Wall Street Journal

Meta reportedly plans ‘large-scale layoffs,’ but what of its metaverse division?

Social media and tech giant Meta is reportedly gearing up for “large-scale layoffs” this week amid rising costs and a recent collapse of its share price. According to Wall Street Journal (WSJ) report on Nov. 6 citing people familiar with the matter, the planned layoffs could impact thousands of employees in a broad range of divisions across Meta’s 87,000-strong workforce. It is not currently understood whether the firm’s Reality Labs division, which registered a $3.7 billion loss in the third quarter, would see staff cuts. Last week, Meta CEO Mark Zuckerberg said that the company would be focusing its investment on “a small number of high-priority growth areas,” including its Artificial Intelligence (AI) Discovery Engine and its advertisement and business messaging p...

Contagion: Genesis faces huge losses, BlockFi’s $1B loan, Celsius’s risky model

It’s been another day of watching the ripples of contagion spread through the crypto market. With Three Arrows Capital being ordered into liquidation by a British court, details have also emerged today of BlockFi liquidating a $1B loan to 3AC, and the fallout from the insolvency was partly to blame for lending firm and market maker Genesis Trading facing losses of “a few hundred million dollars.” Withdrawals remain suspended at the possibly insolvent lending and borrowing platform Celsius, which was revealed to have had a highly risky 19 to 1 assets-to-equity ratio before it ran into liquidity troubles this year. Celsius’ risky business According to documents reviewed and reported on by the Wall Street Journal (WSJ) on June 29, Celsius was operating on very fine and risky margins as ...

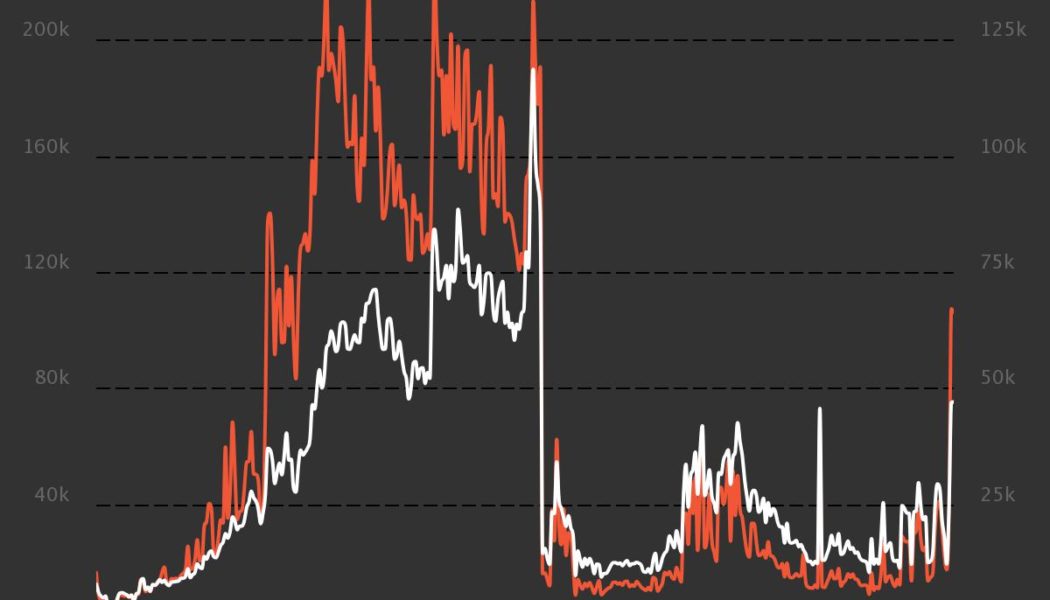

WSJ says ‘the NFT market is collapsing’ but the data says otherwise

An article in the Wall Street Journal has claimed sales of non-fungible tokens (NFTs) are “flatlining” — in the same week that the top five collections alone accounted for more than $1 billion in primary and secondary sales. The article cited data from NFT market analysis platform Nonfungible suggesting the number of NFT sales has fallen by 92% since an all-time high in September 2021. Wallets active in the Ethereum (ETH) NFT market were also said to have declined by 88% since a high in November 2021. “The NFT market is collapsing,” the article concluded. Red line shows number of sales with volume on left y-axis, white shows active market wallets, volume on right y-axis. Source: Nonfungible However, onchain data from Dune Analytics’ dashboard suggest that the NFT market is still robust, wi...

Apple Music pays one penny per stream

Engadget Apple Music’s payment rate for artists and labels is fundamentally a penny per stream, according to a letter from the company posted on its artist dashboard and first reported by the Wall Street Journal. That payment rate is higher than Spotify, which has a confusing variable rate scheme that basically tops out at a half-penny per stream. Announcing a penny-per-stream rate is a nice PR win for Apple Music, since it is 1. very simple and 2. Spotify hates talking about its per-stream payments, which the company insists are a misleading figure. Seriously, it just launched an entire website called Loud&Clear last month designed to help artists and fans understand how payments work, and a good chunk of it is devoted to explaining why per-stream rates are not the right thing to focu...

WSJ: China’s Ant Group plans revamp amid regulator pressure

China’s Ant Group Co Ltd is planning to refashion itself as a financial holding company under the supervision of China’s central bank in the face of regulatory pressure, the Wall Street Journal reported on Wednesday. The fintech affiliate of Alibaba Group Holding Ltd has submitted an outline of a restructuring plan, which could be finalised before China goes into the week-long lunar new year holiday in mid-February, the Wall Street Journal said, citing sources. Chinese regulators had asked Ant to consider folding up most of its financial businesses into a holding company that would be subject to more stringent capital requirements, two sources told Reuters in December. The country’s central bank, People’s Bank of China, has said Ant controls a range of financial institutions, including sec...