US Dollar

Price analysis 1/17: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

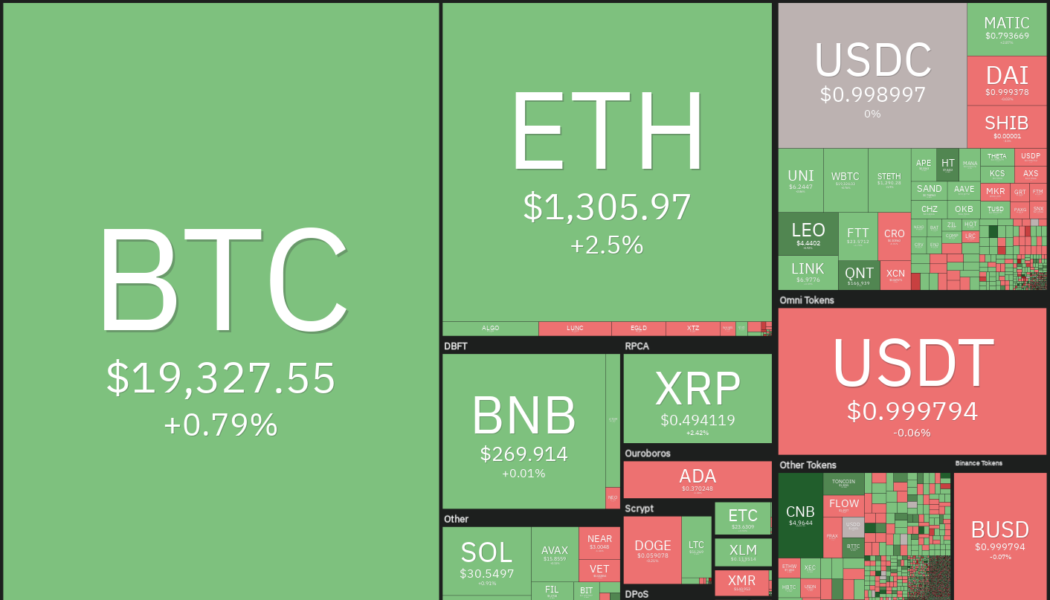

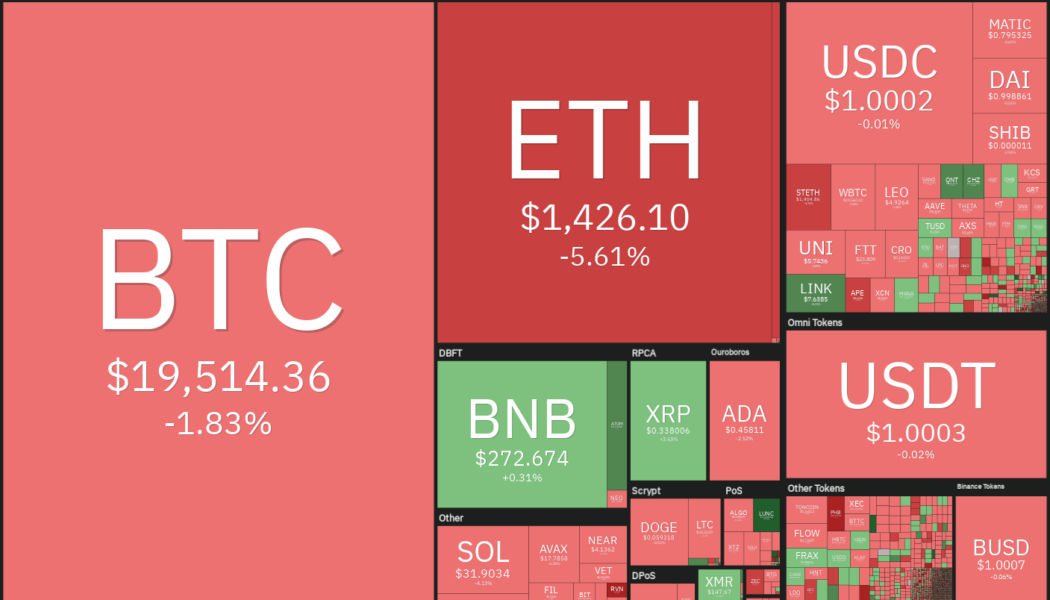

Risk assets have started the new year on a strong note. The S&P 500 (SPX) and the Nasdaq closed in the positive for the second successive week and also notched their best weekly performance since November. Bitcoin (BTC) led the recovery in the crypto markets with a sharp 21% rally last week. That sent the Bitcoin Fear and Greed Index into the neutral territory of 52 on Jan. 15, its highest since April 5, 2022. However, the index has given back its gains and is again back into the Fear zone on Jan. 17. Daily cryptocurrency market performance. Source: Coin360 The strong rally in Bitcoin has divided analysts’ opinions. While some expect the rally to be a bull trap, others believe that the up-move could be the start of a new bull market. The confirmation of the same will happen...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Kevin O’Leary says Bitcoin can’t crash as it is now a store of value

Shark Tank host Kevin O’Leary is confident Bitcoin price will never collapse to zero The TV personality and entrepreneur has invested in Gold, Bitcoin and several other altcoins In a Monday interview with Kitco’s Michelle Makori, TV personality Kevin O’Leary asserted that the price of Bitcoin will never reach zero. The Canadian businessman defended his take, arguing that the crypto asset, now 13 years old, has secured its place in the financial space as a store of value. O’Leary compared Bitcoin to gold in this regard, adding that he has invested an equal fraction of his portfolio in both assets. “Bitcoin is never going to zero. This is a personal opinion. There are enough people around the world that see it as a store of value, me included. It is a 5% weighting in my portfolio, just like ...

Cardano founder not sold on the idea of a Bitcoin world reserve currency

