United States

CFTC and SEC open comments for proposal to amend crypto reporting rules for large hedge funds

The United States Securities and Exchange Commission, or SEC, and the Commodity Futures Trading Commission, or CFTC, have called for comments on a proposal which would require large advisers to certain hedge funds to report exposure to crypto. In a joint proposed rule published to the Federal Register on Sept. 1, the SEC and CFTC established a 40-day comment period for amendments to Form PF, the confidential reporting document for certain investment advisers to private funds of at least $500 million. The proposal suggested qualifying hedge funds report exposure to crypto in a different category other than “cash and cash equivalents,” as the current iteration of Form PR does not specifically mention cryptocurrencies. Members of the public have until Oct. 11 to submit comments regarding the ...

Crypto ‘cannot be partisan,’ says US lawmaker who scored negative on bipartisanship index: Report

United States House of Representatives member Tom Emmer has reportedly suggested that regulating and encouraging innovation in the crypto space should not be a political win for either Democrats or Republicans. According to an interview released Tuesday by Axios reporter Brady Dale, Emmer said many of his colleagues in Congress were treating cryptocurrencies as a risk that merited warnings, rather than an investment opportunity for the United States. The U.S. lawmaker added that encouraging figures like FTX CEO Sam Bankman-Fried to stay in the country will open more doors for residents rather than driving them away with regulatory uncertainty. Emmer, who has often pushed back against the “regulation by enforcement” approach some government agencies — including the Securities and Exchange C...

