United States

OCC makes its staff available for fintech-related discussions

The United States Office of the Comptroller of the Currency, or OCC, has announced its representatives will be available on a one-to-one basis to discuss financial technology. In a Nov. 3 announcement, the OCC said entities considering fintech products and services, partnerships with banks, or concerns “related to responsible innovation in financial services” have the opportunity for one-hour meetings with its staff between Dec. 14-15. The government office said it will screen requests and proposed topics of discussions and announce virtual meeting times. The OCC announcement followed the department saying it planned to establish an Office of Financial Technology starting in 2023 in an effort to gain a “deep understanding of financial technology and the financial technology landscape.” The...

38% of US voters will consider candidates’ position on crypto in midterms: Survey

Roughly a third of eligible voters in the United States will be “considering crypto policy positions” when choosing candidates in the 2022 midterm elections, according to a new survey. In the results of a 2,029-person survey conducted by The Harris Poll between Oct. 6 and 11, 57% of likely midterm voters say they would be more likely to vote for a political candidate interested in staying informed about cryptocurrencies, while 38% said they would consider positions on crypto policy when voting in the midterms. The survey, initiated by Grayscale Investments, also suggests that crypto regulation is a bipartisan issue, with 87% of Democratic and 76% of Republican respondents saying they want clarity from the U.S. government. “Voters and lawmakers alike have been hearing about crypto, and...

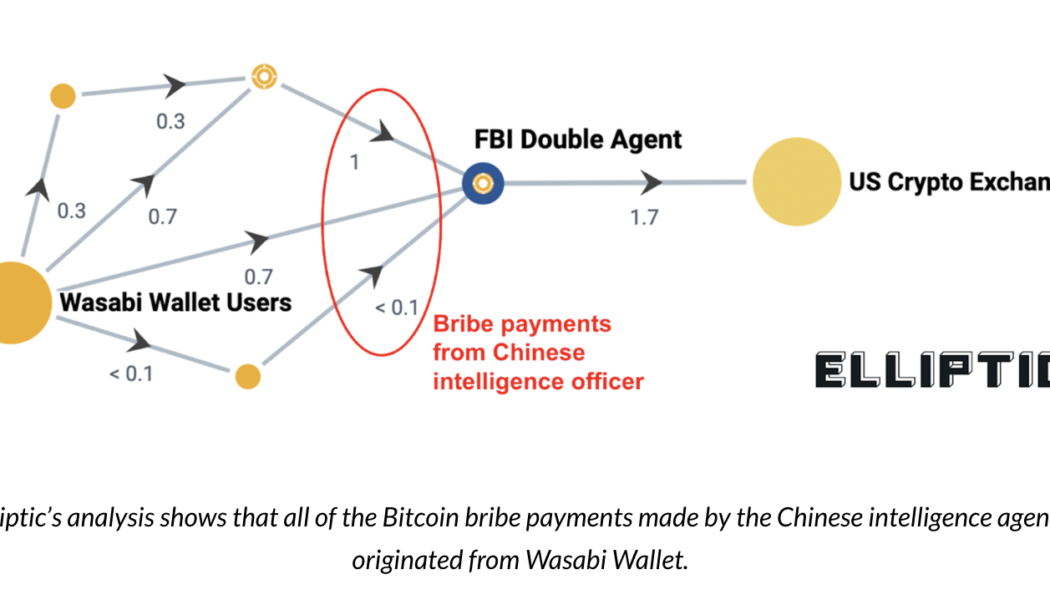

Chinese agents used Bitcoin transactions through Wasabi to allegedly bribe US government employee

The United States Department of Justice has announced charges against two Chinese intelligence officers who allegedly bribed a double agent with Bitcoin. In an Oct. 24 announcement, the Justice Department said Guochun He and Zheng Wang attempted to obstruct the prosecution of an unnamed global telecommunications company based in China, which allegedly involved paying a U.S. government employee roughly $61,000 in bribes using Bitcoin (BTC). However, the individual was a double agent working on behalf of the Federal Bureau of Investigation and did not move against authorities in the Eastern District of New York in the case against the China-based company. According to an analysis by cryptocurrency risk management firm Elliptic, He and Wang used Wasabi Wallet to conceal the BTC transactions a...

