United States

Crypto and decentralization could influence voters in 2022 US midterm elections: Report

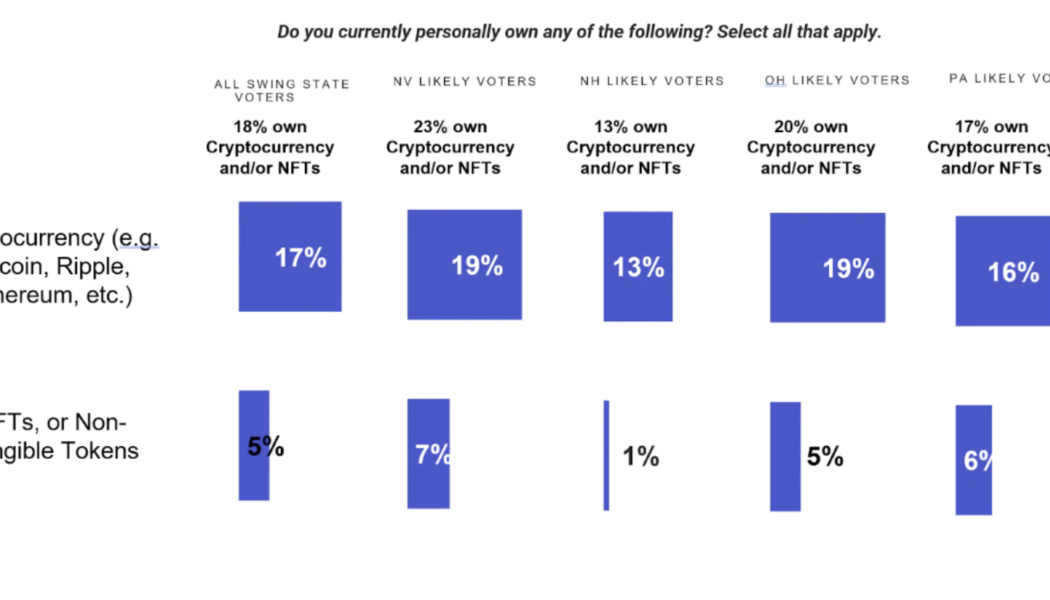

A poll of 800 likely midterm voters in four U.S. swing states suggested that the overwhelming majority favored ideas around decentralization, and many were HODLers. According to a Sept. 29 report from venture capital firm Haun Ventures on a survey conducted by business intelligence company Morning Consult, roughly one in five voters polled in New Hampshire, Nevada, Ohio and Pennsylvania said they owned cryptocurrency or nonfungible tokens. In addition, 91% of respondents supported a “community owned, community governed” internet that “gives people greater control over their information.” Poll of 800 swing state voters who own digital assets. Source: Haun Ventures “Significantly, and reflective of how the values that voters associate with Web3 will drive electoral behavior, voters are less ...

DeFi needs appropriate regulation before moving to retail, says Fed Chair: Finance Redefined

