United States

Trouble brewing for the US: Two-thirds of TradFi expects a 2023 recession

The United States economy could be in for an upset. Data from a Wall Street Journal survey revealed financial experts expect the country to face an economic downturn this year. Over two-thirds of economists at 23 major financial institutions that do business with the Federal Reserve believe the U.S. will have a “shallow” or “mild” recession in 2023. Two of the surveyed institutions predict a recession for the following year. The research included big names in the financial services sector, such as Barclays, Bank of America, TD Securities and UBS. Collectively, the Federal Reserve was named as the primary reason for the recession due to it raising interest rates to fight inflation. At the time of writing, the inflation rate in the U.S. is 7%, compared with the Fed’s target desired rate...

US lawmakers under pressure following FTX collapse: Report

Legislators in the United States seem to be reevaluating the crypto industry and its regulatory needs in light of FTX’s collapse. According to the Wall Street Journal, since the crypto exchange filed for bankruptcy in November, lawmakers have been under pressure to set a new regulatory framework for cryptocurrencies. Several proposals are in the works that would apply existing banking, securities, and tax rules to cryptocurrencies, and lawmakers are calling on the Securities and Exchange Commission (SEC) to adopt an aggressive approach to the crypto market. In a December House hearing, Rep. Jake Auchincloss, who is also a member of the bipartisan Congressional Blockchain Caucus, reportedly noted that “it’s time for the blockchain investors and entrepreneurs to build thing...

Sam Bankman-Fried to reportedly plead not guilty to criminal charges

Former FTX CEO Sam Bankman-Fried (SBF), currently free on a $250 million bail bond, will reportedly plead not guilty to the alleged FTX and Alameda-related financial frauds in court on Jan. 3. SBF was arrested in the Bahamas at the request of the U.S. government under suspicion of defrauding investors and misappropriation of funds held on the FTX crypto exchange. Following a court hearing on Dec. 22, SBF was released on bail and is slated to appear on court on Jan.3 before U.S. District Judge Lewis Kaplan in Manhattan. During the hearing, SBF is expected to enter a plea of not guilty to the criminal charges, according to a Reuters report. On Dec. 13, the SEC charged the former FTX CEO with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of ...

