USD Coin

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

Solana-based protocol seeking to decentralize ride-sharing raises $9M

The ride-sharing industry is poised for another paradigm shift with Web3 protocols, allowing new companies and drivers to bid for rides using a matching algorithm, according to the Decentralized Engineering Cooperation (DEC) — the company behind the Solana-based protocol TRIP that enables mobility-based applications. According to DEC, on the TRIP platform, companies and riders can collaborate and compete in a shared marketplace. The protocol also rewards the most active participants with a stake in its governance for both drivers and customers. The first company to operate on TRIP is Teleport, a decentralized ride-sharing application set to be launched in December and run by the parent company DEC. On Oct. 27, DEC announced a $9 million seed round co-led by Foundation Capital and Road Capi...

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

UFC fighter El Ninja to become first argentinian athlete paid in crypto

Guido Cannetti, an Argentinian Ultimate Fighting Championship (UFC) fighter, is now the first martial arts athlete in the country to receive 100% of his salary in stablecoins, amid rising inflation and Argentina’s economic deteriorating, announced the crypto payroll company Bitwage on Monday. Dubbed El Ninja, he returns to the Octagon on October 1st in the United States to face the local fighter Randy Costa. According to Bitwage, Guido will receive his payment in USDC stablecoin via the Stellar Network on Vibrant, a wallet application developed by the Stellar team specifically for Argentines experiencing inflation. As per official government figures’, inflation in the 12 months through August was 78.5% in the country, whereas prices in the first eight months of the year were up...

3 reasons why USDC stablecoin dropping below $50B market cap is Tether’s gain

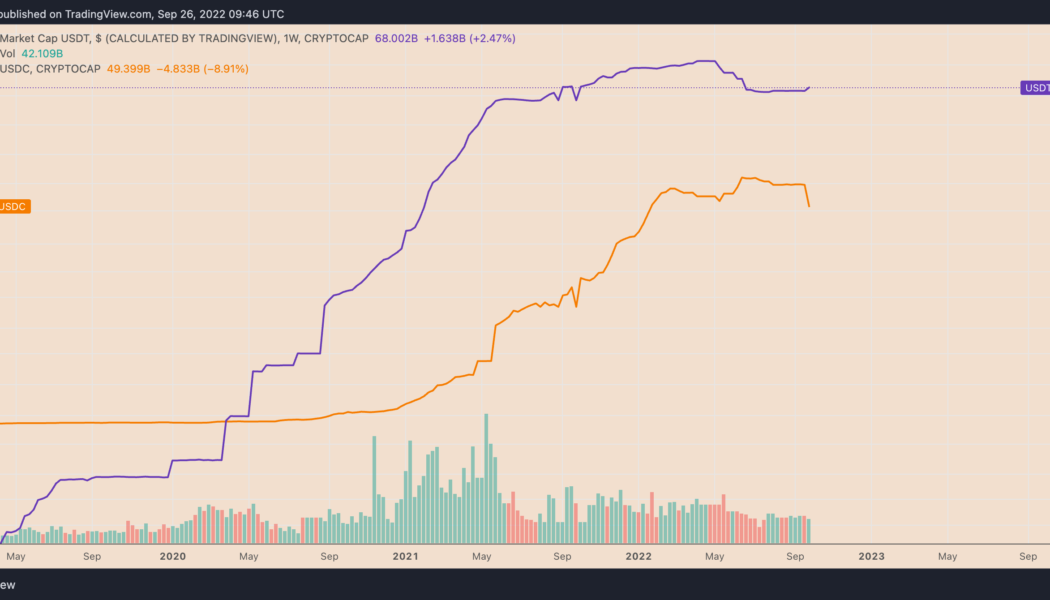

The market capitalization of USD Coin (USDC), a stablecoin issued by U.S.-based payment tech firm Circle, has dropped below $50 billion for the first time since January 2022. On the weekly chart, USDC’s market cap, which reflects the number of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, down almost 12% from its record high of $55.88 billion, established merely three months ago. USDC versus USDT weekly market cap chart. Source: TradingView In contrast, the market cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, crossed above $68 billion on Sep. 26, albeit still down 17.4% from its record high of $82.33 billion in May 2022. The divergence between USDT and USDC shows investors’ renewed preference...

Aave devs look set to receive $16.3M via retroactive funding

The DAO behind the decentralized finance (DeFi) platform Aave has accepted a proposal to reward members from Aave Companies with $16.28 million in retroactive funding for their role in the development of Aave Protocol V3. Voting for the proposal began on Sept. 6, and at the time of writing has already passed 667,000 votes in favor of the funding, more than doubling the 320,000 required. The vote is set to end on Sept. 8. According to the initial proposal, which was first pitched on Aug. 10, the Aave Request for Comment (ARC) seeked “retroactive funding” for work in developing the V3 protocol. The $16.28 million consists of $15 million for work performed by the developers over the course of more than one year and $1.28 million for costs paid to third-party auditors. The money will be given ...

Vitalik: Centralized USDC could decide the future of contentious ETH hard forks

Ethereum co-founder Vitalik Buterin says that centralized stablecoins such as Tether (USDT) and Circle USD (USDC) could become “a significant decider in future contentious hard forks.” Buterin was speaking at the BUIDL Asia conference in Seoul on Aug. 3, along with Illia Polosukhin, the co-founder of Near Protocol (NEAR) to discuss Ethereum’s upcoming Merge. The Ethereum co-founder argued that centralized stablecoins could be a “significant” decider of which blockchain protocol the industry would “respect” in hard forks. A hard fork occurs when there is a radical change to the protocol of a blockchain network that effectively results in two versions. Usually, one chain ends up being preferred over another. “At the moment of the merge, you will have two [separate] networks […] and then you ...

