ust

Terra peg mechanism in doubt as UST crashes to 67 cents

The third-largest stablecoin by market cap Terra USD (UST) appears to be in a catastrophic tailspin which has seen it de-peg from the dollar and drop to as low as $0.67 on May 10. As its price has fallen, so has its market capitalization along with that of Terra (LUNA) which backs the majority of the value of UST. Adding further insult to injury, the market cap of UST has vastly surpassed that of LUNA, drawing extreme scrutiny from the crypto community. UST price chart from CoinGecko As of the time of writing, UST price is $0.78 with a market cap of $14.1 billion while LUNA has been in a freefall, collapsing to $35.07. This has caused massive liquidations on leveraged positions, dropping its market cap to $12.3 billion according to CoinGecko data. If the market cap of LUNA is lower than US...

Bitcoin price target now $29K, trader warns after Terra weathers $285M ‘FUD’ attack

Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC circles $34,400 lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing. The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility. Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets. Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at aroun...

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

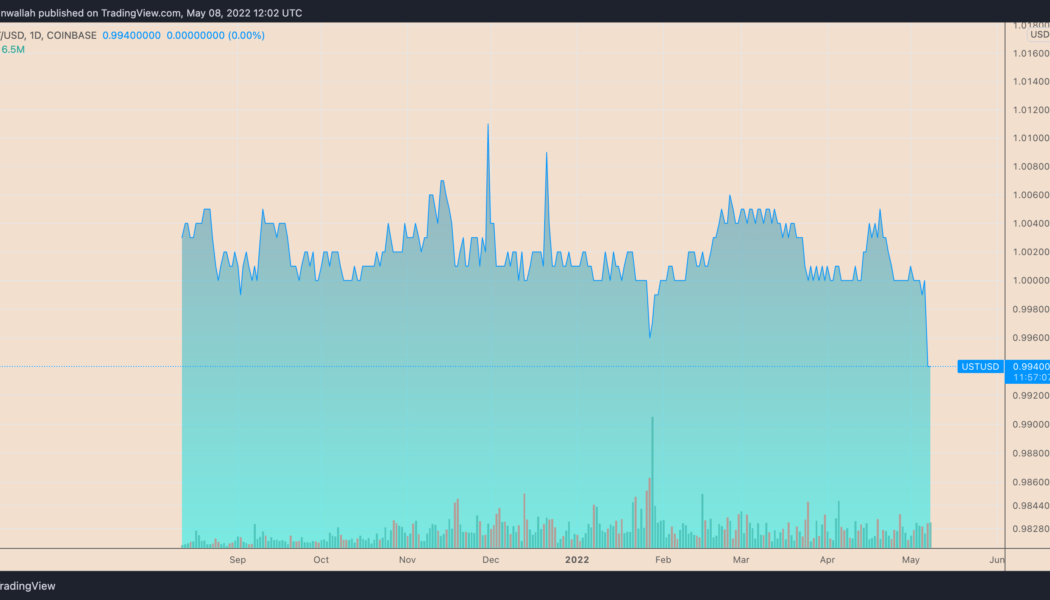

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

Terra’s UST flips BUSD to become third-largest stablecoin

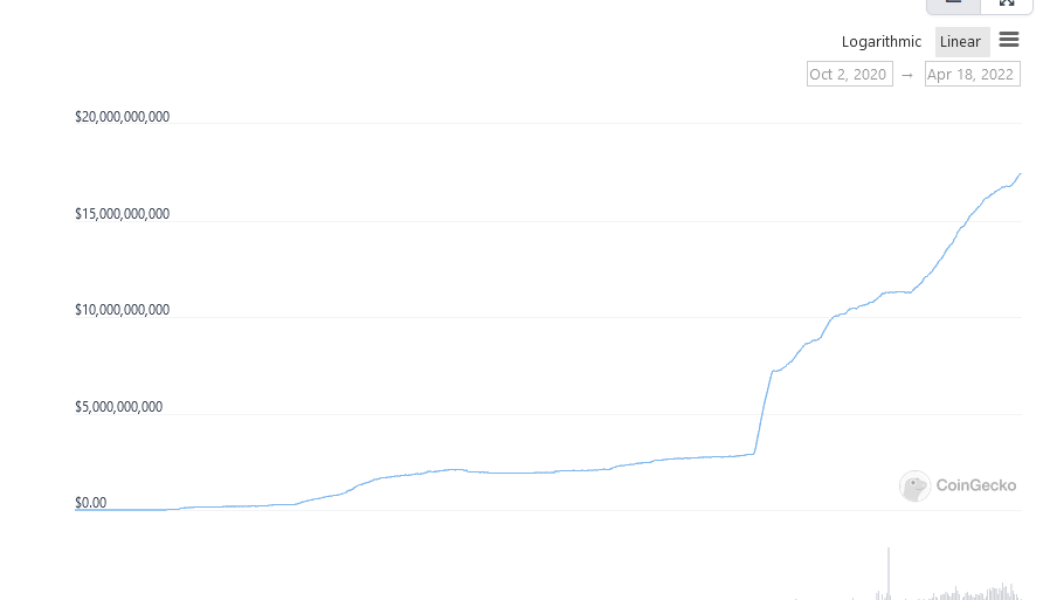

The Terra (LUNA) blockchain’s algorithmic stablecoin Terra USD (UST) has flipped Binance USD (BUSD) to become the third-largest stablecoin on the market. UST is a USD-pegged stablecoin that was launched in September 2020. Its minting mechanism requires a user to burn a reserve asset such as LUNA to mint an equivalent amount of UST. According to Coingecko, UST’s total market capitalization has surged 15% over the past 30 days to sit at roughly $17.5 billion at the time of writing. The figure currently places UST as the third-largest stablecoin after it flipped BUSD with a slightly lower market cap of $17.46 billion. The asset now trailing only behind industry giants Tether (USDT) at $82.8 billion, and USD Coin (USDC) at $50 billion, however, the gap is quite substantial at this stage. The d...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