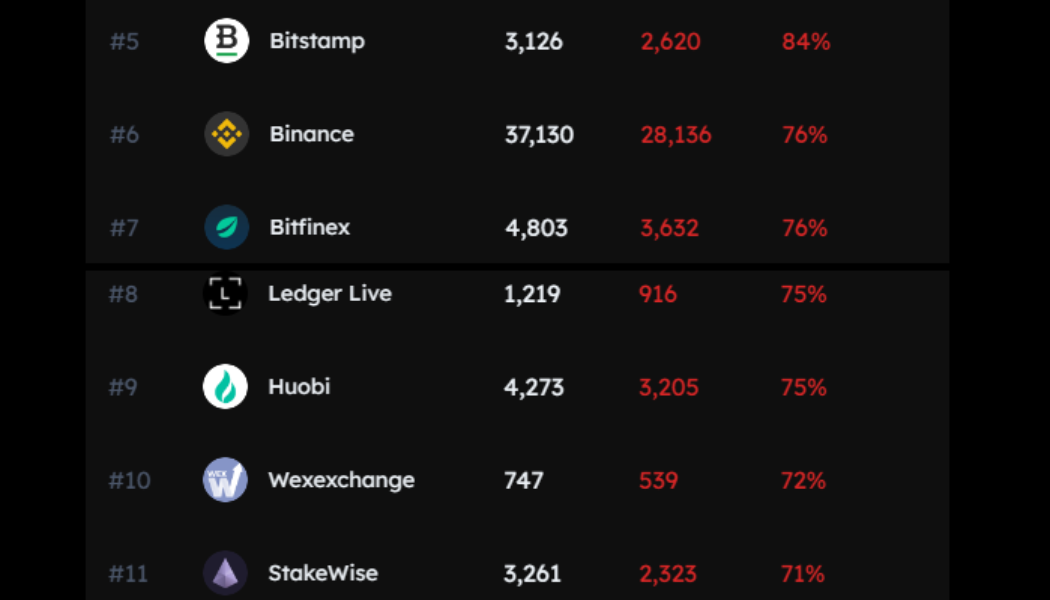

ETH staking on top exchanges contributes to Ethereum censorship: Data

For most crypto ecosystems, being compliant with federal sanctions have a negative impact on its global reach. However, when it comes to Ethereum, investors have significant power to decide the degree of compliance the ecosystem obeys. Nearly 60% of all post-Merge Ethereum blocks comply with the United States sanctions put forth by the Office of Foreign Assets Control (OFAC). While the crypto community stands against this transformation, many fail to realize their own contribution to helping Ethereum attain total OFAC compliance. One of the biggest factors harming Ethereum’s credible neutrality is the use of censoring MEV relays by crypto ecosystems and exchanges. Miner extractable value (MEV) relays work as a mediator between block producers and block builders, which are being used ...

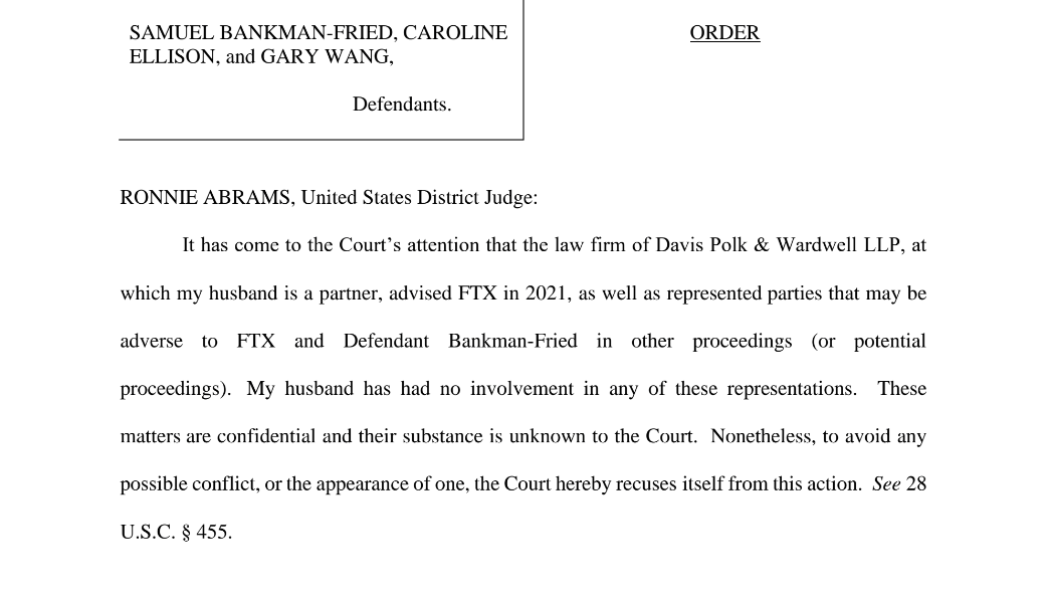

Judge pulls out of SBF-FTX case citing husband’s law firm’s advisory link

The ongoing legal proceedings around former FTX CEO Sam Bankman-Fried (SBF) took a new turn as District Judge Ronnie Abrams withdrew her participation from the case. The United States District Court for the Southern District of New York rescued itself from the FTX case after revealing that a law firm — which employs Abrams’ husband as a partner — had advised the crypto exchange in 2021. In a Dec. 23 filing, Judge Abrams revealed that her husband, Greg Andres, is a partner at Davis Polk & Wardwell, a law firm where he has been employed since June 2019. Additionally, it was highlighted that the law firm had advised FTX in 2021. Abrams also stated that the law firm represented parties that may be adverse to FTX and SBF in other legal proceedings. “My husband has had no involvement i...

SEC general counsel announces departure from public service

Dan Berkovitz, general counsel for the United States Securities and Exchange Commission, said he will be leaving the agency after more than a year. In a Dec. 22 announcement, the SEC said Berkovitz will depart on Jan. 31. A former commissioner with the Commodity Futures Trading Commission, Berkovitz joined the agency in November 2021. At the time, he said he planned to work with SEC chair Gary Gensler on a “regulatory agenda that will enhance investor protection.” “After thirty-four years of public service, it is time for me to pursue new and different challenges and opportunities,” said Berkovitz. It’s unclear whether Berkovitz intends to join the private sector after leaving the SEC. Brian Quintenz, who served as a CFTC commissioner from 2017 to 2021, joined&n...

