US Government

The aftermath of LBRY: Consequences of crypto’s ongoing regulatory process

The case of LBRY highlights a wave of renewed regulatory pressure that could affect both blockchain token-issuing companies and their investors. In November, an over year-long court battle between the United States Securities and Exchange Commission (SEC) and blockchain development company LBRY and its LBRY Credits (LBC) token culminated in the ruling of the token as an unregistered security, despite the company’s argument of its use as a commodity within the platform. The court’s decision in this case sets a precedent that could influence not only the regulatory perception of blockchain-based platforms, but cryptocurrencies as well. The old Howey Old standards don’t always apply when it comes to the regulation of new technologies. The LBRY case was mostly centered on the basis of th...

Congress may be ‘ungovernable,’ but US could see crypto legislation in 2023

The United States House of Representatives finally elected a speaker last week, concluding a four-day, 15-ballot ordeal that left many wondering if political gridlock was now the new normal in the U.S., and if so, what the consequences would be. For example, were the concessions made by Republican Kevin McCarthy to secure his election as speaker ultimately going to make it difficult to achieve any sort of legislative consensus, making it impossible for the U.S. to raise its debt ceiling and fund the government later this year? Not all were optimistic. The House of Representatives will be largely “ungovernable” in 2023, Representative Ritchie Torres, a Democrat from New York, told Cointelegraph on Jan. 6, shortly before joining colleagues for that day’s series of ballots — which final...

Gensler’s approach toward crypto appears skewed as criticisms mount

Since taking over at the United States Securities and Exchange Commission (SEC), chairman Gary Gensler has repeatedly been referred to as the “bad cop” of the digital asset industry. To this point, over the past 18 months, Gensler has taken an extremely hard-nosed approach toward the crypto market, handing out numerous fines and enforcing stringent policies to make industry players comply with regulations. However, despite his aggressive crypto regulatory stance, Gensler, for the most part, has remained mum about several key issues that digital asset proponents have been talking about for a long time. For example, the SEC has still failed to clarify which cryptocurrencies can be considered securities, stating time and again that most cryptocurrencies in the market today could be classified...

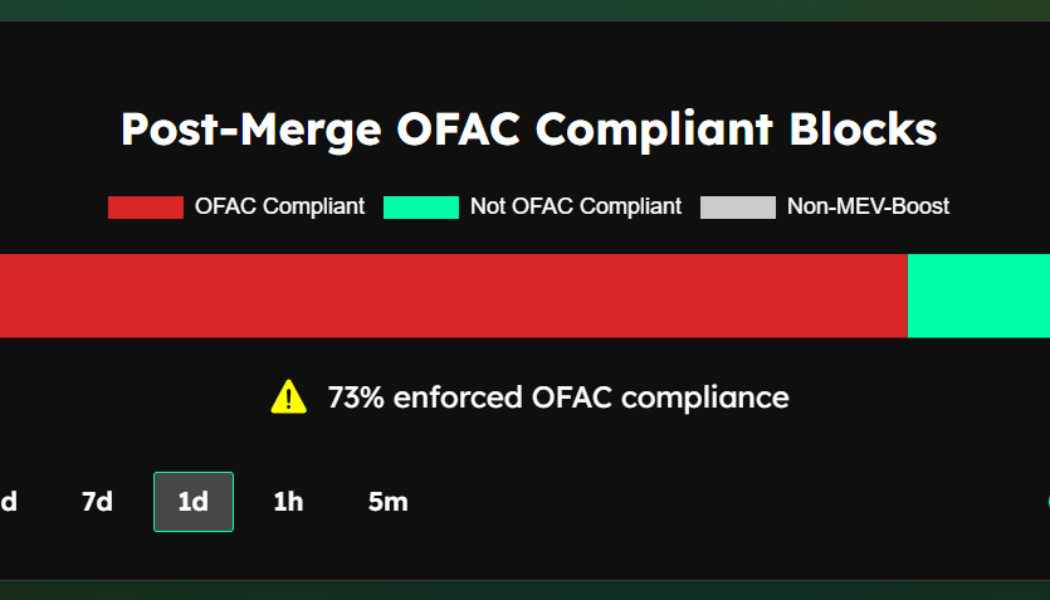

Ethereum inches even closer to total censorship due to OFAC compliance

Considering that protocol-level censorship is deterrent to the crypto ecosystem’s goal of highly open and accessible finance, the community has been keeping track of Ethereum’s growing compliance with standards laid down by the Office of Foreign Assets Control (OFAC). Over the last 24 hours, the Ethereum network was found to enforce OFAC compliance on over 73% of its blocks. Ethereum sporting 73% OFAC-compliant blocks. Source: mevwatch.info In Oct. 2022, Cointelegraph reported on the rising censorship concerns after 51% of Ethereum blocks were found compliant with OFAC standards. However, data from mevWatch confirmed that the minting of OFAC-compliant blocks on a daily basis has grown to 73% as of Nov. 3. Ethereum’s PFAC compliance trend. Source: mevwatch.info Some MEV-Bo...

California Gov. Newsom vetoes crypto licensing and regulatory framework

Adding to the existing regulatory hurdles for the crypto ecosystems, California Governor Gavin Newsom refused to sign a bill that would establish a licensing and regulatory framework for digital assets. Assembly Bill 2269 sought to allow the issuance of operational licenses for crypto companies in California. On Sept. 1, California State Assembly passed the bill with no opposition from the assembly floor and went on to the governor’s office for approval. Letter of rejection from Gov. Mewsom. Source: leginfo.legislature.ca.gov Opposing the notion, Newsom recommended a “more flexible approach” that would evolve over time while considering the safety of consumers and related costs, adding: “It is premature to lock a licensing structure in statute without considering both this work (...

