Venture Capital

Huobi Global launches $1B investment arm focused on DeFi and Web3

Digital asset exchange Huobi Global has spun out a new investment arm focused on decentralized finance (DeFi) and Web3 projects, further highlighting venture capital interest in the blockchain economy. Dubbed Ivy Blocks, the new investment arm has over $1 billion in crypto assets under management to deploy, a spokesperson for Huobi confirmed. These funds have been earmarked for “identifying and investing in promising blockchain projects,” the company said. In addition to financing, Ivy Blocks will offer various services to selected projects, including an asset management platform, a new blockchain incubator and a dedicated research arm. The firm’s asset management department will provide “liquidity investments” to help DeFi and Web3 projects get up and running, according to Lily Zhan...

Crypto Biz: Smart Money is betting big on Web3, layer 2, May 19-25

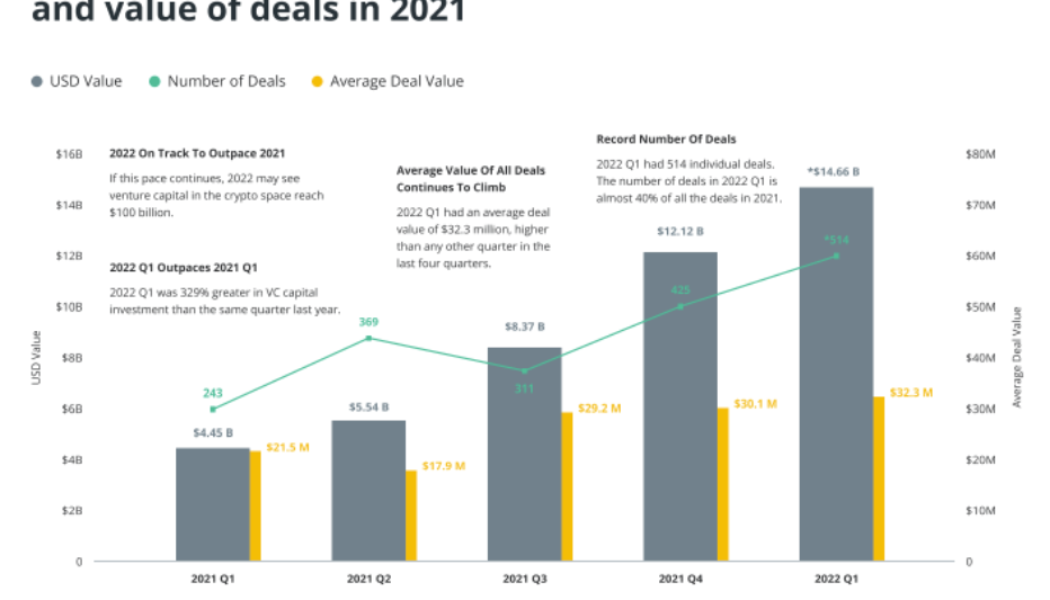

Billions and billions. That’s what venture capitalists are spending to get ahead of the curve in crypto. Their latest fixation is Ethereum layer-2 scaling solutions and Web3, an umbrella term that describes the next stage of the internet’s evolution. So, while the cryptocurrency market is in a state of extreme fear, smart money investors — TradFi folks who invest with expert knowledge — continue to pour countless sums into the space. This week’s Crypto Biz newsletter gives you the latest funding stories from the world of blockchain and explores interesting developments surrounding Google and Sam Bankman-Fried. Andreessen Horowitz closes $4.5 billion crypto fund amid market turmoil The crypto market selloff of 2022 hasn’t deterred Andreessen Horowitz from pledging additional billions ...

Singapore venture firm launches $100M Web3 and metaverse fund

Crypto-focused venture firm NGC Ventures has launched a new ecosystem fund dedicated to Web3 projects, underscoring heightened investor demand for startups that are contributing to the development of a decentralized internet. NGC Metaverse Ventures, the company’s third blockchain fund, raised $100 million from investors that included Babel Finance, Huobi Ventures, Nexo Ventures, Altonomy and GBIC. The fund will allocate capital towards “high-potential projects” in the Web3 economy, according to Roger Lim, NGC Ventures’ general partner. The Web3 fund has already invested in three startups, NGC disclosed on Wednesday. Based in Singapore, NGC Ventures was founded in 2017 as a blockchain and fintech-focused venture firm. It was an early investor in Solana (SOL), Algorand (ALGO) and Oasis...