US lawmakers question regulators over ‘revolving door’ with crypto industry

Several Democratic members of the United States Senate and House of Representatives have requested information from top regulators and agencies in the country regarding crypto firms hiring government officials upon their departure. In letters dated Oct. 24 addressed to the heads of the Securities and Exchange Commission, Commodity Futures Trading Commission, Treasury Department, Federal Reserve, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, and Consumer Financial Protection Bureau, five U.S. lawmakers asked for a response in regard to the steps the government departments and agencies were taking “to stop the revolving door” between themselves and the crypto industry. Senators Elizabeth Warren and Sheldon Whitehouse and Representatives Alexandria Ocasio-C...

Celsius users concerned over personal info revealed in bankruptcy case

Crypto lending platform Celsius filed for Chapter 11 bankruptcy on July 13, 2022. Although the Celsius case involves digital assets, it remains subject to United States Bankruptcy Code under the Bankruptcy Court for the Southern District of New York. While this may be, a series of unusual events have ensued since Celsius filed for bankruptcy. For instance, Chief United States Bankruptcy Judge Martin Glenn — the judge overseeing the Celsius case — stated on Oct. 17 that the court will look abroad for guidance. Glenn specifically mentioned that “Legal principles that are applicable in the United Kingdom are not binding on courts in the United States,” yet he noted that these “may be persuasive in addressing legal issues that may arise in this case.” While the treatment of the Celsius c...

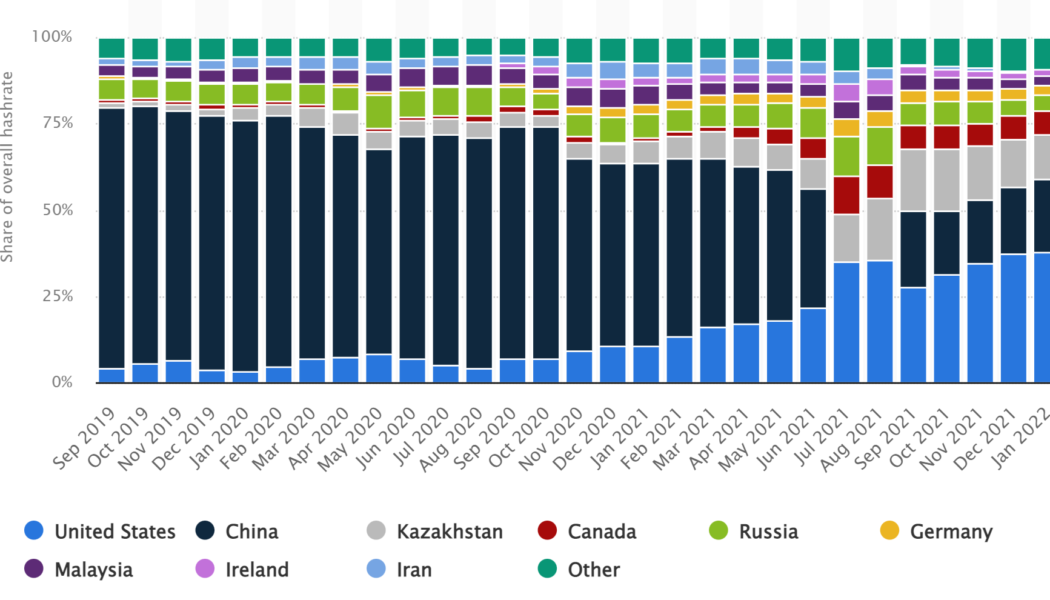

Kazakhstan among top 3 Bitcoin mining destinations after US and China

For over a year, the oil-rich Central Asian country of Kazakhstan has maintained its position as the third-biggest contributor to Bitcoin (BTC) mining after surpassing Russia back in February 2021. As of January 2022, Kazakhstan contributed to 13.22% of the total Bitcoin hash rate, positioned right after the historical leaders the United States (37.84%) and China (21.11%), as shown below. Along similar timelines, Cambridge Centre for Alternative Finance data estimated that Kazakhstan’s absolute hash rate contribution (monthly average) was 24.8 exahashes per second (Eh/s). Meanwhile, the US and China contributed 71 Eh/s and 39.6 Eh/s, respectively. The International Energy Agency (IEA), which is co-funded by the European Union, highlighted Kazakhstan’s heavy reliance on non-renewable ...

