Venture Capital

Bnk To The Future eyes acquisition of crypto lender SALT

Crypto lending platform SALT has received a buyout offer from a prominent online investment platform — a move the company said could potentially enhance its product offerings and advance its mission of making digital assets more accessible to mainstream audiences. Bnk To The Future, or BF, has submitted a letter of intent to acquire SALT for an undisclosed amount, the companies disclosed Friday. The acquisition is contingent on both parties signing definitive agreements and requires regulatory approval. Robert Odell, SALT’s chief product officer, described the potential acquisition as being a unity of first-movers in the cryptocurrency market: “This potential union will combine SALT, the world’s first crypto lending platform, with BF, the world’s first Bitcoin and crypto securi...

Alameda Research and FTX merge VC operations: Report

Sam Bankman-Fried’s cryptocurrency exchange FTX’s investment arm has reportedly absorbed the venture capital operations of Alameda Research in response to the ongoing crypto bear market. According to a Thursday Bloomberg report, Alameda’s Caroline Ellison said in an interview that the merger had happened prior to former co-CEO Sam Trabucco announcing his resignation on Wednesday, leaving Ellison as the firm’s sole CEO. The investment arm of the crypto exchange, FTX Ventures launched in January — when the absorption of Alameda reportedly began — with $2 billion in assets under management. BREAKING: Sam Bankman-Fried’s FTX and Alameda merged their VC operations as the billionaire copes with a prolonged crypto winter https://t.co/5bXiTHphzs pic.twitter.com/EYUSa2bItG — Bloomberg Crypto ...

Polygon founder Sandeep Nailwal raises $50M for Web3 fund

Cryptocurrency entrepreneur and Polygon founder Sandeep Nailwal has raised $50 million for a new startup fund dedicated to Web3 companies, underscoring venture capital’s growing interest in the blockchain-powered internet. Nailwal’s venture firm, Symbolic Capital, is backed by cryptocurrency protocols, exchanges, crypto-focused auditing firms and other venture capital investors, the company disclosed Thursday. Symbolic’s fund has already invested in three blockchain-focused gaming startups: BlinkMoon, Planet Mojo and Community Gaming. The initial funding received by these startups was not disclosed. In perhaps a new take on venture funding, Nailwal said his company is focused on supporting project founders from emerging markets. “Starting Polygon in India, we struggled to get connect...

Crypto Biz: Crypto VC is back with a vengeance

You’ve no doubt heard the expression, follow the money. Well, if you do that in the venture capital world, you’ll be led directly to crypto, blockchain and digital assets. After a modest summertime lull in venture financing, this week saw the announcement of two massive raises worth a combined $500 million. That’s $500 million VCs are allocating to crypto-focused startups at the intersection of Web3, blockchain infrastructure and decentralized communities. If you think funding deals have stopped amid the bear market, think again. I mentioned “summertime lull” at the outset, but that doesn’t mean funding has stopped. There are so many deals, in fact, that I’ve had to start a separate series called VC Roundup just to keep track. Data from Cointelegraph Research also shows that Q2 fundi...