Charles Hoskinson is pessimistic of Bitcoin becoming the world reserve currency of the future He cited, among other reasons, the lack of smart contract functionality and low throughput Input Output Hong Kong CEO Charles Hoskinson has opined that Bitcoin is not fit to become a world reserve currency but acknowledged that it could evolve into suitability for the role. Hoskinson was responding to a question by Crypto Jebb on YouTube that sought to establish what evolution away from the dollar would be like. Despite Bitcoin’s first mover advantage, the Cardano CEO dismissed its submission as a world reserve currency, explaining that it was plagued by characteristics that “don’t make it very desirable.” So, why not Bitcoin? As a Proof of Work digital asset, Bitcoin mining consumes massive amoun...

Here’s why Minnesota rep Tom Emmer thinks the Federal Reserve is unfit to issue a CBDC

Tom Emmer has previously shown a preference for a decentralised digital currency as it would uphold user privacy and retain the elements of cash The US representative for Minnesota’s 6th congressional state, Tom Emmer, revealed yesterday that he intends to introduce new regulations around crypto. The proposed law from Emmer, who had hinted of it a day earlier, would bar the Federal Reserve from conducting any activity as a retail ban. In effect, it would prevent the Fed from issuing a central bank digital currency directly to consumers in the US. He insisted that unlike other countries, such as China, that have developed tokens lacking the “benefits and protections of cash,” a US digital currency should guarantee privacy to users and retain the US dollar’s hege...

Bitcoin rises above $51K as the dollar flexes muscles against the euro

Bitcoin (BTC) regained its bullish strength after reclaiming $50,000 last week and continued to hold the psychological level as support on Dec. 27. Meanwhile, its rival for the top safe-haven spot, the U.S. dollar, also bounced off a critical price floor, hinting that it would continue rallying through into 2022. Triangle breakout The U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, has been trending towards the apex of a “symmetrical triangle” pattern on its daily chart. In doing so, the index has been treating the structure’s lower trendline as its solid support level, thus hinting that its next breakout would resolve to the upside. DXY daily price chart featuring symmetrical triangle setup. Source: Tradi...