former A&R executive with the label and author of music-industry expose Anything for a Hit – filed suit against Atlantic, the label’s parent company Warner Music Group, Ertegun’s estate, former Atlantic co-CEO & co-chairman Doug Morris and former chairman and CEO Jason Flom. In the exhaustive complaint, Carvello alleges she was “horrifically sexually assaulted” by Ertegun and Morris and that Atlantic, WMG and Flom (then an Atlantic vp) enabled the abuse. “During her employ...

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

Triller Removes Music From Universal, Sony, Warner and Merlin

Try using some of your favorite songs on the short-form video app Triller, and you’ll be hard pressed to find what you’re looking for. On Thursday, the music catalogs for Universal Music Group, Warner Music Group, Sony Music and Merlin — which provides digital licensing to many top independent labels and distributors — were removed from the platform. A Triller spokesperson says the platform is “reassessing each of our label deals as they come due as our catalogue music usage is a small fraction of our overall business with creators. “Some labels are more used than others and if we can make financial arrangements which make sense for the platform, on a label by label basis, we will. In other cases the usage does not justify the cost.” The news follows a lawsuit filed by Sony Music Entertain...

Warner Music Posts $1.5B in Quarterly Revenue as Publishing Rises 32%

Warner Music Group, helped by digital revenue growth across recorded music and publishing, reported quarterly revenues rose 16% at constant currency (9% as reported) to $1.5 billion in the fiscal fourth quarter ended Sept. 30, the company announced Tuesday (Nov. 22). Adjusted earnings before interest, taxes, amortization and depreciation (EBITDA) grew by 16% to $276 million. In his final quarterly earnings after 12 years as Warner Music’s chief executive, Steve Cooper said, “Against the backdrop of a challenging macro environment, we once again proved music’s resilience, with new commercial opportunities emerging all the time. We’re very well positioned for long-term creative success, and continued top and bottom line growth. We’re excited to have Robert Kyncl joining next year as WMG’s ne...

Music Companies Must Now Include Salary Ranges on New York Job Postings

A new New York City law requiring employers to disclose salary ranges in job postings has officially gone into effect this week, with music companies hiring in the city mandated to comply. On the first day of the law, a picture of at least one of the major music companies’ salary ranges has come into focus. The day the law went into effect, several companies were criticized for overly-broad salary ranges that effectively subverted the point of the regulation, which was designed to give prospective employees insight into what they could be expected to earn at different companies in the city and address salary discrepancies between men and women and for people of color. The Wall Street Journal, for instance, posted reporting and producing jobs with ranges between $40,000 to $160,000; te...

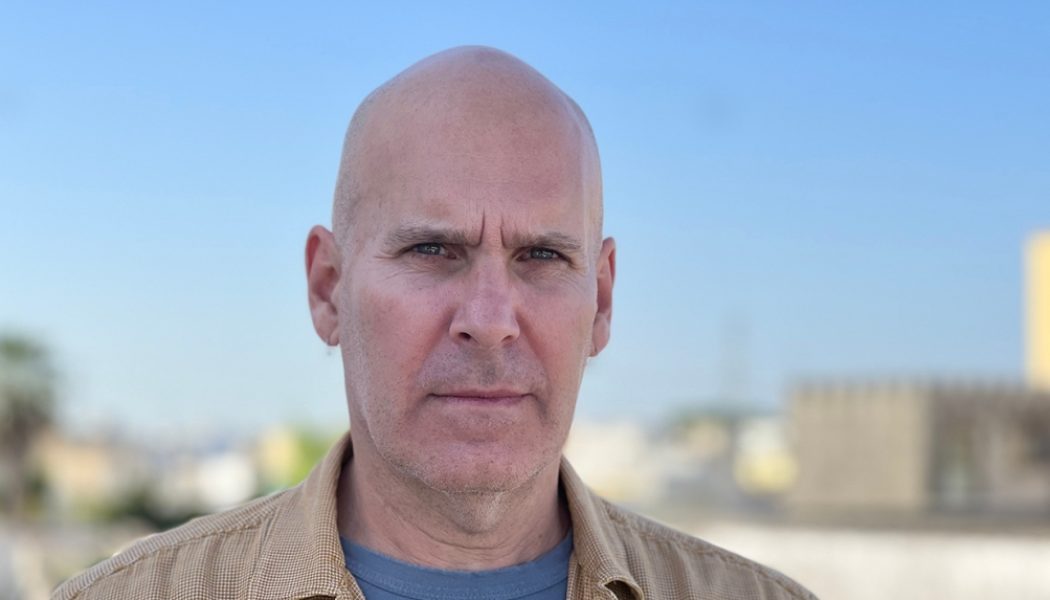

Ex-WMG Innovation Chief Scott Cohen Named CEO of Music Investing Platform

Former Warner Music Group executive and the Orchard co-founder Scott Cohen said on Tuesday (Nov. 1) he is taking a new job as chief executive officer of a fintech platform aimed at selling fractional shares in song catalogs. Cohen, who stepped down from his role as chief innovation officer at WMG in September, said the aim of the new venture is to “fractionalize ownership of music royalties.” Fractional shares are a familiar concept in finance, and brokerages like Robinhood and Fidelity Investments sell them as a way to buy a slice of a share for less than the price of the whole stock. The market for buying and investing in music publishing rights has traditionally been open to only the world’s largest music companies and, more recently, money managers. Introducing fractional shares could ...

Apple Music’s Price Hike Boosts Music Stocks

Universal Music Group, Hipgnosis Songs Fund and other music stocks got a much-needed boost on Tuesday (Oct. 25) following news of Apple Music’s price hike, as investors bet it would trigger a wave of streaming subscription cost increases. Universal Music Group’s stock closed 11.6% higher, Hipgnosis Songs Fund Ltd ended up 7.8% and Korean music companies SM Entertainment and HYBE finished the trading day 4.8% and 4.4% higher, respectfully, on Tuesday. On Monday, Apple announced that it was raising the standard U.S. and U.K. individual plan price to $10.99 from $9.99. This 10% price hike — Apple’s first — comes amid high inflation and a darkening economic environment in many global markets. If Apple can raise prices at a time like this, that is a sign the music industry can charge more ...

Adam Lambert Returns to WMG With EastWest Records Deal

Singer-songwriter and Queen collaborator Adam Lambert has returned to the Warner Music fold, signing a global deal with EastWest Records ahead of new music. The American Idol runner-up’s first release under the deal, a cover of Noël Coward’s “Mad About The Boy” for a documentary about the witty playwright, arrives Friday (Oct. 7). According to the label, fans of Lambert can expect more music soon and a new album next year. Lambert’s first pairing with WMG — for flagship Warner Records — resulted in 2015’s The Original High, which peaked at No. 3 on the Billboard 200 chart. That album, his third studio effort, followed a successful run at Sony Music’s RCA, where he scored a No. 1 album for 2012’s Trespassing and top-3 finish for his debut, 2009’s For Your Entertainment. The singer and LGBTQ...