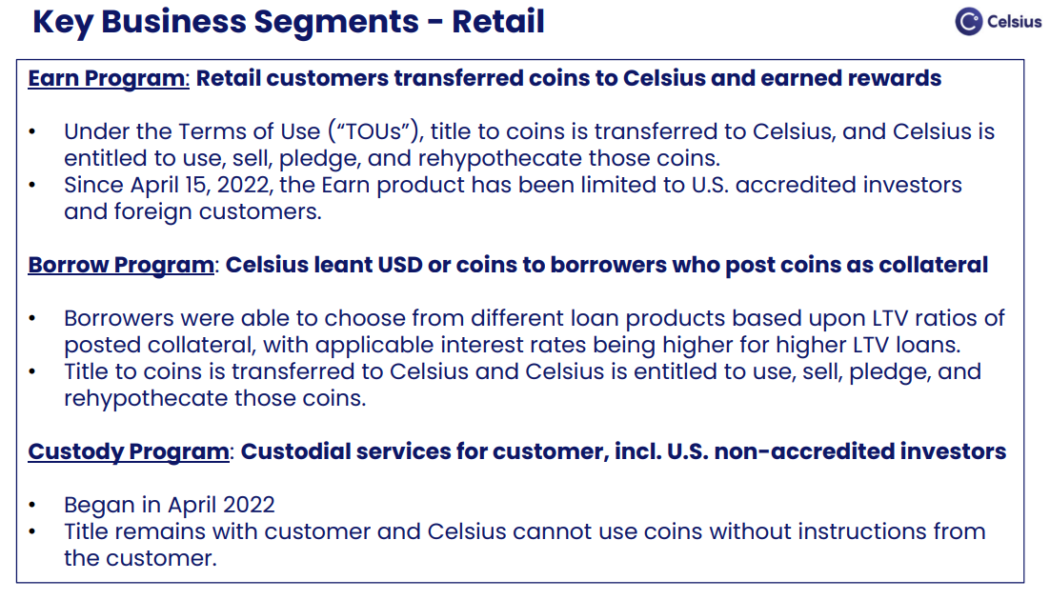

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

AML and KYC: A catalyst for mainstream crypto adoption

For Satoshi Nakamoto, the creator of Bitcoin (BTC), the motivation to create a new payment ecosystem from scratch in 2009 stemmed from the economic chaos caused by the banking sector’s over-exuberant and risky lending practices mixed accompanied by the bursting of the housing bubbles in many countries at the time. “And who do you think picked up the pieces after the fallout? The taxpayer, of course,” said Durgham Mushtaha, business development manager of blockchain analytics firm Coinfirm, in an exclusive interview with Cointelegraph. Satoshi recognized the need for a new monetary system based on equity and fairness — a system that gives back power into the hands of the people. A trustless system with anonymous participants, transacting peer-to-peer and without the need of a central ...

US crypto regulation bill aims to bring greater clarity to DAOs

On June 7, United States Senators Cynthia Lummis and Kirsten Gillibrand launched the much anticipated Responsible Financial Innovation Act, proposing a comprehensive set of regulations that address some of the biggest questions facing the digital assets sector. By providing holistic guidance to the rapidly growing industry, the bill offers a bipartisan response to President Biden’s call for a whole-of-government approach to regulating crypto. Among its many proposals, the bill establishes basic definitions, provides an exemption for digital currency transactions and harmonizes the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), delineating regulatory swim lanes and granting a significant jurisdictional expansion to the CFTC. The bi...

CTFC looks at expanded authority to regulate crypto, for less than a 10% budget increase

The U.S. Commodity Futures Trading Commission, or CFTC, has released its Fiscal Year 2023 (FY2023) budget request, seeking $365 million. This marks a 9.9% increase over the previous year and 20% over FY2021. The commission regulates the country’s derivatives market and has been increasingly active in recent years in policing financial products that incorporate cryptocurrencies. According to the agency’s request document, the CTFC focuses on digital asset custodian risk, ensuring secure storage, as well as on accounting. The agency has its own staff of certified public accountants due to the lack of guidance on digital asset accounting from sectoral oversight bodies. In addition, the agency ensures derivative clearing organizations “employ strong segregation of duty processes and proc...

Law Decoded: Crypto taxes and taxes on crypto, March 21–28.

It was relatively quiet in the digital asset policy department last week, as regulators and lawmakers in most key jurisdictions retreated to their offices to do the necessary homework. In the U.S., federal agencies got on with the various reports that President Joe Biden’s recent executive orders directed them to produce. Over in the United Kingdom, both the central bank and the Financial Conduct Authority also dropped position papers on crypto-related issues. After thorough deliberation, Thailand’s financial authorities spoke out against using crypto as a means of payment, while rumors of potential legal tender adoption of crypto emerged and died in Honduras. One theme that has been conspicuous throughout the week is the relationship between digital assets and taxation. Few would argue th...

President Bukele hits out at Bitcoin Bond ‘FUD’ as CZ jets in to El Salvador

El Salvador President Nayib Bukele took to Twitter on Wednesday evening, hitting out at a Reuters report claiming Binance CEO Changpeng Zhao (CZ) was flying in to save El Salvador’s Bitcoin Bond. “Please don’t spread Reuter’s FUD,” Bukele tweeted to his 3.6 million followers, rebuking the claim that CZ was flying in to assist after the $1 billion bond offering, originally scheduled for mid-March, was postponed until September. He was responding to a tweet on the subject by Bitcoin Magazine, which has now deleted the post. I’m a fan of @BitcoinMagazine, please don’t spread @Reuters FUD. The #Bitcoin Volcano Bonds will be issued with @bitfinex. The short delay in the issuance is only because we are prioritizing internal pension reform and we have to send that to congress before. https://t.co...