Wall Street

Disney+ Hits 137.7M Subscribers, Beats Wall Street Expectations

Disney once again beat Wall Street expectations last quarter in streaming, adding 7.9 million Disney+ subscribers, and suggesting that the company may be positioned to take a lead in what has become a cutthroat race to the top in streaming. While Wall Street expectations for Disney+ were varied, a midpoint expectation was 4.5 million to 5 million adds. Explore Explore See latest videos, charts and news See latest videos, charts and news Disney reported revenue of $19.2 billion and income of $3.7 billion, with earnings per share of $1.08. Wall Street expectations were for revenue of $20.1 billion, operating income of $3.3 billion, and EPS of $1.17. The EPS miss could be due to a change in tax regulations, which saw the company’s effective tax rate balloon from 8.8 percent a year a...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

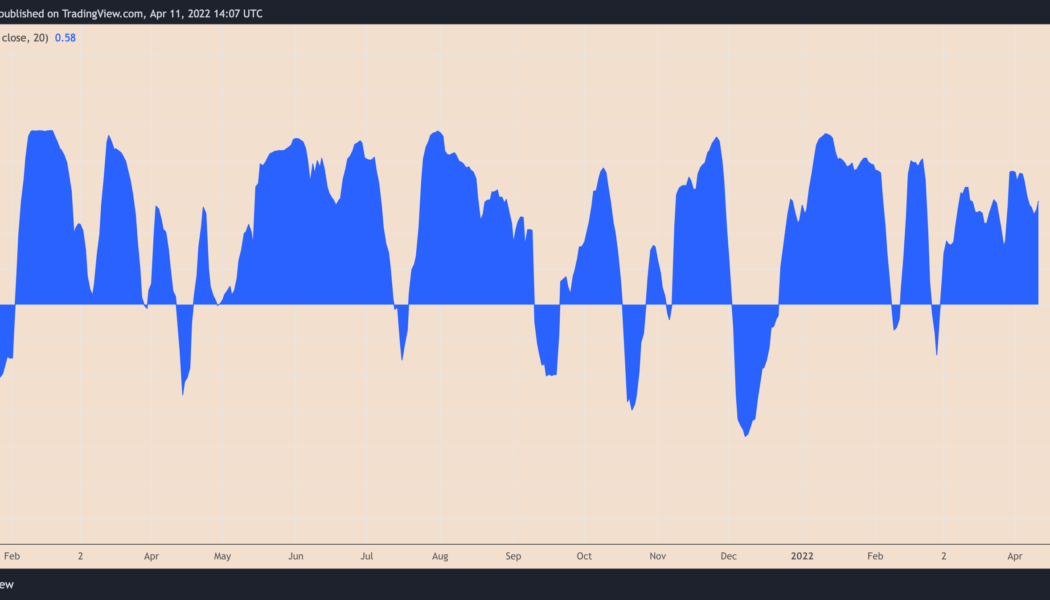

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

BTCS stock jumps 44% after announcing first-ever dividend payable in Bitcoin

On Wednesday, Nasdaq Composite logged its biggest daily loss since February last year. But for one of its listed companies, the day turned out to be extremely bullish. Blockchain stock soars The share value of BTCS Inc. (BTCS), a blockchain technology company, surged nearly 44% to $4.36 at the New York closing bell, thus becoming the third-best performer on Nasdaq after Lixte Biotechnology (LIXT) and Mainz Biomed BV (MYNZ). Top Nasdaq performers as of Jan. 5, 2022’s close. Source: TheStockMarketWatch.com In contrast, Nasdaq plunged 3.3% Wednesday, its losses driven primarily by the release of the minutes of the Federal Open Market Committee (FOMC) meeting in mid-December last year. In detail, the minutes revealed the Federal Reserve officials’ intention to rais...

Bitcoin daily losses near $4K as S&P 500 hits 69th all-time high of 2021

Bitcoin (BTC) dropped nearly $4,000 on Dec. 28 as the market offered a sharp reminder that the bull run would need to wait. BTC analysts eyes $44,000 BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $48,335 on Bitstamp at Dec. 28’s Wall Street open. The pair had passed $52,000 the previous day, this marking a three-week high, before pressure from sellers halted progress. At the time of writing, Bitcoin circled $49,000 as traders took the opportunity to remind audiences of Bitcoin’s ongoing active range. “Humans get bullish at resistance. It’s a thing,” Scott Melker summarized. “Still ranging. Nothing has changed.” The $52,000 trip indeed failed ...