vechain

2 metrics signal the $1.1T crypto market cap resistance will hold

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally. Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading. Total crypto market cap, USD billions. Source: TradingView While the two leading cryptoassets were unable to print weekly gains, traders’ appetite...

Supply chain thwacking: VeChain’s $100M sponsorship deal with UFC

Blockchain logistics firm the VeChain Foundation has signed a multi-year marketing partnership with the Ultimate Fighting Championship (UFC) worth nearly $100 million, becoming the UFC’s first-ever Layer 1 blockchain partner. The UFC is the largest promoter and event organizer for Mixed Martial Arts (MMA) and VeChain’s marketing assets and brand will be integrated across the UFC in live events, in-arena promotion, social media and other areas. The deal is reportedly worth almost $100 million over a minimum five-year partnership according to an anonymous source quoted by Sports Business Journal. The UFC’s Senior Vice President of Global Partnerships Paul Asencio said the UFC’s sponsorship revenues are up 30% from an already record-breaking 2021 as a result of the deal. The partnership kicks...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

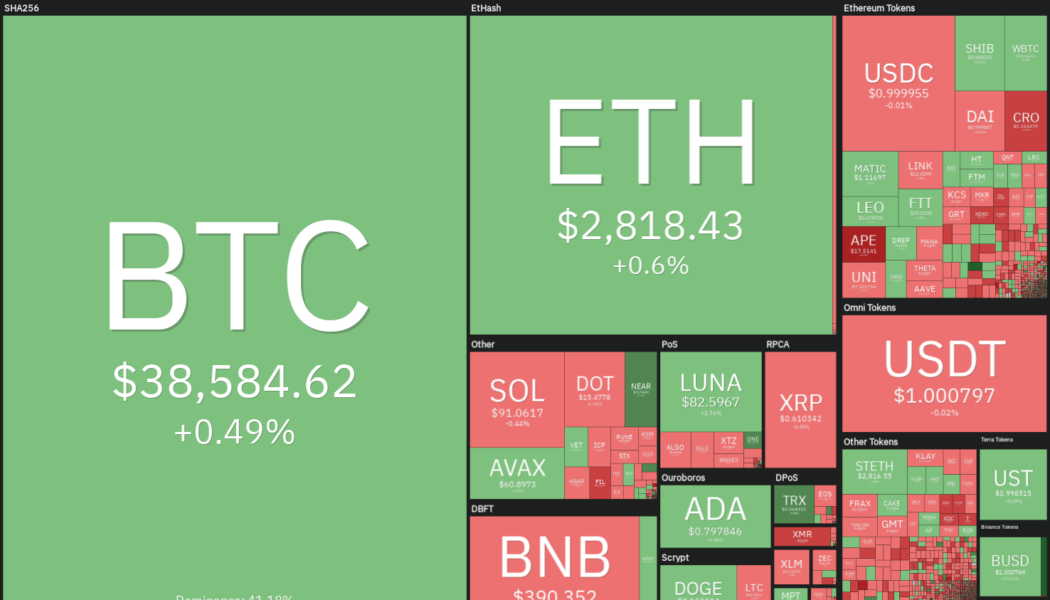

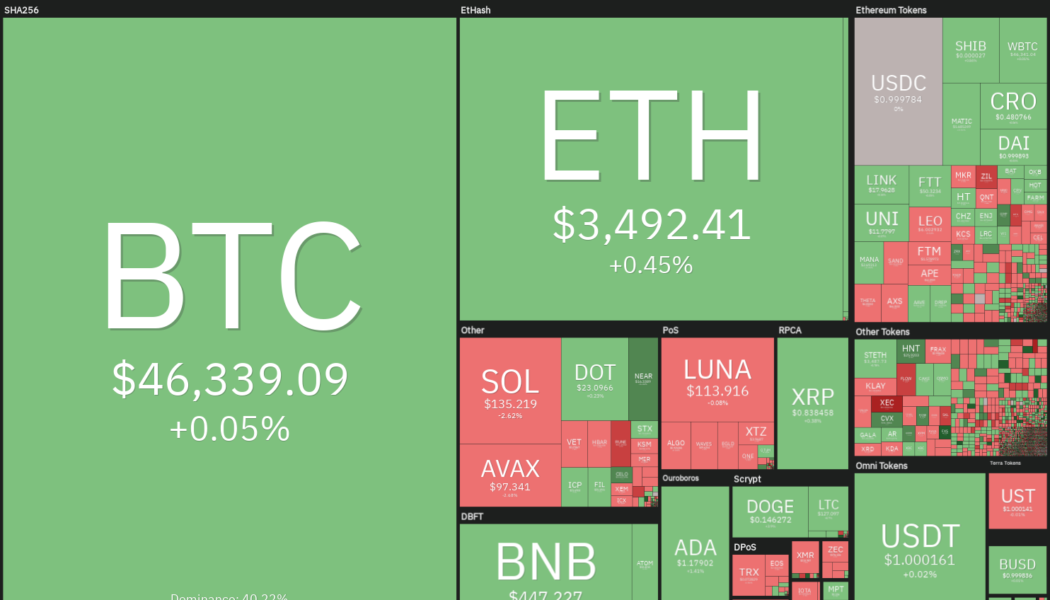

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

VeChain can be used as payment in 2M stores — and VET bridged to BNB chain

Supply chain blockchain project VeChain has announced a new partnership with crypto payment services, Alchemy Pay that will allow people to use its VET token as payment in over 2 million stores throughout 70 different countries. The news came alongside its inclusion as a supported token on the recently launched Binance Bridge 2.0. Thanks to partner @AlchemyPay, $VET can now be used to buy goods at 2 million+ stores globally! Using our advanced low-#carbon #blockchain, transactions cost fractions of a cent & are processed in seconds from any #VeChain wallet!$ACH #DeFi $VTHO #Web3https://t.co/ceeHRpcbKT — VeChain Foundation (@vechainofficial) April 27, 2022 VeChain was included in the first group of tokens to be supported on the new Binance Bridge 2.0. The Binance Bridge 2.0 provides a n...