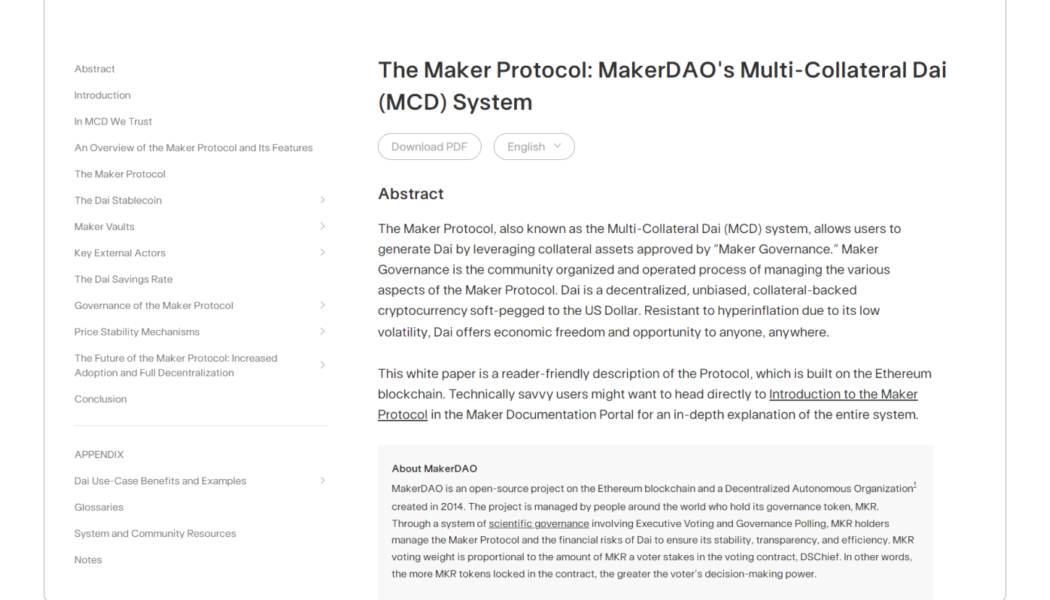

How to incorporate a DAO and issue tokens to be ready to raise money from VCs

What is a DAO? A DAO, or decentralized autonomous organization, is an online-based organization that exists and operates with no single leader or governing body. DAOs are run by code written on a blockchain like Ethereum (ETH) and are owned and operated by the people who use them. There are many different types of DAOs, but they all have one thing in common: they are decentralized, meaning that decisions about the organization’s future are decided by the collective group and not a single individual. This decentralization is what makes DAOs promising, as it theoretically removes the possibility of corruption or manipulation by a single entity. Smart contracts (and not people) execute the terms and conditions of the organization, making them incredibly efficient and resilient to change...

VC Roundup: Gaming, crypto fintech and blockchain infrastructure dominate venture capital rounds

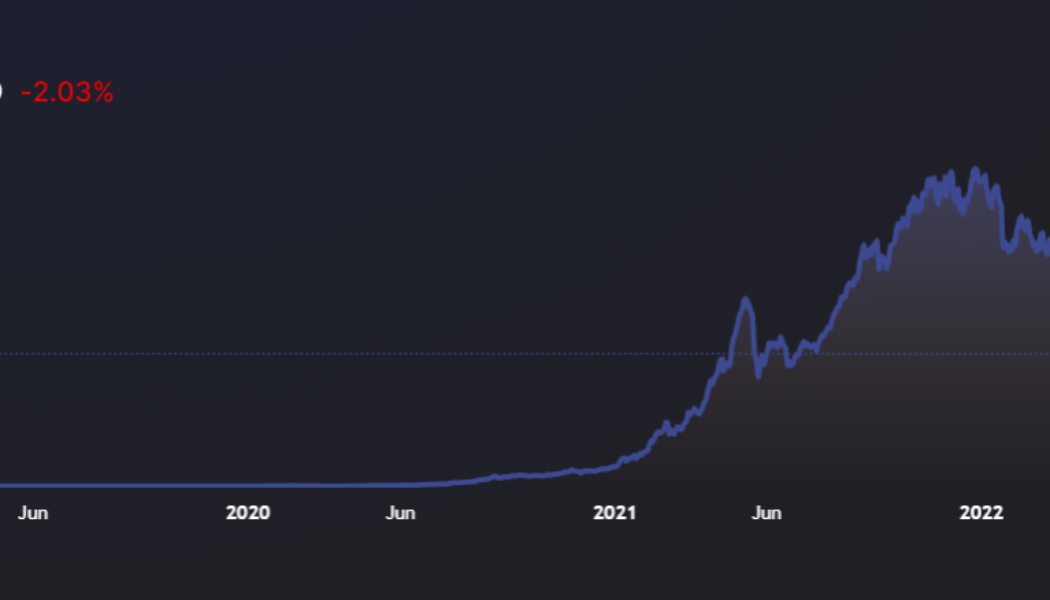

Cryptocurrency markets remain caught in a macro-based downtrend, with Bitcoin (BTC) and Ether (ETH) showing further signs of weakness at the end of April. But, venture capital activity in the crypto and blockchain sectors is the strongest it has ever been, offering further evidence that major investors are looking beyond immediate price action and ignoring divisive bull/bear narratives. The latest edition of VC Roundup highlights the growing excitement surrounding Web3 gaming, decentralized finance (DeFi) and blockchain infrastructure. The first quarter of 2022 was brutal for crypto prices, but venture capital activity was the strongest ever. bloXroute secures $70M from major investors Blockchain distribution network provider bloXroute has raised $70 million in funding to continue de...