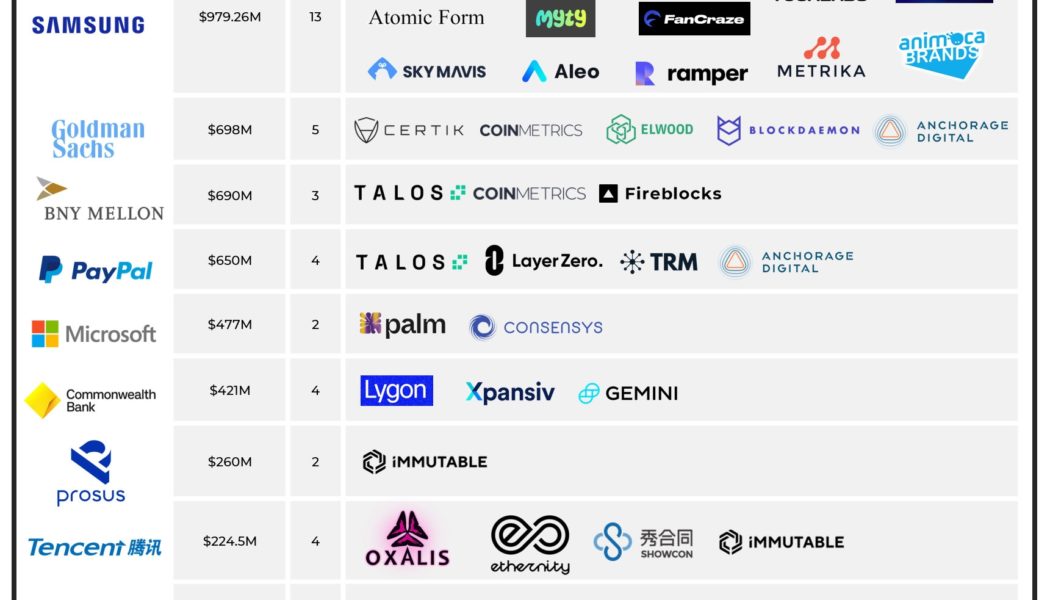

Google invested a whopping $1.5B into blockchain companies since September

Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows. In an updated blog published by Blockdata on Aug. 17, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period. The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage, and venture capital company Digital Currency Group. This is in stark contrast to last year, where Google diversified its much smaller $60...

Crypto Biz: A Futurist take on crypto

You might not know it, but Canada is quietly becoming a major player in the blockchain and crypto scene: Ethereum has strong Canadian roots, Toronto-based 3iQ launched North America’s first physically-settled Bitcoin (BTC) exchange-traded fund (ETF) and the percentage of active crypto holders in the country has increased steadily over the past two years. Against this backdrop, I had the pleasure of attending this year’s Blockchain Futurist Conference in Toronto, where I got to moderate two panels on rebuilding the financial system through Web3 and onboarding the next wave of crypto users. The event served as another reminder that the industry’s brightest minds are still building amazing products despite current market conditions. Not to sound overly cliche, but it’s hard to be b...

Wealth managers and VCs are helping drive institutional crypto adoption — Wave Financial execs

Two executives at Wave Financial, an asset management firm providing bespoke strategies to high-net-worth individuals and entities, have reported seeing increased institutional demand for crypto products amid the bear market. Speaking to Cointelegraph at the Blockchain Futurist Conference in Toronto on Wednesday, Wave Financial’s head of business development Mike Jones said institutional investment in crypto could be driven by the high end of wealth management firms including Morgan Stanley, Merrill Lynch and Goldman Sachs looking for ways to allow their clients to get exposure to the space. Jones cited the example of BlackRock partnering with Coinbase on Aug. 4, a move that will give users of the asset manager’s institutional investment management platform Aladdin access to crypto trading...

VC Roundup: Lightning Network payment rail, DeFi trading platform and blockchain security firm raise millions

Even with the onset of crypto winter, 2022 has been a watershed year for venture capital funding. Crypto and blockchain companies collectively raised $30.3 billion in venture capital in the first half of 2022, exceeding all of last year’s totals. While the number of deals has declined in recent months, startups at the intersection of blockchain payments, decentralized finance (DeFi) and cybersecurity are still attracting sizable interest from the VC community. The latest edition of VC Roundup highlights some of the most intriguing funding deals of the past month. Related: The risks and benefits of VCs for crypto communities ZEBEDEE closes $35M Series B ZEBEDEE, a Bitcoin (BTC)-powered payment processor for the gaming industry, has raised $35 million from several investors i...

Building the blockchain industry despite market drops and regulation threats

“The cryptocurrency market is the only truly free market that exists in the financial universe,” said Dan Tapiero, CEO of 10T Holdings, during a recent video discussion with Cointelegraph Research. A major concern of venture capital (VC) and investment firms as of late has been centered around regulation from different countries around the globe. While the theme of the discussion was on regulation, the conversation also touched upon how these different members of the crypto space see the future of the industry. Investors undaunted by regulation Each of the panel members brought their own perspective: Dan Tapiero’s 10T Holdings is a mid-stage private equity investment firm and has decades of experience. Smiyet Belrhiti is the managing partner for Keychain Ventures, which provides inst...

Crypto Biz: The 3AC saga takes another bizarre twist

About eight months ago, I vouched pretty strongly for Su Zhu to be included in the prestigious Cointelegraph Top 100. My reasoning was pretty straightforward: Zhu was not only an influential figure on social media, but he ran arguably the most revered hedge fund in crypto — Three Arrows Capital, also known as 3AC. Then, the bear market of 2022 exposed 3AC as a house of cards run by founders who believed their own hype — and made reckless business decisions along the way. With the 3AC saga still unfolding, we received privileged information this week about the company’s remaining assets. The revelations aren’t good if you’re a 3AC creditor looking to be made whole again. Source claims 3AC’s Deribit exposure is worth much less than reported An anonymous source close to the 3AC debacle ...