Venture Capital

Former FTX US president raises $5M for new crypto software firm

Brett Harrison departed FTX US roughly two months before FTX Group filed for bankruptcy, citing “cracks” in his relationship with SBF. News Own this piece of history Collect this article as an NFT The former head of FTX US is launching a new cryptocurrency software company and has raised $5 million from several investors, according to Bloomberg. Brett Harrison, who served as president of FTX US between May 2021 and September 2022, has received backing from Coinbase Ventures and Circle Ventures to launch a new software startup. SALT Fund, Motivate VC, P2P Validator, Third Kind Venture Capital, Shari Glazer of Kalos Labs and Anthony Scaramucci also participated in the seed round. His new startup, dubbed Architect, will develop trading software for large institutions looking...

Crypto Biz: SBF’s newest Excel spreadsheet reveals all

Large enterprise businesses spend tons of money keeping track of their financial dealings — think accountants, financial analysts, consultants and enterprise-grade accounting software. Sam Bankman-Fried, meanwhile, used Microsoft Excel. On Jan. 17, in another sloppy Excel spreadsheet, SBF revealed that FTX US was solvent. The Excel file purportedly showed customer balances, bank deposits and assets held in cold storage. “S&C forgot to include bank balances” of roughly $428 million, SBF said, referring to FTX’s former legal counsel Sullivan & Cromwell. “Once you add those back in, you get in the neighborhood of my prior balance sheet” of around $350 million, he said. This week’s Crypto Biz explores the “Herculean investigative effort” to identify billions in liquid FTX assets....

FTX VCs liable to ‘serious questions’ around due diligence — CFTC Commissioner

Amid ongoing investigations around the defunct crypto exchange FTX, the Commodity Futures Trading Commission (CFTC) questions the due diligence conducted by institutional investors and their accountability regarding the loss of users’ funds. CFTC Commissioner Christy Goldsmith Romero stated that VCs that had to write down their investments in millions of dollars to nearly zero raises “serious questions” about the due diligence conducted over the last year, speaking to Bloomberg. CFTC Commissioner Christy Goldsmith Romero questioning the VCs that once backed FTX. Source: Bloomberg She raised concerns about FTX CEO John Ray’s revelations in court about not having any records and controls over the exchange’s financials. I’m glad Mr. Ray is finally paying lip service to turning the excha...

Deal Box launches $125M blockchain and Web 3 venture fund

According to a press release published on Jan. 18, U.S.-based capital markets advisory and token offering platform Deal Box has launched a new $125 million venture capital arm dedicated to blockchain and Web 3.0 startups. The fund, dubbed Deal Box Ventures, will invest in companies categorized in the emerging growth, real estate, fintech, funtech, and social impact fields. Commenting on today’s development, Thomas Carter, founder and chairman of Deal Box, said: “Deal Box Ventures is an important milestone in our journey to invest in the most promising and disruptive blockchain startups, providing them with the tools and funding ecosystem they need to be successful by simplifying and reimagining traditional financing models.” As part of initial Web 3.0 investments, D...

FTX collapse may boost ‘further trust’ in crypto ecosystem — Nomura exec

The winds of crypto winter may be still blowing, but it doesn’t seem to be stopping venture capital firms from piling into cryptocurrencies. In fact, recent events influenced by the bear market, such as the collapse of FTX, could bring “further trust into the ecosystem,” according to Jez Mohideen, co-founder and CEO at Laser Digital, the recently launched digital assets arm of the Asian giant Nomura Holdings. “More traditional players are entering the space who can help to regulate the sector. This means players who understand regulation as well as the importance of clients’ aggregation, stability, and execution,” explained Mohideen, a long-time participant in the venture sector and former director at Barclays and partner at the hedge fund Brevan H...