New York-based forex broker Oanda launches crypto trading services in US

New York-based multi-asset trading services Oanda has launched a new cryptocurrency trading service in the United States. This latest addition, developed in partnership with regulated blockchain infrastructure provider Paxos Trust Company, is designed to give investors easy access to crypto alongside their existing forex portfolios in a secure environment. The collaboration will enable U.S.-based investors to spot-trade cryptocurrencies on Paxos’s itBit exchange through Oanda’s mobile platform, the broker said. Investors will be able open and fund trading accounts, as well as access major cryptocurrencies such as Bitcoin (BTC) and Ether (ETH). According to Oanda, users will benefit from the company’s long track record in the forex and derivatives markets. Oanda’s partner Paxos is a r...

Germany leaves the US behind in top crypto economies in Q3: Report

Germany has become the most favorable crypto economy in the world in the third quarter of 2022, according to a new report. The United States, the joint top-rank holder from last quarter, fell six places to rank seventh on the top crypto economy. The crypto economy rankings compiled by Coincub looked into various factors such as favorable crypto outlook, clear crypto tax rules, more transparent regulatory communications and more to rank countries. Germany although not a tax haven, is considered one of the strongest all-around ‘traditional-tax’ crypto economies that reward long-term crypto holders. German law charges zero tax on crypto holdings of over a year. Switzerland ranked second with its positive crypto regulatory stance and is home to some of the top crypto organizations in the ...

It’s time for the feds to define digital commodities

This month, the European Union (EU) agreed on the text for a unified licensing regime for cryptocurrency exchanges to operate across the EU bloc as part of its Markets in Crypto Assets Regulation (MiCA). The United States — despite being a traditional global leader in legal frameworks for technological innovation — has not provided that same regulatory clarity. National cryptocurrency exchanges in the U.S. are regulated at the state level through a patchwork of money transmission laws that overburden companies while under-protecting consumers. In our view, many digital tokens are properly characterized as digital commodities rather than securities. Yet, a unified federal regime for cryptocurrency exchanges listing digital commodities does not exist. To create one, Congress must pass ...

US lawmakers request Justice Dept share CBDC assessment

Republican members of the U.S. House Financial Services Committee have requested the Department of Justice provide its assessment and legislative proposals regarding a digital dollar within ten days. In an Oct. 5 letter addressed to U.S. Attorney General Merrick Garland, 11 Republican lawmakers asked the Justice Department for a copy of its “assessment of whether legislative changes would be necessary to issue a CBDC,” as required by President Joe Biden’s executive order on digital assets issued in March. The House members claimed the “appropriate place for the discussion” on legislation concerning a central bank digital currency would be in the U.S. legislative branch rather than the federal executive department. “The House Committee on Financial Services […] has spent considerable ...

CFTC can issue summons through Ooki DAO’s help chat box, says judge

The United States Commodities Futures Trading Commission can serve members of the Ooki decentralized autonomous organization, or DAO, with summons through online communications, according to a federal judge. In an Oct. 3 order granting a CFTC motion, U.S. District Judge William Orrick said the commission could provide a copy of its summons and complaint through Ooki DAO’s help chat box as well as a notice on its online forum. The judge said the court’s decision was based on the CFTC effectively serving the Ooki DAO by providing the necessary documents. The CFTC filed a lawsuit against the Ooki DAO on Sept. 22, alleging the organization offered “illegal, off-exchange digital asset trading,” violated registration guidelines and broke provisions of the Bank Secrecy Act. The legal action came ...

US Treasury recommends lawmakers decide which regulators will oversee crypto spot market

Officials with the United States Financial Stability Oversight Council, or FSOC, have recommended U.S. lawmakers pass legislation to determine which “rulemaking authority” will be responsible for regulating parts of the crypto spot market. In an Oct. 3 meeting of the FSOC, Jonathan Rose, a senior economist at the Federal Reserve Bank of Chicago, said the FSOC had released a report in accordance with President Joe Biden’s executive order on crypto, detailing potential financial stability risks of digital assets and regulatory gaps. The report identified regulatory gaps including the spot market for cryptoassets that were not securities subject to “limited direct federal regulatory” — hinting at lawmakers stepping in to prevent possible market manipulation and conflicts of interest. “While s...