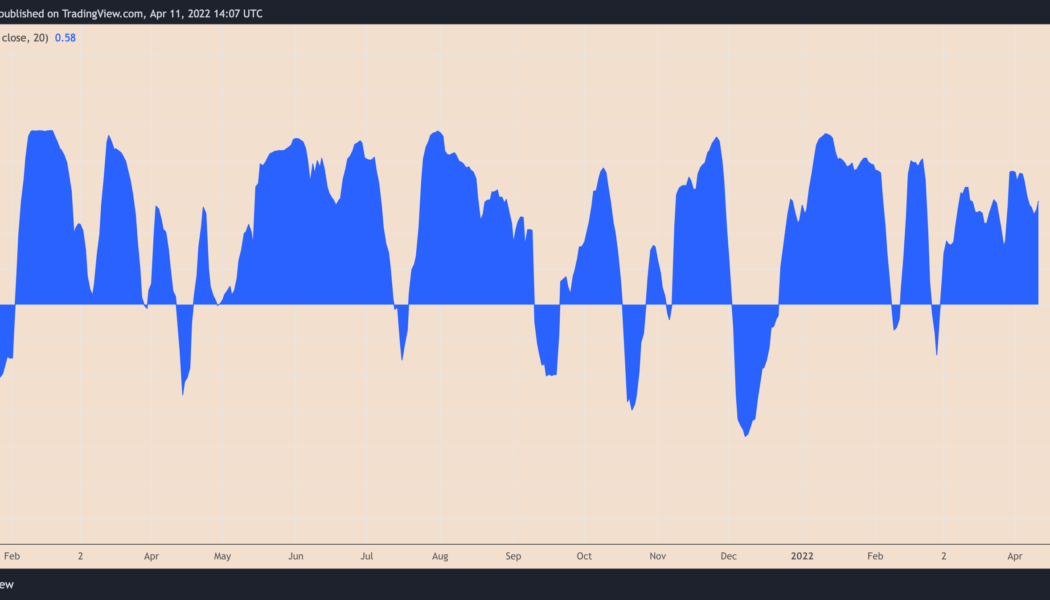

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

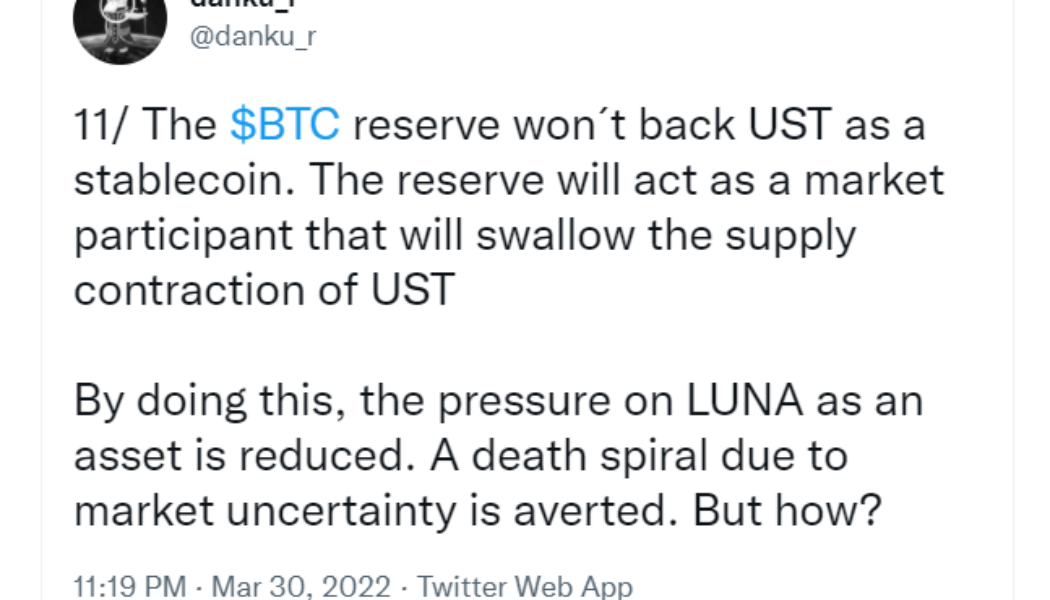

Terra founder reveals what will happen to UST if Bitcoin price crashes

Terraform Labs CEO Do Kwon has conceded that a crash in the price of Bitcoin would be “negative” for the stability of the UST stablecoin, but that he expects Bitcoin to go up. Terraform Labs is the entity behind the Terra (LUNA) blockchain platform which plans on buying a total of $3 billion in Bitcoin as a reserve for the UST stablecoin. Kwon made the comments in an interview on the Unchained podcast on Mar. 29. Host Laura Shin asked Kwon what the short term implications of holding so much BTC will be for the stability of UST. Kwon said “the worst case would be if we were buying Bitcoin and a crash happens six months later, and it’s correlated with a massive fall in demand for UST” which would be, as he modestly put it, “negative.” However, that scenario isn’t keeping him up at nigh...

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...

Terraform Labs donates $1.1B for Luna Foundation Guard‘s reserves

On Friday, Do Kwon, founder and CEO of Terraform Labs, which develops the blockchain ecosystem consisting of Terra Luna (LUNA) and the TerraUSD stablecoin (UST), announced that TFL had donated 12 million LUNA, or $1.1 billion at the time of publication to the Luna