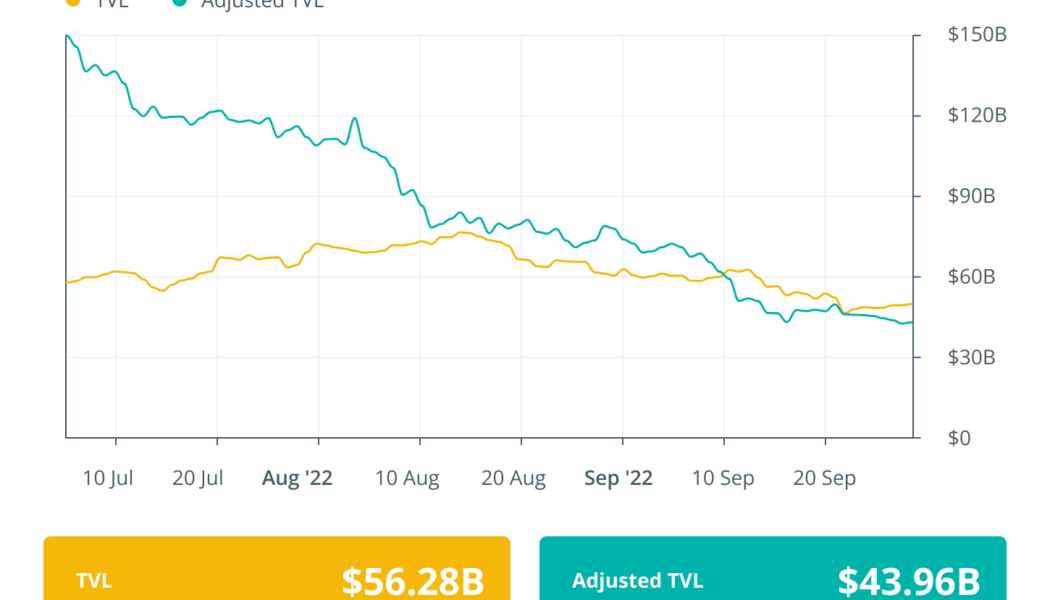

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. United States Federal Reserve chairman Jerome Powell has given his verdict on the evolution of the DeFi market, claiming there is a definite need for robust regulation before the nascent market could expand to retail. Maple Finance CEO believes that separating the risk from lending saved DeFi from the market crash. He added that crypto lending has operated as intended through the crypto winter because of the transparency. Members of the Ooki DAO are discussing various ways to respond to the recent lawsuit filed by the Commodity Futures Trading Commission. Another interesting turn of events from the DeFi ecosystem ...

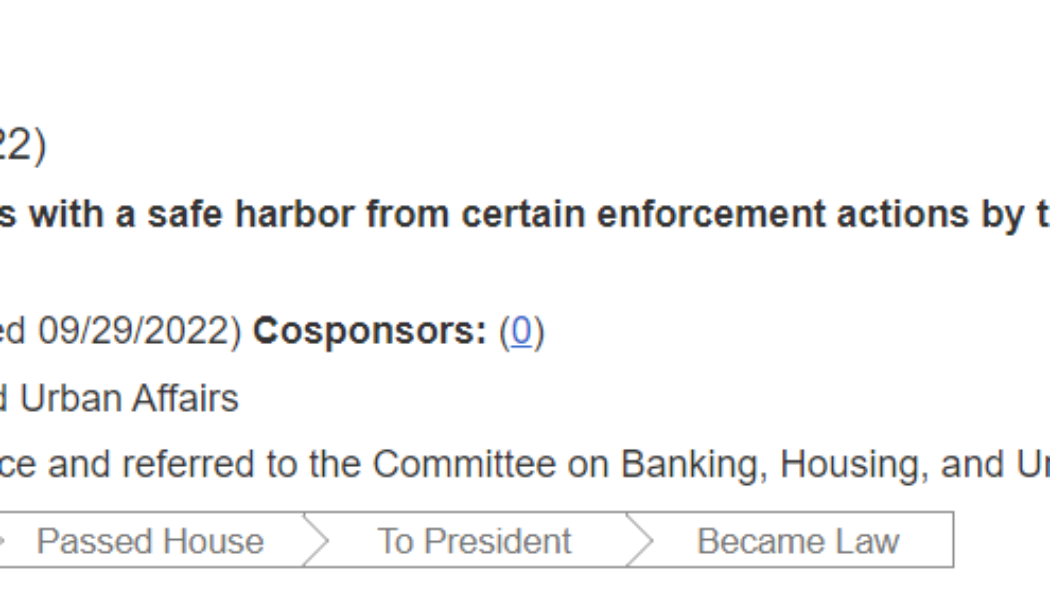

US senator bill seeks to cushion crypto exchanges from SEC enforcement actions

United States Senator Bill Hagerty, a member of the Senate Banking Committee, introduced legislation seeking a safe harbor for cryptocurrency exchanges from “certain” Securities and Exchange Commission (SEC) enforcement actions. The Digital Trading Clarity Act of 2022, introduced by Sen. Hagerty, aims to provide regulatory clarity around two primary concerns plaguing crypto exchange establishments — (i) the classification of digital assets and (ii) related liabilities under existing securities laws. A bill to provide digital asset intermediaries with a safe harbor from certain enforcement actions by the Securities and Exchange Commission, and for other purposes. Source: congress.gov Sen. Hagerty outlined an overview of the problems amid regulatory hurdles: “The current lack of regulatory c...

US lawmaker hints at calling for Republican votes in 2022 midterms over crypto policies

North Carolina Representative Patrick McHenry may have used his virtual appearance at a cryptocurrency conference as a soapbox to call for votes in the 2022 United States midterm elections. In a prerecorded message for the attendees of the Converge22 conference in San Francisco on Sept. 29, McHenry suggested that the goal of a “clear regulatory framework” for digital assets could drive U.S. lawmakers to develop legislation. The Republican lawmaker used terms including “bipartisan consensus” and support from both major political parties over certain regulatory frameworks related to digital assets and stablecoins before seemingly encouraging crypto users to vote red in the next election. “To ensure that these technologies flourish here in the United States, we need to provide regulatory clar...