Roger Ver denies CoinFLEX CEO’s claims he owes firm $47M USDC

Roger Ver, an early Bitcoin investor and Bitcoin Cash proponent, has pushed against claims from crypto investment platform CoinFLEX regarding an alleged $47-million debt. In a Tuesday tweet, Ver — not mentioning CoinFLEX by name — said he had not “defaulted on a debt to a counter-party,” and alleged the crypto firm owed him “a substantial sum of money.” The denial followed rumors on social media that the BCH proponent was involved in the platform halting withdrawals due to “a high-networth client who has holdings in many large crypto firms” not covering their debts. CoinFLEX CEO Mark Lamb took to Twitter shortly after the statement to claim the company had a written contract with Ver “obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regul...

Tether’s USDT market cap dips below $70B for an 8-month low

Tether (USDT), the biggest stablecoin and the third largest digital currency by market capitalization, continues losing its market value amid the current market downturn. On June 16, USDT’s market cap dropped below $70 billion for the first time since October 2021. The drop followed a cascade of repeated declines shortly after the USDT market value reached its all-time high above $80 billion in May. At the time of writing, Tether USDT’s market capitalization stands at $69.3 billion, up around $300 million from the multi-month low, according to data from CoinGecko. USDT 90-day market capitalization chart. Source: CoinGecko Tether’s biggest rival, USDC, is the second-largest U.S. dollar-pegged stablecoin backed by the peer-to-peer payments technology company Circle. The stablecoin reached $5...

Binance’s CZ says he is ‘skeptical’ about the Terra relaunch

Binance CEO Changpeng Zhao, also known as CZ, expressed skepticism around the revival plan for the Terra ecosystem and the launch of the new LUNA token. “I try not to predict what the community will do. […] Many are skeptical. I’m one of those guys,” said CZ in an exclusive interview with Cointelegraph. Following the collapse of TerraUSD (USD), the Terra ecosystem’s stablecoin, CZ criticized its team for not handling the crisis properly and pointed at the project’s flaws that led to the crash. Still, Binance is now actively participating in Terra’s revival plan by hosting the airdrop of its new LUNA token. As CZ pointed out, despite the widespread skepticism around the Terra relaunch, Binance has a responsibility to help users affected by the crash of LUNA. “We still need to ensure c...

Do you have the right to redeem your stablecoin?

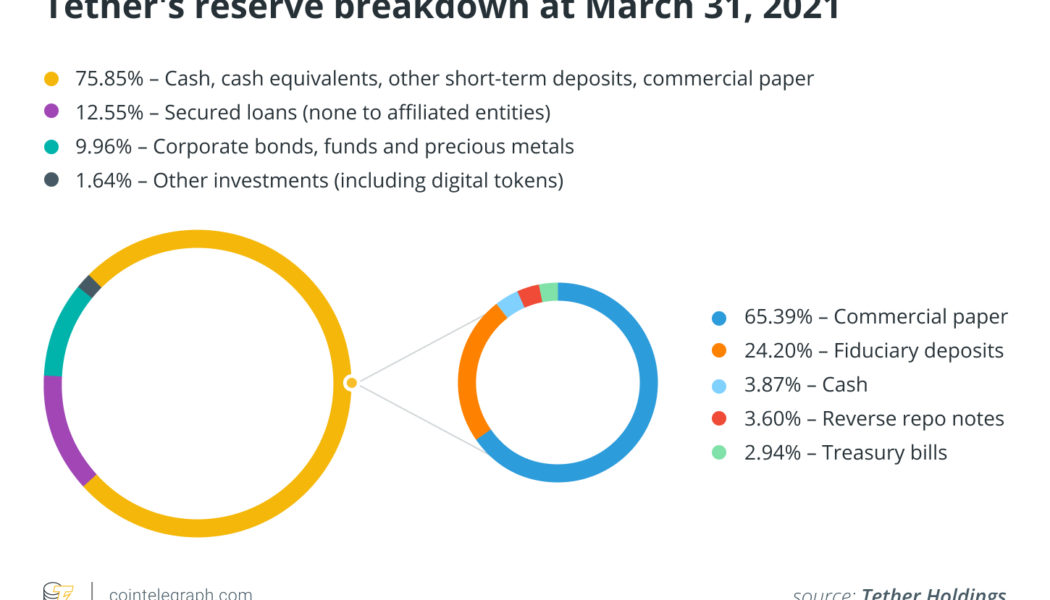

Stablecoins are often discussed with regard to their “stability.” It is usually questioned whether a stablecoin is sufficiently backed with money or other assets. Undoubtedly, it is a very important aspect of stablecoin value. But, does it make sense if the legal terms of a stablecoin do not give you, the stablecoin holder, the legal right to redeem that digital record on blockchain for fiat currency? This article aims to look into the legal terms of the two largest stablecoins — Tether (USDT) by Tether and USD Coin (USDC) by Centre Consortium, established by Coinbase and Circle — to answer the question: Do they owe you anything? Related: Stablecoins will have to reflect and evolve to live up to their name Tether Article 3 of Tether’s Terms of Service explicitly states: “Tether reserves th...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...

- 1

- 2