United States

White House OSTP department analyzes 18 CBDC design choices for the US

As directed by the President of the United States, Joe Biden, the Office of Science and Technology Policy (OSTP) submitted a report analyzing the design choices for 18 central bank digital currency (CBDC) systems for possible implementation in the US. The technical analysis of the 18 CBDC design choices was made across six broad categories — participants, governance, security, transactions, data and adjustments. The OSTP foresees technical complexities and practical limitations when trying to build a permissionless system governed by a central bank, adding: “It is possible that the technology underpinning a permissionless approach will improve significantly over time, which might make it more suitable to be used in a CBDC system.” However, the analysis assumed there is a central authority ...

White House publishes ‘first-ever’ comprehensive framework for crypto

Following President Joe Biden’s executive order on Ensuring Responsible Development of Digital Assets, federal agencies came up with a joint fact sheet on 6 principal directions for crypto regulation in the United States. It sums up the content of 9 separate reports, which have been submitted to the president to “articulate a clear framework for responsible digital asset development and pave the way for further action at home and abroad.” The fact sheet was published on the White House official website on Sept. 16, and consists of 7 sections: (1) Protecting Consumers, Investors, and Businesses; (2) Promoting Access to Safe, Affordable Financial Services; (3) Fostering Financial Stability; (4) Advancing Responsible Innovation; (5) Reinforcing Our Global Financial Leadership and Competitiven...

US Treasury sanctions 5 crypto addresses connected to Russian neo-Nazi paramilitary group

The United States Department of the Treasury added five cryptocurrency addresses tied to a neo-Nazi group involved in Russia’s war on Ukraine to list of entities sanctioned by the Office of Foreign Asset Control. In a Thursday notice, the U.S. Treasury designated 22 individuals and 2 entities, including many the government department claimed had furthered the Russian government’s objectives in Ukraine, to its list of Specially Designated Nationals, effectively barring U.S. persons and companies from dealing with them. Included in sanctions of one of the entities — a neo-Nazi paramilitary group called Task Force Rusich — were 2 cryptocurrency addresses for Bitcoin (BTC), 2 for Ether (ETH), and 1 for Tether (USDT). Treasury Secretary Janet Yellen said the sanctions were imposed as part of th...

Merge is ‘a step in the right direction’ to address crypto’s energy usage — Rostin Behnam

Rostin Behnam, chair of the United States Commodity Futures Trading Commission, or CFTC, said the Ethereum blockchain’s transition to proof-of-stake may help reduce crypto’s energy usage, but hinted legislation would likely still be needed to address the problem. Speaking at a Thursday hearing before the Senate Agriculture Committee, Behnam addressed a question from Minnesota Senator Amy Klobuchar, who brought up the environmental impact of the “significant energy” required of mining cryptocurrencies. Without mentioning the Merge by name, the CFTC chair said the crypto bill currently being considered by lawmakers would require a report on energy usage that could lead to future policy discussion and “incentives to move away from carbon-intensive energy sources.” “We’ve all heard the statist...

Abra announces plans for US bank supporting digital assets

Cryptocurrency trading platform Abra said it was “in the process of” establishing a United States-based state-chartered bank allowing clients to deposit digital assets. In a Monday announcement, Abra said the bank, named Abra Bank, would be regulated to operate within the U.S. and give customers the ability to use digital assets in seemingly the same way as fiat at traditional banks. The company also planned to launch Abra International, a digital asset-focused business based outside the U.S. “The best way to become the default Web3 wallet and crypto bank for everyone is by embracing a global regulatory framework that provides for transparency, oversight, security, and agency,” said Abra. We have some BIG news. Today we’re announcing the formation of Abra Bank and the launch of Abra Boost,...

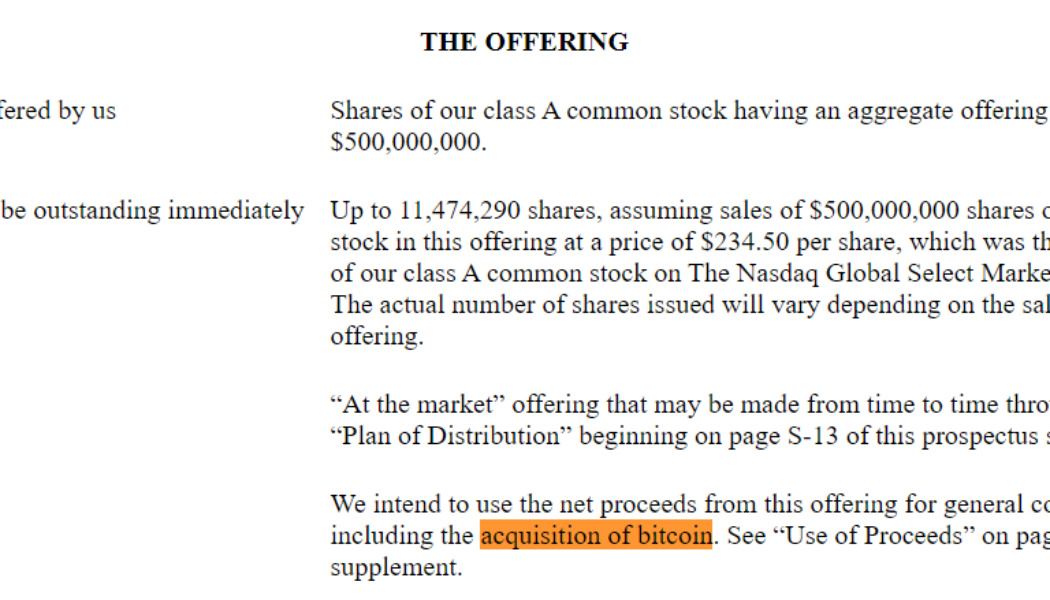

SEC to address growing crypto issuer filings with specialized offices

In light of the influx of filings from cryptocurrency issuers in the United States, the Securities and Exchange Commission (SEC) decided to set up two new offices this fall to provide specialized support to the seven offices currently responsible for reviewing issuer filings. Under the Division of Corporation Finance’s Disclosure Review Program (DRP), the SEC announced plans to add two offices — an Office of Crypto Assets and an Office of Industrial Applications and Services — purely focused on dealing with crypto assets and industrial applications and services, respectively. Sharing insights into the move, Renee Jones, director of the Division of Corporation Finance, stated: “The creation of these new offices will enable the DRP to enhance its focus in the areas of crypto asse...