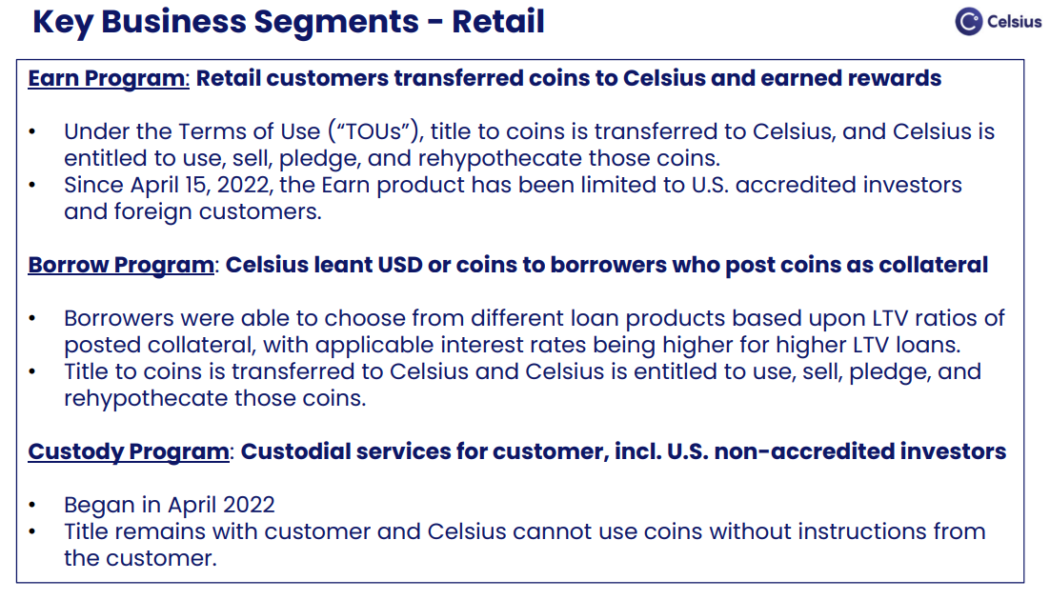

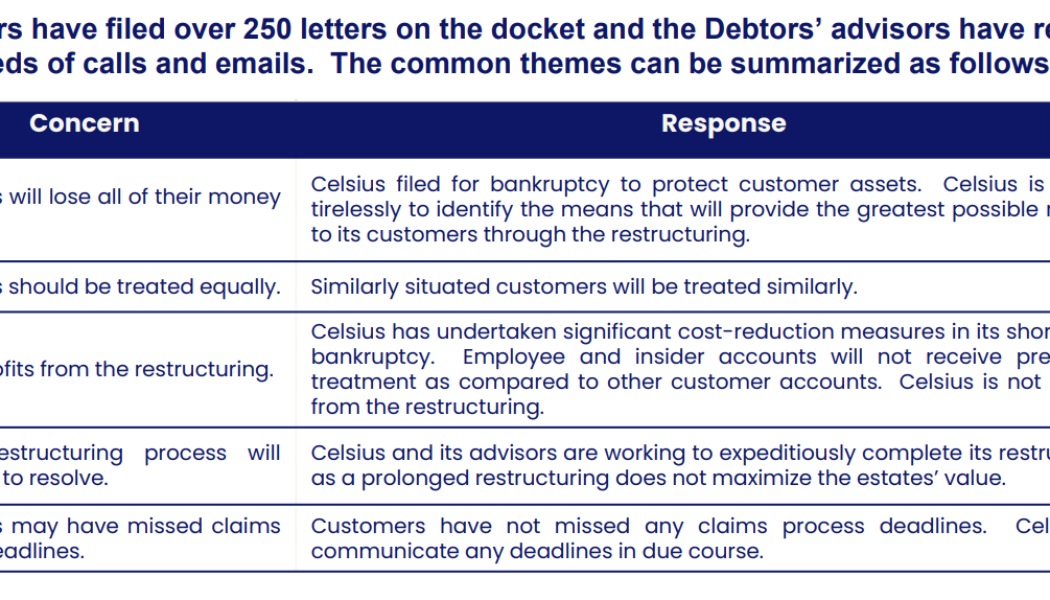

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

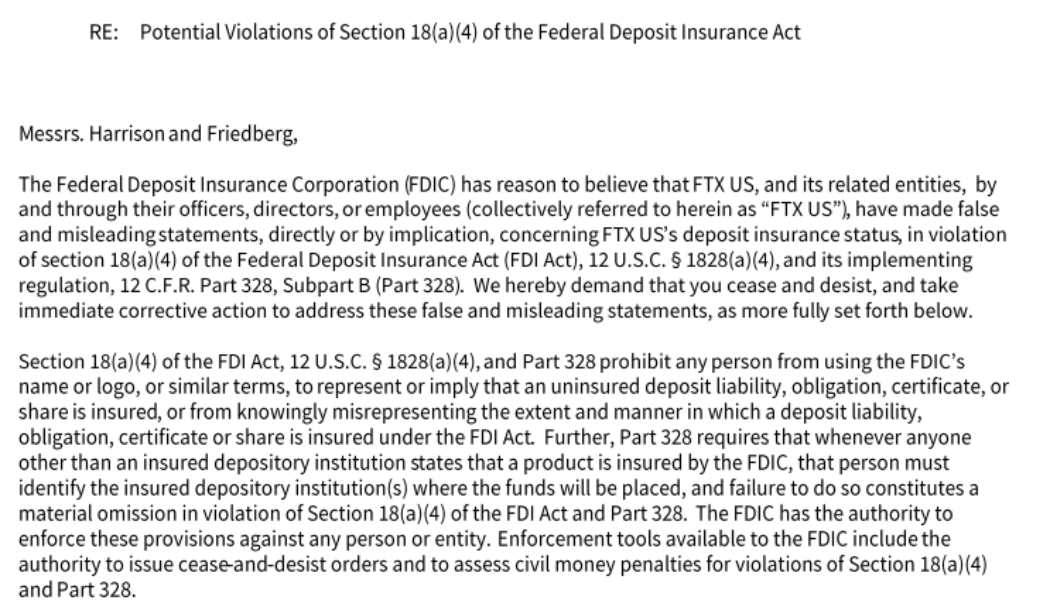

FTX US among 5 companies to receive cease and desist letters from FDIC

The Federal Deposit Insurance Corporation (FDIC) has issued cease and desist letters to five companies for allegedly making false representations about deposit insurance related to cryptocurrencies. FDIC issued a Friday press release disclosing cease and desist letters for cryptocurrency exchange FTX US and websites SmartAssets, FDICCrypto, Cryptonews and Cryptosec. In the letters, which were issued on Thursday, the government agency alleges that these organizations misled the public about certain cryptocurrency-related products being insured by FDIC. “These representations are false or misleading,” the FDIC said in regard to “certain crypto-related products” being FDIC-insured or that “stocks held in brokerage accounts are FDIC-insured.” The regulator said these companies must “take immed...

US lawmakers appeal directly to 4 mining firms, requesting info on energy consumption

Four members of the United States House of Representatives from the Energy and Commerce Committee have demanded answers from four major crypto mining firms in regards to the potential effects of their energy consumption on the environment. In letters dated Wednesday to Core Scientific, Marathon Digital Holdings, Riot Blockchain, and Stronghold Digital Mining, U.S. lawmakers Frank Pallone, Bobby Rush, Diana DeGette, and Paul Tonko requested the companies provide information from 2021 including the energy consumption of their mining facilities, the source of that energy, what percentage came from renewable energy sources, and how often the firms curtailed operations. The four members of the House committee also inquired as to the average cost per megawatt hour the companies spent mining...