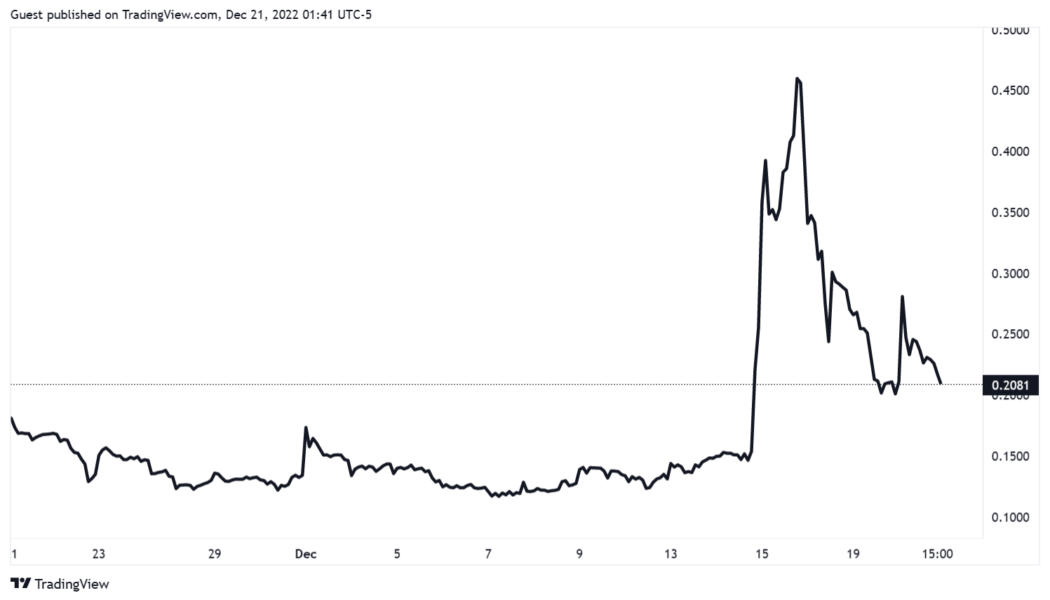

Alameda’s Caroline Ellison and FTX’s Gary Wang hit with additional fraud charges

The United States Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) have hit former Alameda Research CEO Caroline Ellison and former FTX co-founder Gary Wang with fresh fraud charges. The new charges from the SEC and CFTC come as the pair plead guilty to federal fraud charges filed by the U.S. Department of Justice (DOJ) earlier on Dec. 22. SEC states that Ellison and Wang were charged for their role in the “multiyear scheme to defraud equity investors in FTX,” with the SEC also investigating whether other securities laws were violated as well. The SEC alleges that Ellison, under the direction of former FTX CEO Sam Bankman-Fried, furthered the scheme by manipulating the price of FTX Token (FTT), which is described as a crypto security toke...

Sam Bankman-Fried is one step closer to US extradition: Report

Former FTX CEO Sam Bankman-Fried, who has been in the custody of Bahamian authorities, faces extradition to the United States following a hearing. According to reports, Bankman-Fried appeared in a hearing of The Bahamas Magistrate Court on Dec. 21 — the third since his arrest — where he waived his right to a formal extradition process that could have taken weeks. Officials from the U.S. Embassy, Federal Bureau of Investigation, and U.S. Marshals Service were reportedly in attendance to facilitate Bankman-Fried’s handover, to which he had first signed papers on Dec. 20. Reuters reported that SBF’s legal team said the former CEO was “anxious to leave” The Bahamas. Jerome Roberts, on Bankman-Fried’s legal team, reportedly heard SBF say on Dec. 19 his decision...