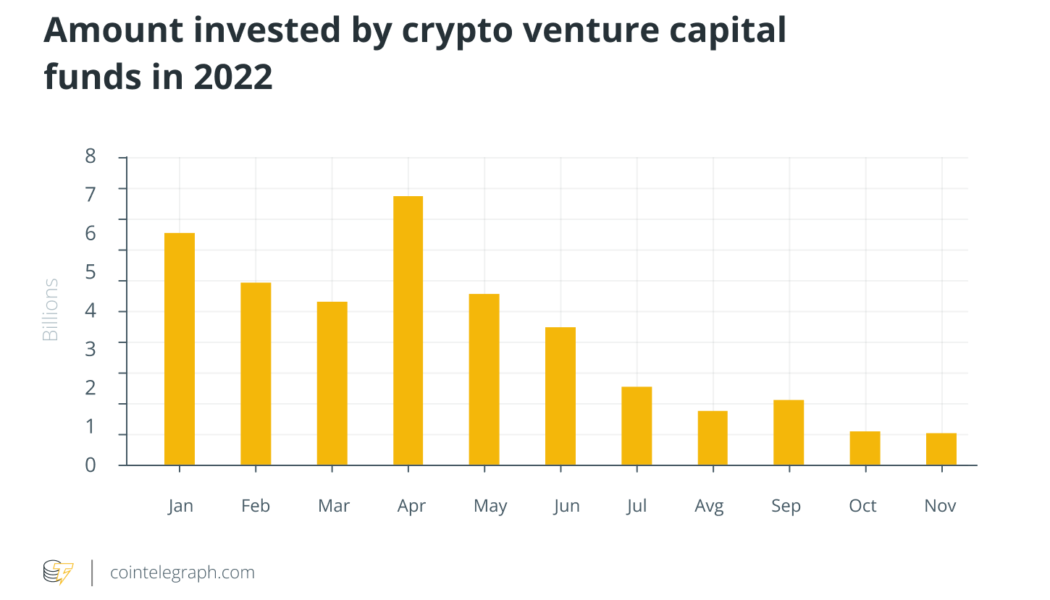

2023 could be a rocky year for crypto venture investments: Galaxy Research

Last year was a big one for crypto venture capital despite multiple high-profile meltdowns and the FUD (fear, uncertainty, and doubt) tsunami that followed. However, the funds may not flow as easily this year, a crypto researcher warns. The number of deals and amount invested by venture firms into Web3 and crypto startups was a little over $30 billion in 2022, according to Galaxy Research Galaxy’s head of firmwide research, Alex Thorn, described it as a “monster year” that was only just eclipsed by the $31 billion in VC investments in 2021. However, in a Jan. 5 report, Thorn stated that macroeconomic and crypto market conditions led to significant investment drawdowns in Q3 and Q4. This will likely continue into 2023, until macro and crypto market conditions improve. Thorn noted that there...