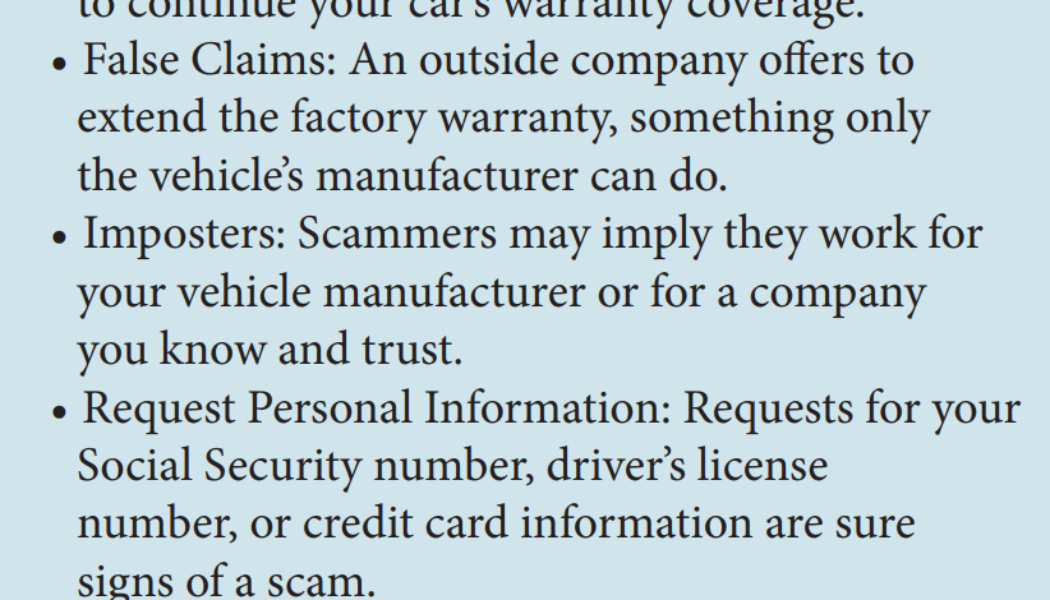

Florida govt warns against auto warranty scammers asking crypto payments

The Florida Department of Agriculture and Consumer Services (FDACS) issued a warning sharing insights into identifying robocall scam marketing auto warranties, which includes being asked to pay for the services via gift cards and cryptocurrencies. Consumer complaints against increasing robocall scams — wherein scammers use prerecorded calls to market and sell fraudulent services — led the Enforcement Bureau to order phone companies to avoid carrying robocall traffic. Regardless of the methods used by scammers to contact potential victims, the FDACS newsletter highlighted five red flags that indicate scams. Five red flags for identifying scams. Source: fdacs.gov Stressing on some of the go-to payment methods often being recommended by the scammers, the announcement read: “Payment...

‘We’re not giving crypto a pass’ on enforcement action, says SEC’s Gurbir Grewal

Gurbir Grewal, the enforcement director for the United States Securities and Exchange Commission, said the financial regulator will continue to investigate and bring enforcement actions against crypto firms, despite the narrative of “picking winners and losers” and “stifling innovation.” In written remarks for a Friday program hosted by the Practising Law Institute, Grewal pushed back against criticism that the SEC “somehow unfairly targeted crypto” in its enforcement actions when compared with those against financial products or traditional markets. He also hinted that the SEC had a responsibility to many “non-White and lower-income investors” drawn to crypto projects, who may feel as though the financial system and its regulators “failed, or simply ignored, them.” “It often seems c...

FBI seeks Bitcoin wallet information of ransomware attackers

Three federal agencies in the United States — the Federal Bureau of Investigation (FBI), the Cybersecurity and Infrastructure Security Agency and the Multi-State Information Sharing and Analysis Center — jointly issued an advisory seeking information to curb ransomware attacks. As part of the #StopRansomware campaign, the joint cybersecurity advisory alerted citizens of Vice Society, a ransomware-type program that encrypts data and demands ransom for decryption. The trio anticipates a spike in ransomware attacks, primarily aimed at educational institutions, adding that “School districts with limited cybersecurity capabilities and constrained resources are often the most vulnerable.” While proactive measures remain vital to counter ransomware, the FBI asked US citizens to report infor...

US congressman and crypto skeptic explains why a crypto ban won’t work

In a recent interview, United States congressman and a known crypto skeptic Brad Sherman claimed that banning cryptocurrencies is not an option at this point. In a statement to LA Times, the Northridge-area Democrat said that the crypto industry has become quite powerful over the years. He added that the high capital donations to the politicians and strong crypto lobbying make it impossible for them to impose a blanket ban. He explained: “We didn’t ban it at the beginning because we didn’t realize it was important, and we didn’t ban it now because there’s too much money and power behind it.” The democratic representative is a well-known skeptic who has been demanding a crypto ban since 2019. Nearly three years later, Sherman has changed his tune about a ban and now advocates for regul...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...