Volatility

Abnormal token price movements on Binance not hack-related, confirms CZ

Crypto exchange Binance began investigating suspicious behavior on its platform after noticing abnormal price movements for certain trading pairs involving Sun Token (SUN), Ardor (ARDR), Osmosis (OSMO), FUNToken (FUN) and Golem (GLM) tokens. Nearly 40 minutes into the investigation, Binance CEO Changpeng ‘CZ’ Zhao revealed that the price movements “appears to be just market behavior.” On Dec. 11 at 3:10 am ET, Binance issued a notice about abnormal price movements for some trading pairs. The exchange began an investigation to narrow down suspicious accounts responsible for the issue. To investors’ relief, Binance’s investigation did not point to the possibility of compromised accounts or stolen API keys. Based on our investigations so far, this appears to be just market behavior. One guy d...

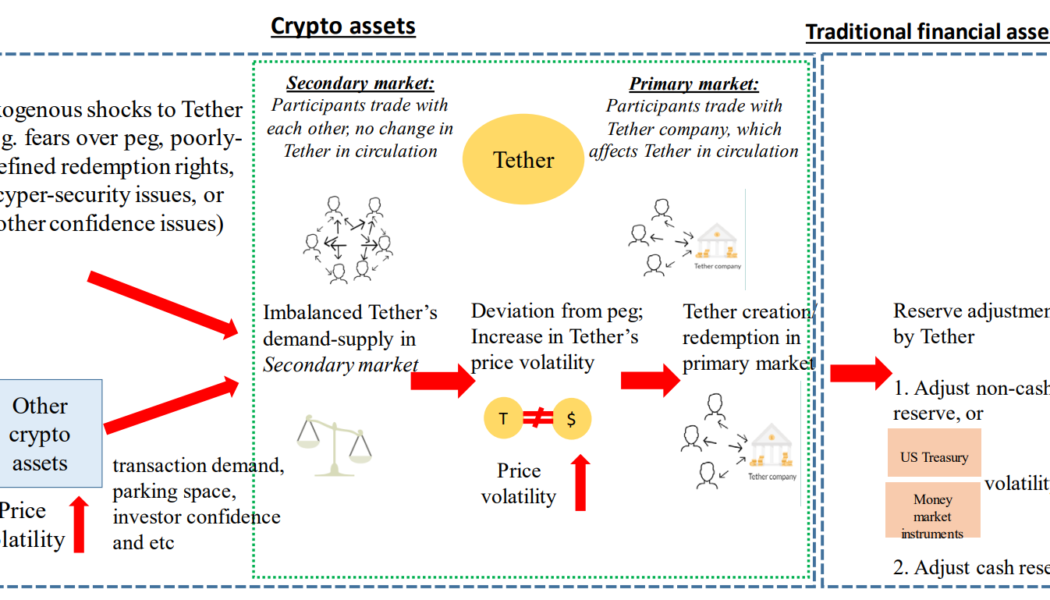

Hong Kong believes stablecoin volatility can spillover to traditional finance

The fall of crypto giants this year reignited questions about the stability of cryptocurrencies and their impact on fiat ecosystems. Hong Kong Monetary Authority (HKMA) assessed the situation and found that the instabilities of crypto assets, including asset-backed stablecoins, can potentially spill over to the traditional financial system. The HKMA assessment on asset-backed stablecoins pointed out the risks of liquidity mismatch, negatively impacting their stability during “fire-sale” events. A fire sale event relates to a momentary price fluctuation when investors can purchase stablecoins cheaper than their market price — a phenomenon noticed during the Terra (LUNA) crash. According to Hong Kong’s central bank, the interconnection of crypto assets has made the crypto ecosystem more vuln...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

Why are institutions accumulating crypto in 2022? Fidelity researcher explains

Institutions’ investment in crypto has increased in 2022 despite the bear market, according to a recent survey by Fidelity Digital Assets. In particular, the amount of large investors betting on Ethereum have doubled in the last two years, as revelead by Chris Kuiper, the Head of Research at Fidelity Digital Assets in a recent interview with Cointelegraph. “The percentage of respondents saying they were invested in Ethereum doubled from two years ago”, pointed out Kuiper. Kuiper pointed out that Ethereum’s appeal in the eyes of institutions is likely to increase even more now that after the Merge, Ether has become a more environmentally friendly, yield-bearing asset. In general, according to the same survey, institutional players are accumulating crypto despite the cr...

BTC to outperform ‘most major assets’ in H2 2022 — Bloomberg analyst

Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, stated October has historically been the best month for Bitcoin (BTC) since 2014, averaging gains of about 20% for the month, and that commodities appearing to peak could imply that Bitcoin has reached its bottom. In an Oct. 5 Bloomberg Crypto Outlook report, McGlone says while the rise of interest rates globally is putting downwards pressure on most assets, Bitcoin is gaining the upper hand when compared with commodities and tech stocks like Tesla, with the report noting: “When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum, and the Bloomberg Galaxy Crypto Index to outperform most major assets.” McGlone notes that Bitcoin has its lowest ever volatility against the Bloomberg Comm...