US lawmakers propose amending cybersecurity bill to include crypto firms reporting potential threats

United States Senators Marsha Blackburn and Cynthia Lummis have introduced proposed changes to a 2015 bill that would allow “voluntary information sharing of cyber threat indicators among cryptocurrency companies.” According to a draft bill on amending the Cybersecurity Information Sharing Act of 2015, Blackburn and Lummis suggested U.S. lawmakers allow companies involved with distributed ledger technology or digital assets to report network damage, data breaches, ransomware attacks, and related cybersecurity threats to government officials for possible assistance. Should the bill be signed into law, agencies including the Financial Crimes Enforcement Network and the Cybersecurity and Infrastructure Security Agency would issue policies and procedures for crypto firms facing potential cyber...

Brett Harrison will step down as FTX US president, move into advisory role

The president of cryptocurrency exchange FTX US, Brett Harrison, has announced he will be transitioning into an advisory role in the next few months. In a Sept. 27 announcement on Twitter, Harrison said he will be resigning his position as FTX US president but will remain with the exchange “with the goal of removing technological barriers to full participation in and maturation of global crypto markets, both centralized and decentralized.” Harrison has worked as FTX US president since May 2021, following a job at Citadel Securities. “I can’t wait to share more about what I’m doing next,” said Harrison. “Until then, I’ll be assisting Sam [Bankman-Fried] and the team with this transition to ensure FTX ends the year with all its characteristic momentum.” 1/ An announcement: I’m stepping down ...

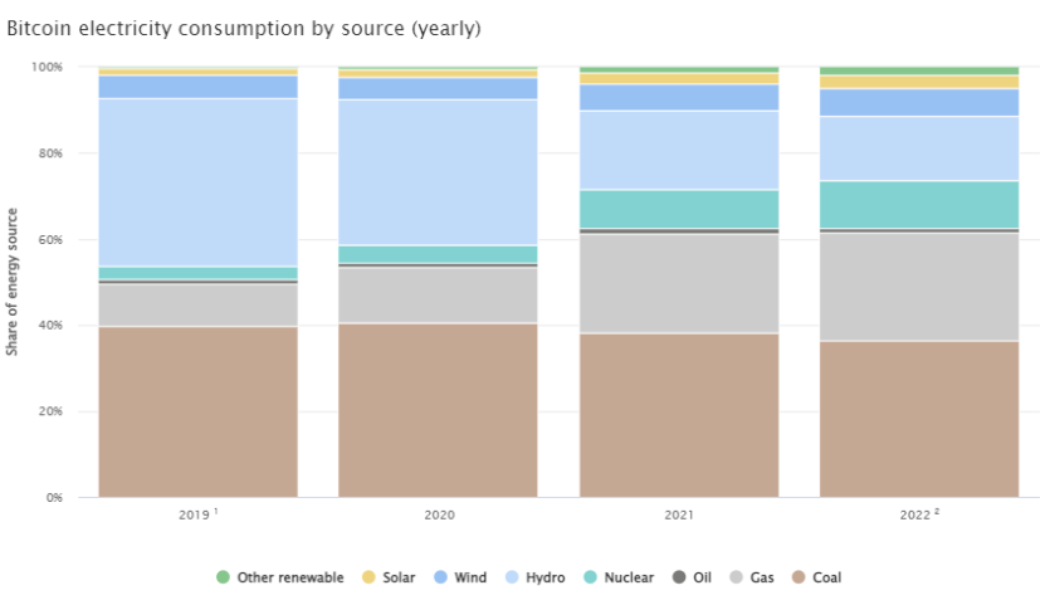

Nuclear and gas fastest growing energy sources for Bitcoin mining: Data

The electricity mix of Bitcoin (BTC) has drastically changed over the past few years, with nuclear energy and natural gas becoming the fastest growing energy sources powering Bitcoin mining, according to new data. The Cambridge Centre for Alternative Finance (CCAF) on Tuesday released a major update to its Bitcoin mining-dedicated data source, the Cambridge Bitcoin Electricity Consumption Index (CBECI). According to the data from Cambridge, fossil fuels like coal and natural gas made up almost two-thirds of Bitcoin’s total electricity mix as of January 2022, accounting for more than 62%. As such, the share of sustainable energy sources in the BTC energy mix amounted to 38%. The new study suggests that coal alone accounted for nearly 37% of Bitcoin’s total electricity consumption as of earl...

California Gov. Newsom vetoes crypto licensing and regulatory framework

Adding to the existing regulatory hurdles for the crypto ecosystems, California Governor Gavin Newsom refused to sign a bill that would establish a licensing and regulatory framework for digital assets. Assembly Bill 2269 sought to allow the issuance of operational licenses for crypto companies in California. On Sept. 1, California State Assembly passed the bill with no opposition from the assembly floor and went on to the governor’s office for approval. Letter of rejection from Gov. Mewsom. Source: leginfo.legislature.ca.gov Opposing the notion, Newsom recommended a “more flexible approach” that would evolve over time while considering the safety of consumers and related costs, adding: “It is premature to lock a licensing structure in statute without considering both this work (...