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

SBF signs extradition papers, set to return to face charges in the US

Sam Bankman-Fried, the jailed founder of the FTX cryptocurrency exchange has reportedly signed papers on Dec. 20 that will soon see him handed over to Federal Bureau of Investigation (FBI) agents and flown to the United States to face criminal charges. The move was expected, as Bankman-Fried was reported to have agreed in principle to being extradited to the U.S. earlier this week on Dec. 19, despite earlier reports indicating he wanted to see the indictment against him fir ABC News reported the development that Bankman-Fried signed extradition papers on Dec. 20 citing The Bahamas’ acting commissioner of corrections Doan Cleare. A Dec. 21 report from Bloomberg said the exchange founder signed surrender documents on Dec. 20 citing Cleare, with another set of papers waiving h...

Gate.io closer to launching US services after receiving local licenses

Gate US, the United States arm of the fourth largest cryptocurrency exchange by trading volume, Gate.io says it has received operating licenses in “several” states, bringing it closer to launching services in the country. Founder and president of Gate.io and its U.S. entity, Dr. Lin Han, announced in a Dec. 19 statement that Gate US is now registered as a money services business with the Financial Crimes Enforcement Network (FinCEN) — the country’s money laundering and financial crimes watchdog. He added the exchange “obtained some money transmission licenses or similar to operate, and is currently working to obtain more.” Gate US did not disclose what states it had obtained licenses from but said it is yet to accept users from the country at this stage. Its terms of use however...

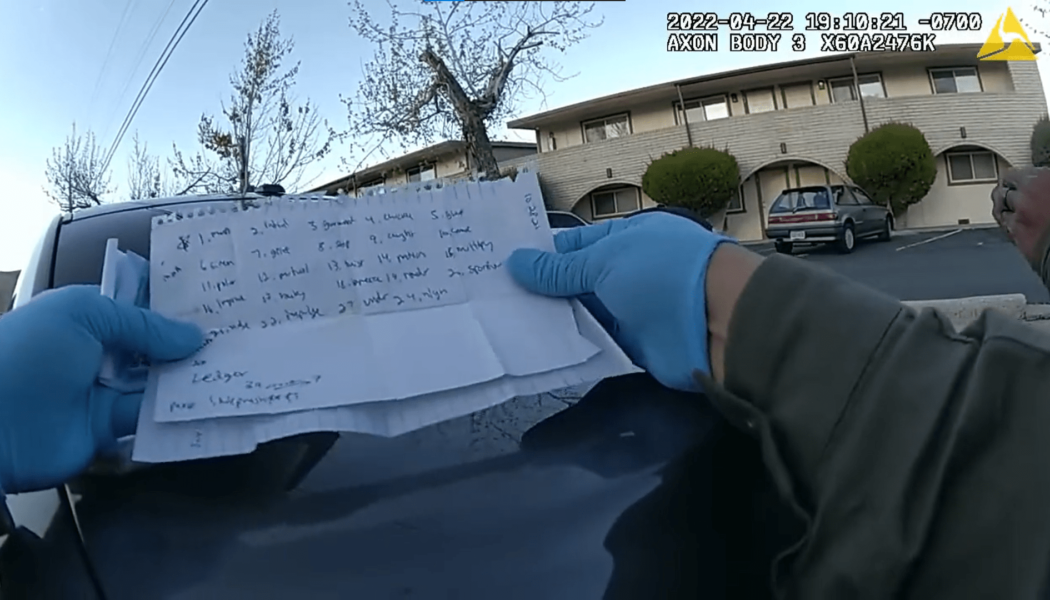

Police body cam leaks suspect’s seed phrase during vehicle inspection

While self-custody is considered the ultimate way to secure one’s funds, many fail to acknowledge the risks associated with physically storing seed phrases. A search conducted by the State Police agency for Nevada ended up making a suspect’s seed phrase public after being picked up by the body cam. A viral video making rounds on Twitter showed two police officers searching a suspect’s car and coming across pieces of paper. It turns out, the suspect was a strong believer in self-custody as unfolding the pieces of paper revealed the suspect’s seed phrase, which was hand-written — a popular method to prevent online compromises. Nevada State Police body cam records suspect’s seed phrase. Source: Twitter As the incident got recorded by one of the officer’s body camera, the suspect’s seed ...