Bitcoin’s 60% year-to-date correction looks bad, but many stocks have dropped by even more

Bitcoin’s (BTC) and Ether’s (ETH) agonizing 60% and 66% respective drops in price are drawing a lot of criticism from crypto critics and perhaps this is deserved, but there are also plenty of stocks with similar, if not worse, performances. The sharp volatility witnessed in crypto prices is partially driven by major centralized yield and lending platforms becoming insolvent, Three Arrows Capital’s bankruptcy and a handful of exchanges and mining pools facing liquidity issues. For cryptocurrencies, 2022 has definitely not been a good year, and even Tesla sold 75% of its Bitcoin holdings in Q2 at a loss. The quasi-trillion dollar company still holds a $218 million position, but the news certainly did not help investors’ perception of Bitcoin’s corporate adoption. Cryptocurrencies are n...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

21Shares launches S&P risk controlled Bitcoin and Ether ETPs

With cryptocurrency markets shrinking over 50% this year, 21Shares are working to replicate S&P Dow Jones Indices’ benchmarks with its new risk-adjusted crypto investment products. The Swiss crypto investment firm 21Shares has launched two new exchange traded products (ETP) offering investors exposure to the largest cryptocurrencies — Bitcoin (BTC) and Ether (ETH) — while aiming to soften volatility via rebalancing assets to the U.S. dollar (USD). The new products, the 21Shares S&P Risk Controlled Bitcoin Index ETP and 21Shares S&P Risk Controlled Ethereum Index ETP, will start trading on the Swiss SIX Exchange on July 20. The ETPs will trade under tickers SPBTC and SPETH, the firm announced on Wednesday. Both ETPs target a volatility level of 40%, which is achieved through dyn...

What is Bitcoin whale watching and how to track Bitcoin whales?

Whales are held responsible for sudden price fluctuations in the crypto and traditional markets every so often. Given their capability to manipulate market prices, it becomes paramount for the general Bitcoin (BTC) investors to understand the nuances that make one a whale and their overall impact on trading. Wallet addresses that contain large amounts of BTC are identified as Bitcoin whales. Dumping or transferring large amounts of BTC from one wallet to another negatively impacts the prices, resulting in losses for the smaller traders. As a result, tracking Bitcoin whales in real-time allows small-time traders to make profitable trades amid a fluctuating market. Despite Bitcoin’s global and decentralized nature, tracking down and monitoring whales simply boils down to accessing read...

Magic Internet Money token depegs as Terra (LUNA) domino effect persists

Magic Internet Money (MIM), a US dollar-pegged stablecoin of the Abracadabra ecosystem, joins the growing list of tokens losing their $1 value amid an untimely crypto winter. The sudden de-pegging of the MIM token commenced roughly on June 17, 7:40 pm ET, which saw the token’s price drop to $0.926 in just three hours. Terra’s LUNA and TerraUSD (UST) death spiral not only affected the investors but also had a negative impact on numerous crypto projects, including Abracadabra’s MIM token ecosystem — as alleged by Twitter handle @AutismCapital. Depegging of Magic Internet Money (MIM) token price chart. Source: CoinMarketCap Citing an insider scoop, AutismCapital claimed that Abracadabra accrued $12 million in bad debt as a direct result of Terra’s sudden downfall “because liquidations couldn&...

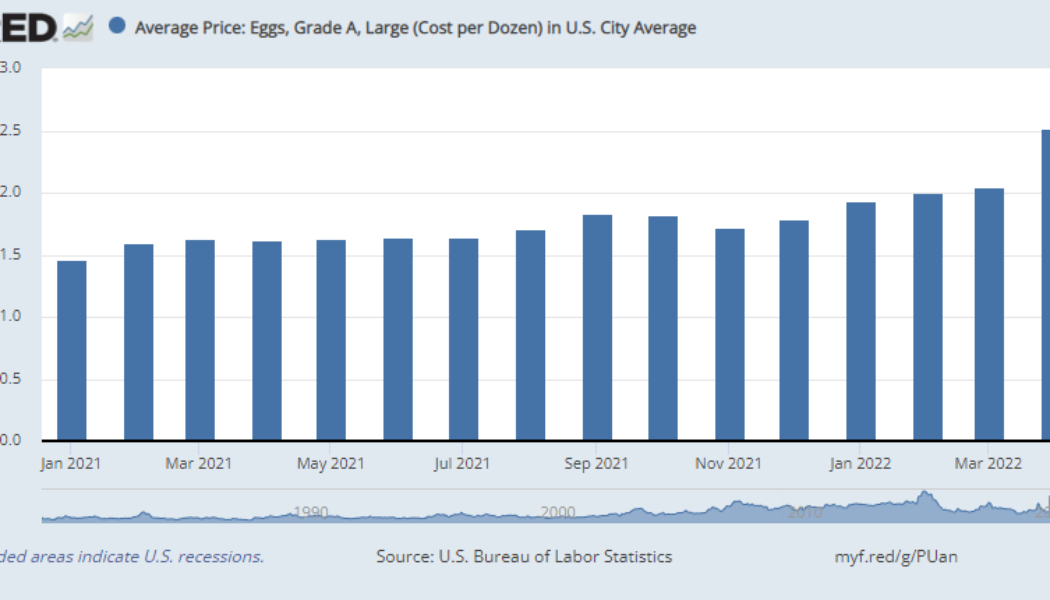

Fed forgets long-term dollar devaluation when pricing eggs in BTC

The St. Louis Federal Reserve stirred up a mix of amusement and curiosity from the crypto community on Tuesday, May 7, after publishing a post showing how the cost of eggs in Bitcoin (BTC) has fluctuated over the last 14-months compared to the U.S. dollar. On June 6, the Fed research arm posted a blog post titled “Buying eggs with bitcoins – a look at currency-related price volatility.” The FRED Blog compares egg prices in U.S. dollars vs. bitcoins. Check out the post to see which prices are more stable https://t.co/Qfy9w8zgBk pic.twitter.com/qpFH4ny33S — St. Louis Fed (@stlouisfed) June 6, 2022 The post initially features a graph showing the historical price of eggs in U.S. dollars for every month since January 2021, noting that the prices fluctuated between $1.47 and $2.52 ov...

- 1

- 2