Takeaways and reviews, what went down during Miami Tech Week

Miami Tech Week took place last week in the South Florida city as part of April’s Tech Month programming, which also included NFT Miami and the Bitcoin 2022 conference earlier in the month. Tech Week kicked off with the eMerge Americas conference and the myriad of panel discussions scheduled throughout the city that followed. Cointelegraph gathered some key insights from thought leaders who participated, and the two main themes are Miami as a hot spot for crypto folks, and crypto as a disruptor of the investment landscape. eMerge Americas is a venture-backed organization with a mission to position Miami as the tech hub of North and South America. Its signature event since 2014 has been the annual tech conference, which features a startup pitch competition. After a two-year hiatu...

Crypto Biz: The Web3 arms race is upon us, April 14–20, 2022

“Web3” used to be an empty industry buzzword that described the next iteration of the internet. In 2022, Web3 is still an annoying buzzword, but at least the blockchain community is trying to assign it real-world utility. This week’s Crypto Biz newsletter features several major funding rounds dedicated to building the Web3 economy. After reading through the stories, you can decide whether we’re actually getting closer to defining Web3. Oh, and remember all the buzz surrounding Special Purpose Acquisition Companies, or SPACs? A crypto-focused SPAC just closed an initial public offering on the Nasdaq, raising $115 million in the process. Framework Ventures allocates half of $400M fund to Web3 gaming Remember DeFi Summer 2020? Well, venture capitalists are gearing up for Web3 Summer 202...

deadmau5’s 720Mau5 Venture Fund Joins $10.4 Million Raise to Support Future of LimeWire

The music industry and major cryptocurrency institutions are getting behind LimeWire‘s quest to forge a new path. LimeWire, the company synonymous with online piracy, closed up shop a dozen years ago, but under new management, the brand has returned to embark on a new initiative that may just right the wrongs of its past. Limewire’s new mission statement is to “bring digital collectibles to everyone, no matter the budget or the tech-savviness,” the company writes. The advent of Web3 and NFT technology has given LimeWire a new lease on life and—this time around—a means to get artists their fair share of the metaphorical pie. A new funding round led by Arrington Capital, Kraken Ventures, and GSR Ventures has provided the LimeWire team with over $10 million to ex...

Framework Ventures allocates half of $400M fund to Web3 gaming

Crypto-focused venture firm Framework Ventures has raised $400 million in new funding to invest in early-stage companies across the Web3, blockchain gaming and decentralized finance (DeFi) industries. The completed raise will go towards “FVIII,” an oversubscribed fund worth $400 million, the company announced Tuesday. Approximately $200 million of that total will be allocated to the emerging blockchain gaming industry. The venture firm, which had early exposure to DeFi, now has over $1.4 billion in assets under management. Framework Ventures was an early investor in projects such as Chainlink, Aave and The Graph. Like DeFi in 2020, gaming and Web3 have been identified as the next major growth plays for the blockchain industry. Axie Infinity — a popular play-to-earn game constructed a...

KuCoin-backed companies launch $100M Web3 developer fund

Crypto exchange KuCoin’s venture capital arm and nonfungible token (NFT) marketplace have launched a $100 million “Creators Fund” to help bootstrap early-stage NFT projects at the intersection of art, sports and GameFi. KuCoin Ventures and the Windvane NFT marketplace have created the fund to help artists and creators showcase their work and scale their business to wider audiences, the companies announced Tuesday. The fund’s mandate is to support promising NFT projects that are contributing to the development of Web3, which refers to the next iteration of the internet powered by blockchain technology. Windvane is a new NFT marketplace from KuCoin that aims to tap into the crypto exchange’s large user base. At the time of writing, KuCoin was the fifth largest crypto exchange by volume, acco...

Crypto Biz: An eye-opening chat with Mr. Wonderful, April 7–13, 2022

The past seven days have reminded me of how lucky I am to have forged a career in the Bitcoin (BTC) and cryptocurrency industry. Cointelegraph sent a contingency of reporters to the Bitcoin conference in Miami, where we got to chop it up with billionaires, business leaders and hedge fund managers. I had the privilege of sitting down with Canadian businessman and Shark Tank star Kevin O’Leary, who actually revealed most of his crypto portfolio. I also got to interview Bloomberg’s senior commodity strategist Mike McGlone, who shed light on crypto market volatility, as well as Mark Yusko of Morgan Creek Capital. Yusko and I laughed at traditional 60/40 portfolio strategies, and I got to ask him a curious question: Who in their right mind is buying bonds today? This week’s Crypto Biz giv...