For greater good: NY judge allows Celsius to mine, sell Bitcoin

Not even 24 hours after revealing a three-month cash flow forecast that threatens total exhaustion of funds, a New York judge allowed crypto lender Celsius Network to mine and sell Bitcoin (BTC) during its bankruptcy. Since July 2022, Celsius Networks stands at the crosshair of United States officials after reports of bankruptcy surfaced, which risks losing the live savings of numerous crypto investors. Last week many got very upset with me as I said @CelsiusNetwork would run out of money & solutions needed to be acted upon faster. I was told I don’t understand Chapter 11. They have now confirmed they run out of money by October. https://t.co/CyzjgKpId7 pic.twitter.com/vBIRIGEmG2 — Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) August 15, 2022 During the second day of the case h...

Built to fall? As the CBDC sun rises, stablecoins may catch a shadow

There’s a ferment brewing with regard to central bank digital currencies (CBDCs), and most people really don’t know what to expect. Varied effects seem to be bubbling up in different parts of the world. Consider this: China’s e-CNY, or digital yuan, has already been used by 200 million-plus of its citizens, and a full rollout could happen as early as February — but will a digital yuan gain traction internationally? Europe’s central bank has been exploring a digital euro for several years, and the European Union could introduce a digital euro bill in 2023. But will it come with limitations, such as a ceiling on digital euros that can be held by a single party? A United States digital dollar could be the most awaited government digital currency given that the dollar is the world’s rese...

SBI Group reports investee getting CFTC approval for OTC derivatives trading in US

The United States subsidiary of electronic trading platform developer Clear Markets has reportedly received approval from the Commodity Futures Trading Commission, or CFTC, to offer over-the-counter crypto derivatives products with physical settlement. In a Tuesday notice, SBI Holdings — a stakeholder of Clear Markets — said the CFTC had approved the U.S. subsidiary operating a Swap Execution Facility, in which it plans to offer derivatives trading for U.S. dollar and Bitcoin (BTC) pairs. The Japan-based financial services company said its market maker planned to expand its trading partners in the United States following pilot transactions on Clear Markets. SBI Holdings announced it had acquired a 12% stake in Clear Markets in August 2018, which it planned to increase in the future. At the...

Coinbase hit with 2 fresh lawsuits amid SEC probe

Coinbase is now facing increased scrutiny from regulators, with the company now becoming the target of multiple lawsuits. The San Francisco-based cryptocurrency exchange, which is presently being investigated by the United States Securities and Exchanges Commission (SEC), now faces two additional legal claims from two law firms. On Thursday, New York-based legal firm Bragar Eagel & Squire revealed that it would be suing Coinbase for making deceptive claims about its business practices. Pomerantz LLP has also filed a claim against the exchange, alleging that it is entitled to compensation for any losses incurred as a result of the defendant’s violations of federal securities laws. This lawsuit was filed to compensate the plaintiffs. In both complaints, plaintiffs claim that Coinba...

US lawmakers request crypto firms provide info on diversity and inclusion

A group of five lawmakers from the United States House of Representatives has requested data on the diversity and inclusion practices of 20 major firms dealing with cryptocurrencies and Web3. In a Thursday notice, House Financial Services Committee chair Maxine Waters along with Representatives Joyce Beatty, Al Green, Bill Foster and Stephen Lynch penned a letter requesting U.S.-based crypto firms provide information on “how and whether the industry is working toward a more equitable environment for everyone.” The lawmakers sent letters to 20 companies including Aave, Binance.US, Coinbase, Crypto.com, FTX, Kraken, Paxos, Ripple and Tether as well as venture capital firms Andreessen Horowitz, Haun Ventures and Sequoia Capital. “There is a concerning lack of publicly available data to effect...

Crypto firms failed to deliver ‘promised benefits’ from lawmaker-backed incentives, says nonprofit

The Tech Transparency Project, or TTP, a research initiative of the United States-based nonprofit watchdog group Campaign for Accountability, has released a report claiming crypto firms “provided little in return” for state governments offering financial incentives. In a report released Thursday, the TTP said that many crypto firms based in certain U.S. states have “reaped special benefits” for setting up operations while not always delivering jobs, economic growth or tax benefits for residents. According to the group, crypto lobbyists worked on behalf of firms to gain tax breaks and discounted energy prices while state governments have “faced budget shortfalls, surging energy consumption and serious environmental damage.” A new TTP report outlines favorable laws and tax breaks given...

Blockchain.com wins registration next to parent firm on the Cayman Islands

Blockchain.com, one of the oldest Bitcoin (BTC) infrastructure firms, is strengthening regulation and compliance efforts by securing registration in the Cayman Islands. The blockchain wallet and cryptocurrency exchange platform Blockchain.com is expanding operations in the Cayman Islands after receiving registration from the Cayman Islands Monetary Authority (CIMA). Issued on July 6, the registration officially authorizes Blockchain.com to provide custodial services, operate an exchange, and offer over-the-counter crypto brokerage services for institutional clients under the CIMA’s regulatory framework. Blockchain.com’s chief business officer Lane Kasselman pointed out that the Cayman Islands is an important jurisdiction for the company’s business as the local community and regulators have...