Top 5 cryptocurrencies to watch this week: BTC, VET, THETA, RUNE, AAVE

Bitcoin (BTC) is attempting to hold above its closest support level, and traders are watching to see if the price can remain strong and close above the 2022 yearly open price at $46,200 for the second week in a row. April has historically been the best performing month of the year for the S&P 500, according to Sam Stovall, chief investment strategist at CFRA. If history repeats itself and the close correlation between the United States equity markets and Bitcoin continues, it could bode well for the crypto markets in the near term. Crypto market data daily view. Source: Coin360 Another sentiment booster could be that the 19th million Bitcoin entered circulation on April 1. For the remaining 2 million BTC, the crypto markets will have to wait for a long time because the last Bitcoin is ...

5 times quickfire crypto traders bought the news for double (or triple) digit profits

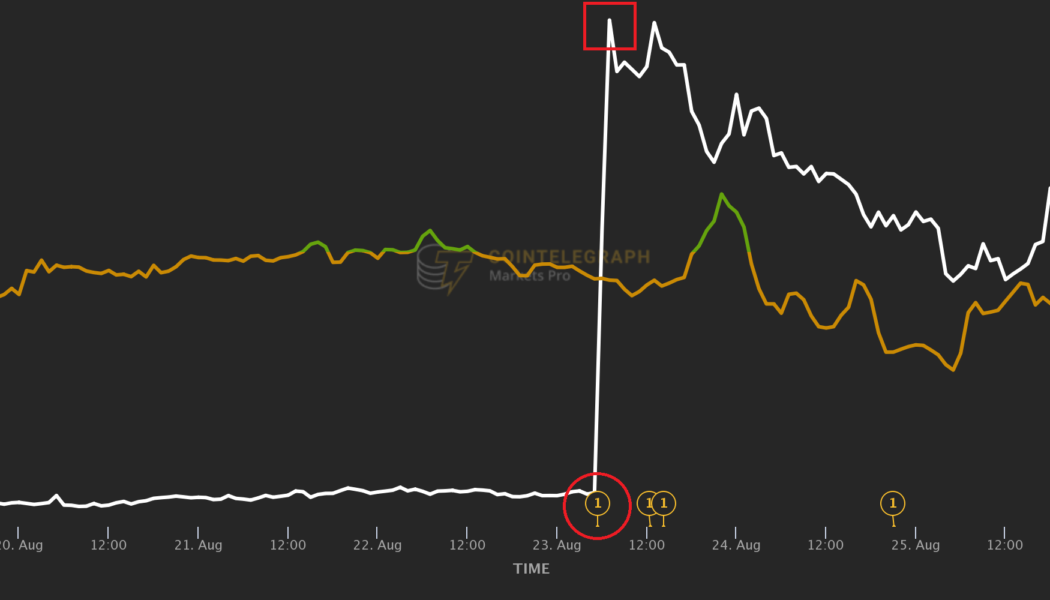

Why do crypto traders “buy the rumor, sell the news”? Simple. Because whispers of exchange listings or big-name partnerships reach very few people… while an article in Cointelegraph can reach hundreds of thousands of crypto enthusiasts in seconds. While insiders are quietly amassing tokens on rumors, the rest of us are completely ignorant of what may be coming. But with rumors, there are no guarantees. Which can lead to disappointment and serious loss of investment for those traders who gamble that they’re true… and end up wrong. So how can you possibly compete with thousands of other market participants when important news actually breaks? You’d have to be one of the very first to know in order to catch the price before it spikes. Look at the examples below — the time between a closely-gu...