Foundation Guard (LFG). LFG launched in January to grow the Terra ecosystem and improve the sustainability of its stablecoins. Kwon noted that the funds, denominated in LUNA, will be burned to mint UST to grow the LFG‘s reserves: “We will keep growing reserves until it becomes mathematically impossible for idiots to claim de-peg risk for UST.” UST is an algorithmic stablecoin with a theoretical exchange rate of 1:1 with the U.S. dollar and is in part maintained by swapping of/for LUNA tokens when its market value deviates from it...

Luna Foundation Guard raises $1B to form UST reserve denominated in Bitcoin

The nonprofit organization focused on the open-source stablecoin network behind Terra USD, Luna Foundation Guard, has closed on a $1 billion raise through the sale of LUNA tokens. In a Tuesday tweet, Terra said Jump Crypto and Three Arrows Capital led the $1 billion round with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital and others. The platform said proceeds from the sale — $1 billion — would “go towards establishing a Bitcoin-denominated Forex Reserve for UST,” a stablecoin in the Terra ecosystem. 1/ The long awaited [REDACTED] 3 is here! The Luna Foundation Guard (LFG) has closed a $1 billion private token sale to establish a decentralized $UST Forex Reserve denominated in $BTC! — Terra (UST) Powered by LUNA (@terra_money) February 22, 2022 “One common ...

- 1

- 2