Top crypto funding stories of 2022

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

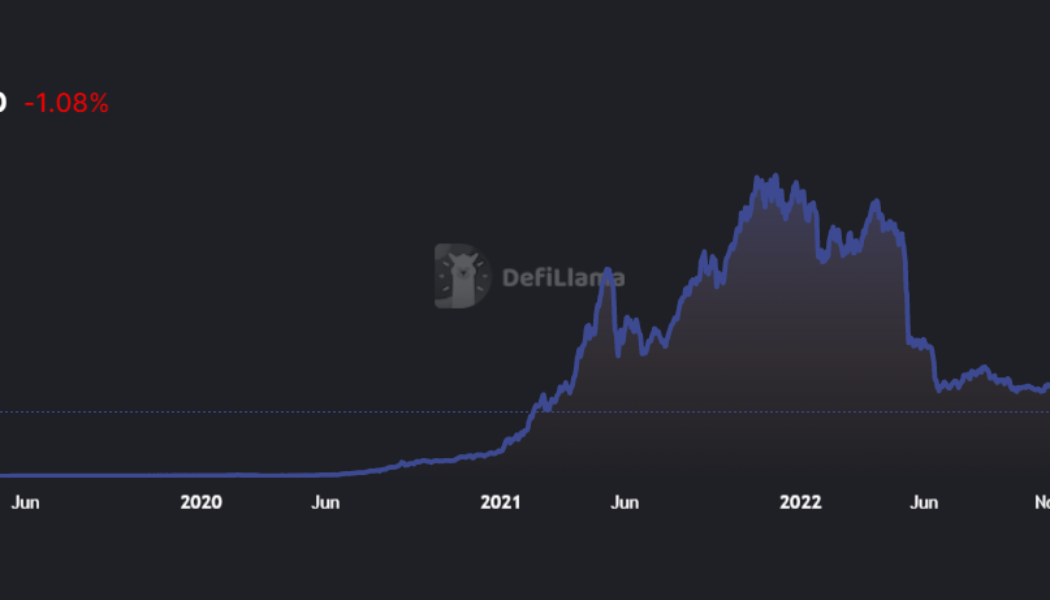

Blockchain VC funding surpasses 2021 total despite declining since May

It’s been a tough year for crypto, and venture capital activity confirms it. The collapse of FTX in November was the latest and most shocking in a series of closures of key market players this year — including Celsius, Voyager and BlockFi — that have shaken investor sentiment and wiped out $1.5 trillion in market capitalization from cryptocurrency space. Blockchain venture capital funding has been on a downward slope since May 2022, and November was no different, with inflows declining even further. However, the total capital inflows for 2022 have surpassed 2021 by almost $6 billion. According to Cointelegraph Research, VC funding declined 4.8% in November, totaling $840.4 million — down from $843 million in October. The Cointelegraph Research Terminal’s Venture Capital Database — which co...

The VC-dominated crypto funding model needs a reboot

Does the crypto industry’s funding space need an overhaul? This is one of many questions swirling in the wake of FTX’s downfall: When the prominent exchange collapsed, it left behind a long line of helpless creditors and lenders — including many promising projects dependent on funds promised by Sam Bankman-Fried and company. But there is a bigger problem at the heart of the current funding picture, wherein deep-pocketed venture capital firms throw their weight around in the low-liquidity Web3 market, heavily backing early-stage projects before cashing out at a profit once retail has FOMO’d into the market. For all the talk of how blockchain and cryptocurrencies represent a critical fiat off-ramp and a wholesome pathway towards greater decentralization, transparency, fairness and incl...

Investors chase Web3 as blockchain industry builds despite bear market

The third quarter of 2022 saw a reduction in venture capital activity across the entire blockchain industry. Investors appear to be moving away from decentralized finance (DeFi) and into Web3. The crypto industry tends to have a problem with overusing buzzwords, like the way “DeFi” was everywhere just a couple of years ago. In 2022, it seems like every new startup and established blockchain company alike is taking up the “Web3” mantle. But what exactly is Web3? Cointelegraph Research delved into the matter in its recently released Q3 2022 Venture Capital Report. To further understand the subject, it held a panel discussion with venture capitalist investors to find out how they see Web3. [embedded content] Web3: The newest buzzword The panel was asked whether the term Web3 is ov...

Alameda Research invested $1.15B in crypto miner Genesis Digital: Report

Crypto mining company Genesis Digital Assets was the biggest venture investment made by Alameda Research, FTX’s sister company and in the center of the exchange’s bankruptcy. Documents disclosed by Bloomberg on Dec. 3 show that Genesis Digital raised $1.15 billion from Alameda in less than nine months. The capital infusion was made before the crypto prices downturn, between August 2021 and April of this year. Genesis Digital is the major United States-based Bitcoin mining company, and it’s not related to Genesis Capital, the trading company with $175 million worth of funds locked away in an FTX trading account. Former FTX CEO Sam Bankman-Fried recently recognized participating in Alameda’s venture decisions, including the investment in Genesis Digital, despite...

Thai VC fund acquires troubled exchange Zipmex for $100M: Report

After weeks of negotiations on a potential buyout of Zipmex, venture capital fund V Ventures has reportedly reached a deal to acquire the embattled cryptocurrency exchange. V Ventures, a subsidiary of Thoresen Thai Agencies (TTA) public company, is looking to purchase a 90% stake in Zipmex crypto exchange, Bloomberg reported on Dec. 2. The VC fund is about to acquire Zipmex for about $100 million in digital assets and cash, anonymous sources familiar with the matter claimed. Citing a court hearing on Friday in Singapore, the report says that Zipmex was offered $30 million in cash and the rest in crypto. According to the court hearing, Zipmex is planning to use cryptocurrency assets received from the transaction to unlock frozen customer accounts on the exchange by April 2023. The acquisiti...