Blockchain infrastructure firm Chain will sponsor New England Patriots football team

Chain, a blockchain infrastructure firm that offers developers Web3 services to build and maintain blockchain-based applications, will sponsor the New England Patriots football team as well as other venues and sporting clubs controlled by the Kraft Group. In a Thursday announcement, Chain said it will be the official blockchain and Web3 sponsor of the Patriots, the New England Revolution soccer club, Gillette Stadium in Massachusetts and the shopping center Patriot Place as part of a multi-year partnership deal with Kraft Sports + Entertainment, the marketing and events division of the Kraft Group. Chain will work to develop Web3 experiences for visitors to Gillette Stadium and Patriot Place by “merging the physical with the digital.” Speaking to Cointelegraph, a Chain spokesperson decline...

Framework to ban members of Congress and SCOTUS from trading stocks includes crypto provision

Members of the United States House of Representatives and Senate as well as Supreme Court justices currently trading cryptocurrencies may have to stop HODLing while in office should a bill get enough votes. According to a framework released on Thursday, chair Zoe Lofgren of the Committee on House Administration — responsible for the day-to-day operations of the House — said she had a “meaningful and effective plan to combat financial conflicts of interest” in the U.S. Congress by restricting the financial activities of lawmakers and SCOTUS justices, as well as those of their spouses and children. The bill, if passed according to the framework, would suggest a change in policy following the 2012 passage of the Stop Trading on Congressional Knowledge Act, or STOCK Act, allowing members of Co...

GitHub unbans Tornado Cash repositories following OFAC guidance

Crypto mixer Tornado Cash has returned to the software development platform GitHub after several weeks of being banned on the website. Ethereum developer Preston Van Loon took to Twitter on Thursday to report that GitHub has partly unbanned the Tornado Cash organization and contributors on their platform. The developer suggested that Tornado Cash’s code repositories are now in read-only mode, which means that GitHub is yet to restore full functionality. “But that is progress from an outright ban. I still encourage GitHub to reverse all actions and return the repositories to their former status,” Van Loon stated. According to GitHub data, the latest Tornado Cash repositories updates were made on Aug. 22, or shortly after Tornado Cash co-founder Roman Semenov reported that his account w...

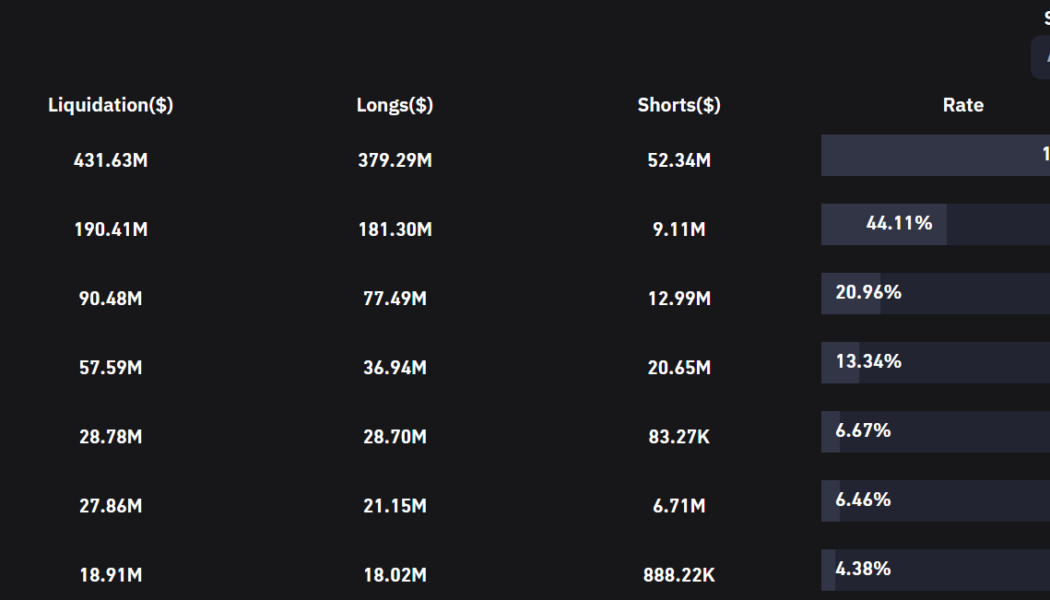

Crypto market bloodbath leads to $432M in liquidation

The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours. The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million. Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short li...